S&P 500, Nasdaq 100 Rallying Towards Critical Technical Resistance

S&P 500, Nasdaq 100 Rallying Towards Critical Technical Resistance

Market update: The S&P 500 is down 3.33% for the month so far

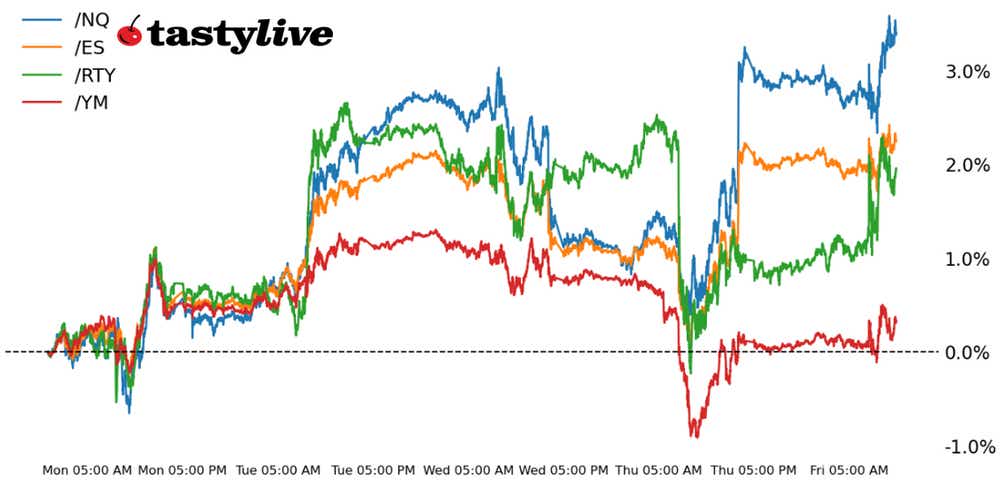

- The S&P 500 is wrapping up its best week of the year, as is the Nasdaq 100.

- Neither index has traded above former support levels that kept prices elevated in March and early-April, suggesting that bulls aren’t fully back in control.

- Considerable binary event risk remains in the coming days, with Amazon earnings on Tuesday and the May FOMC meeting on Wednesday.

April has been a bad month for stocks, although you can’t blame this week. It’s been the best one thus far in 2024 for both the S&P 500 (/ESM4) and Nasdaq 100 (/NQM4).

First-quarter U.S. GDP data and the March U.S. personal consumption expenditures (PCE) price index did little to rock the boat, and the overall sweep of earnings in recent days has been received positively by investors.

Fear rules

Nevertheless, sentiment remains damaged even as volatility has contracted in recent days. The AAII Investor Sentiment survey showed a 0% bull-bear spread for the most recent reading, while the CNN Fear and Greed Index is still issuing a "fear" reading.

The lack of belief in the rebound may be a sign that bulls still have some work to do, and indeed, there are technical reasons to believe that equity markets aren’t out of the woods just yet. Critical overhead resistance looms for both /ESM4 and /NQM4, former support that defined swing lows throughout March and early-April.

/ES S&P 500 price technical analysis: daily chart (October 2023 to April 2024)

In the update on April 11, we noted “price action in [the S&P 500] /ESM4 has formed a head and shoulders pattern with a 166.25 measured move calling for a drop to 5000.25. From a technical perspective, there’s little to like from the long side until a deeper setback transpires.”

Then, on April 16 we observed that “the name of the game right now in /ESM4 is patience: bulls have a better shot above 5125; otherwise, the path of least resistance appears to be a decline to 5000.25.”

Ultimately, the bears won out in the short-term, driving /ESM4 to a low of 4963.50 before closing last week at 5003.75—just above the head and shoulders target.

The question in front of us now is whether the low from mid-April is a low or the low. And the answer on the charts may not be far away. The head and shoulders neckline came in at 5167.25

The daily 21-/34-exponential moving average (EMA) cloud support from early-November 2023 through mid-April 2024, is now resistance between 5140/50. /ESM4 is effectively facing a zone between 5140/70 that if it can break through, an important low would have been established that may pave the way for a return to the yearly high.

However, if /ESM4 fails to trade through 5140/70 over the coming sessions, traders must not rule out a return to the April low at 4963.50. Decision time nears for what very well may determine the next 200 points in /ESM4.

/NQ Nasdaq 100 price technical analysis: daily chart (October 2023 to April 2024)

Previous commentary on the Nasdaq 100 (/NQM4) stipulated that the 18000-18700 range offered directional outcomes for bulls above 18700 and for bears below 18000; with a 700-point range, this would look for /NQM4 to rally to 19400 or drop to 17300.

The latter scenario played out with some overshoot last week, and now /NQM4 is racing back towards multi-month range support near 18000. Similar to /ESM4, /NQM4 also has its daily 21-/34-EMA cloud looming ahead near 17891/981, creating a zone of resistance between 17890/18000. A return above this area would reinforce the bottoming narrative; failure here would suggest that the rally over the past week has been a bull trap, with new lows likely around the corner.

/RTY Russell 2000 price technical analysis: daily chart (October 2023 to April 2024)

For concerns about the viability of the recent rallies in /ESM4 and /NQM4 (because of their daily 21-/34-EMA clouds looming overhead as resistance), one needs to look no further than the Russell 2000 (/RTYM4) to see this dynamic already playing out.

For the fourth day in a row, /RTYM4 has been stuck below its daily 21-/34-EMA cloud, unable to breach former trend support turned resistance. Volatility is higher here (IVR: 55.2) than in either /ESM4 (IVR: 33.8) and /NQM4 (IVR: 42.9), which makes expressing bullish directional bets more appropriate through selling puts rather than buying calls.

Nevertheless, until /RTYM4 clears the area between 2024/35, it’s difficult to distinguish, on a technical basis, whether the recent rally has continuation potential. Failure to clear 2024/35 puts the April low at 1915.8 back into play.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.