S&P 500, Nasdaq 100 Back to Familiar Resistance

S&P 500, Nasdaq 100 Back to Familiar Resistance

The S&P 500 is up 3.91% month-to-date

- The best week of the year for stocks now sees /ESZ3 and /NQZ3 trading back to familiar multi-month resistance.

- Yields churning higher may prove to be a headwind for further gains in the coming sessions and 30s (/ZBZ3) and ultras (/UBZ3) fall back.

- Light earnings and macro calendars in the coming days puts focus on the litany of FOMC officials hitting the lecture circuit this week.

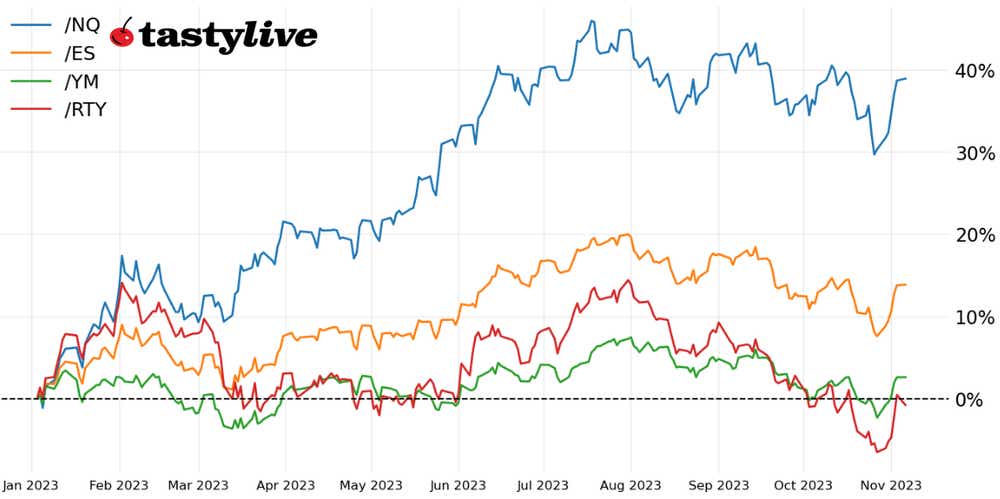

November has started out with a bang, with last week producing the best month of the year thus far for U.S. equity markets.

The S&P 500 (/ESZ3) is up nearly 4% month-to-date, while both the Nasdaq 100 (/NQZ3) and Russell 2000 (/RTYZ3) are up more than 4.5% thus far in November. Between the November Federal Open Market Committee meeting and the October U.S. jobs report, there were significant macro catalysts that helped spur the moves.

Alas, this week no such macro catalysts exist—nor do many meaningful earnings releases. The main highlights may be the procession of Federal Reserve officials set to speak in the coming days, including two separate sets of remarks from Fed Chair Jerome Powell.

It makes sense that, if the sharp rise in Treasury yields in September/October allowed policymakers to tone down their hawkish commentary, the recent collapse in yields may give policymakers more room to sound hawkish on the margins.

The aggregate impact of these factors and lack of catalysts may not mean much, but they offer a sound reason for U.S. equity markets to take a bit of a breather following last week’s tremendous running of the bulls. Indeed, both /ESZ3 and /NQZ3 find themselves back to familiar multi-month resistance, it’s as good a time as any for a review of the charts.

/ES S&P 500 price technical analysis: daily chart (September 2022 to September 2023)

The decline in the second half of October has nearly been eradicated, but /ESZ3 still has some technical wood to chop. Back at the 4380/4420 zone—an area that has been both support and resistance dating back to early-June, and perhaps the neckline of a now-completed head and shoulders pattern—we find ourselves back at a pivotal area for stocks.

Momentum has started to improve, with /ESZ3 back above its daily 5-, 13-, and 21-day exponential moving averages (EMA), although the moving averages are not yet aligned in bullish sequential order. While slow stochastics have begun to reenter overbought territory, it’s worth noting that moving average convergence/divergence (MACD) has not crossed above its signal line, a characteristic of the correction since late-July. A move through the mid-October swing highs around 4430 would offer increased confidence that meaningful lows have developed (rather than a rebound within the context of a broader decline).

/NQ Nasdaq 100 price technical analysis: daily chart (December 2022 to November 2023)

Here we go again: /NQZ3 is finding resistance around 15250, which marks the descending trendline from the July, September, and October swing highs. This multi-month resistance may also constitute the upper band of a bullish falling wedge, which is why hurdling this resistance is so critical for the next directional move. Above this trendline, the bullish falling wedge comes into play, ultimately targeting a return to the yearly high at 16264.25; failure here would open the door for a return below 14500.

/RTY Russell 2000 price technical analysis: daily chart (April 2023 to November 2023)

/RTYZ3 may have been the best performing major index last week, but it struggled on Monday amid another rise in Treasury yields at the long end of the curve. That said, several technical hurdles have been cleared: the downtrend from the September and October swing highs has been breached; and /RTYZ3 closed above its daily 21-day EMA (one-month moving average) for the first time since Aug, 31. In the event of a setback, holding above 1720/22 (early-October swing lows and the daily 21-EMA) will be critical to establish a higher low; below 1720/22, the bullish breakout will have failed.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.