S&P 500 and Nasdaq 100 Are Being Stung by Shifting Fed Rate-Cut Odds

S&P 500 and Nasdaq 100 Are Being Stung by Shifting Fed Rate-Cut Odds

The probability of a 25-basis-point (bps) cut in March closed last week at 81% and is now 66.9%

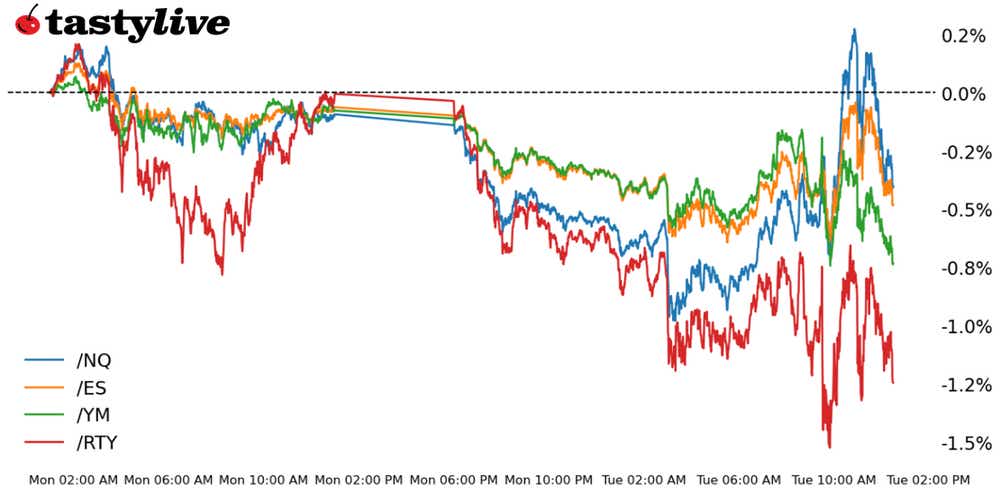

● U.S. stock markets have resumed trading after the holiday on the downside.

● The S&P 500 (/ESH4) and Nasdaq 100 (/NQH4) retain the most bullish technical setups, but cracks are appearing.

● The sell-off has seen the Russell 2000 (/RTYH4) quickly approach multi-month support.

Market Update: S&P 500 down -0.53% month-to-date

The new week is off to a bad start, with each of the four major U.S. equity markets trading lower. Commentary from central bank officials on both sides of the Atlantic has provoked a repricing in global bond markets, as policymakers have deemed elevated rate-cut expectations too high for both the Federal Reserve and European Central Bank.

The abrupt adjustment in Fed rate cut odds—the probability of a 25-basis-point (bps) rate cut in March closed last week at 81% and is now 66.9%—has seen long-end U.S. Treasury bonds (30s (/ZBH4) and ultras (/UBH4)) erase all of their gains from last week. Mixed bank earnings aren’t doing any favors for the Russell 2000 (/RTYH4) either, which is hovering around its lowest levels of the year.

A more muddled technical picture is emerging as the calendar turns into the second half of January, though bears are not fully in control just yet.

/ES S&P 500 Price Technical Analysis: Daily Chart (May 2023 to January 2024)

The S&P 500 (/ESH4) is trading sluggishly at the start of the week, with volatility quickly moving toward its highest level of the year. Notably, /ESH4 is not near its yearly low; perhaps this is a sign of resiliency. Regardless, it doesn’t take much to see a potential right shoulder in a head and shoulders pattern is beginning to come together. While it’s too soon to treat recent price action as a top, this perspective should be in the back of traders’ minds as price action unfolds over the coming days. Momentum is starting to erode, though it’s too soon to be directionally bearish. A directionally neutral position that benefits from an uptick in volatility may work well here, like at at-the-money (ATM) calendar call spread.

/NQ Nasdaq 100 Price Technical Analysis: Daily Chart (June 2023 to January 2024)

The Nasdaq 100 (/NQH4) retains the most bullish structure among all four major equity indexes. A third consecutive doji candlestick is in the works, hinting that the recent uptrend is exhausted. Volatility is starting to tick higher as well (IV Index: 18.3%; IV Rank: 19.1). It’s too early to suggest it’s time to trade against the monthly low, which may have worked out well last week (via selling puts or an ATM call spread, for example). Nevertheless, traders may be interested in looking to fade the uptick in volatility on /NQH4’s initial approach toward 16400.

/RTY Russell 2000 Price Technical Analysis: Daily Chart (July 2023 to January 2024)

If /ESH4 and /NQH4 have muddled technical outlooks in the short-term, there is a case to be made that the Russell 2000’s (/RTYH4) near-term picture is the most daunting. Momentum is increasingly bearish, with /RTYH4 below its daily 5-, 13-, and 21-EMA (exponential moving average) envelope, which is in bearish sequential order. MACD (moving average convergence/divergence) continues to decline toward a cross below its signal line, while slow stochastics have moved into oversold territory. The area around 1925/35 is critical support in the coming sessions; a break below that would see the uptrend from the October and November 2023 swing lows broken, opening up the chart for a deeper setback toward 1850.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.