October in Play as Bear Killer

October in Play as Bear Killer

The S&P 500 is up 2.10% month-to-date

- Both /ESZ3 and /NQZ3 have traded higher through critical resistance levels.

- The bond market may have bottomed, thanks to commentary from Federal Reserve officials.

- October is in play as "the bear killer."

“The bear killer” is in full swing.

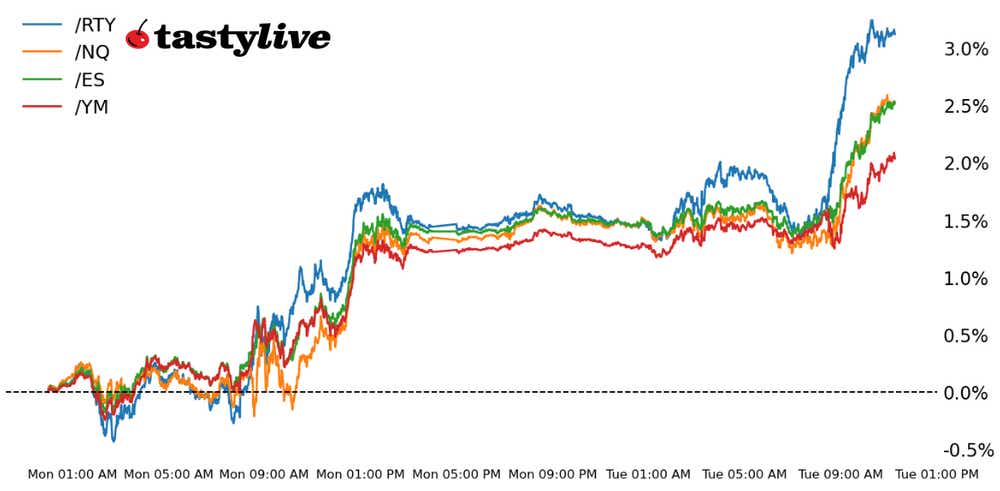

October has ended seven of the 18 bear markets since World War II, as noted in the monthly seasonality report. The green shoots observed last week have begun to blossom, with all four major U.S. equity index futures in positive territory for the week and the month.

Geopolitical risks may be soaring, but signs that the Federal Reserve is done raising rates–straight from the horse’s mouth—have helped bonds start their bottom process. As bond prices go, so will stock prices. Technical evidence is accumulating that significant lows have been carved out. Don't forget that we recently reached a bearish extreme in sentiment too.

/ES S&P 500 price technical analysis: daily chart (September 2022 to September 2023)

As noted last week, “it won’t take much more from here to provide a technical impetus to take advantage of the relatively higher volatility environment and begin looking at selling puts as a way to take advantage of a turn higher.” That threshold was crossed on Friday, with /ESZ3 clocking its first close above its five-day exponential moving average (EMA) since mid-September. moving average convergence/divergence has issued a bullish crossover and Slow Stochastics have raced higher out of oversold territory.

Better yet: /ESZ3 has retaken the neckline of a head and shoulder’s pattern, while /ES (continuous contract) has rebounded above the trendline from the October 2022 and March 2023 swing lows. Last week may have produced the lows for the rest of the year, plain and simple.

/NQ Nasdaq 100 price technical analysis: daily chart (December 2022 to September 2023)

In our last update we were watching “a range over the past 10 days around 14600/15100. A short-term double bottom may be coming together near the August low, which would point to an upside target just north of 15600. If this were accomplished, then the trendline from the January and March swing lows would be retaken.” Indeed, 15100 was breached, sending /NQZ3 racing to the topside in recent sessions.

Resistance arrives soon, however: the trendline off the July, August, and September swing highs comes into focus near 15450/500 over the coming sessions. A break above this area would bring the yearly highs back into sight.

/RTY Russell 2000 price technical analysis: daily chart (April 2023 to September 2023)

/RTYZ3 may still be the weakest performing major U.S. equity index futures in recent weeks, but it has been leading the way higher over the past several sessions.

The technical damage remains, nevertheless, as /RTYZ3 has not yet returned above the critical 1820/50 area – which has been both support and resistance since the onset of the regional banking crisis in March – nor has the downtrend from the July and August swing highs has been broken.

That said, a move above 1850 through the end of the month would substantiate the technical perspective that the lows are in for the rest of 2023.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.