S&P 500 and Nasdaq 100 Hovering Near All Time Highs After FOMC

S&P 500 and Nasdaq 100 Hovering Near All Time Highs After FOMC

Also two-year T-note, silver, natural gas and Japanese yen futures

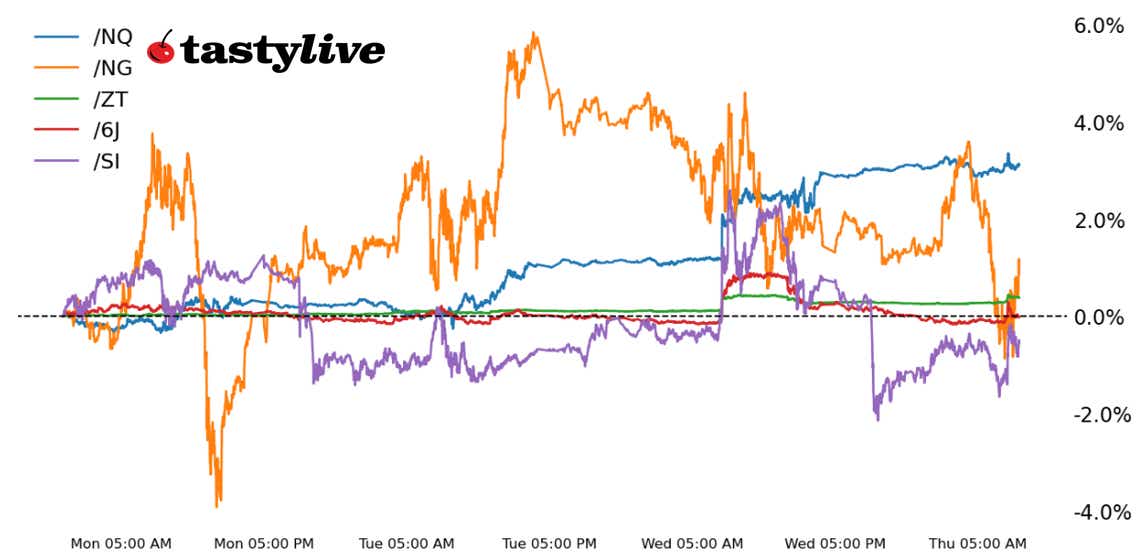

Nasdaq 1000 E-mini futures (/NQ): +0.71%

Two-year T-note futures (/ZT): +0.10%

Silver futures (/SI): -3.15%

Natural gas futures (/NG): -1.54%

Japanese yen futures (/6J): -0.36%

The macro deluge may be finished and markets are emerging on the other side relatively unscathed. Both the S&P 500 (/ESM4) and Nasdaq 100 (/NQM4) are hovering near all-time highs established yesterday afternoon around Federal Reserve Chair Jerome Powell’s press conference. Meanwhile, bonds appear to be shrugging off the updated “dot plot,” as the May U.S. producer price index helped spark a rebound in Fed interest rate cut odds for 2024.

Symbol: Equities | Daily Change |

/ESM4 | +0.29% |

/NQM4 | +0.71% |

/RTYM4 | -0.17% |

/YMM4 | -0.18% |

Nasdaq contracts (/NQM4) jumped higher this morning following the update to factory-gate prices, supporting the view that the Federal Reserve has a clearer path to start cutting rates. That should help to keep sentiment buoyed through the end of the week with most of the event risks out of the way. Tesla (TSLA) jumped in pre-market trading after Elon Musk said shareholders approved his pay package. Broadcom (AVGO) rose more than 13% after the chip maker reported a revenue boost from AI chip demand.

Strategy: (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18600 p Short 18800 p Short 20800 c Long 21000 c | 62% | +1055 | -2945 |

Short Strangle | Short 18800 p Short 20800 c | 69% | +4130 | x |

Short Put Vertical | Long 18600 p Short 18800 p | 86% | +440 | -3560 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.10% |

/ZFU4 | +0.20% |

/ZNU4 | +0.24% |

/ZBU4 | +0.26% |

/UBU4 | +0.22% |

Two-year T-note futures (/ZTU4) rose 0.10% after this morning’s inflation and labor market data supported more buying in the rate-sensitive instrument. The underlying yield fell as low as 4.667%—breaking to the lowest level since early April. The Treasury will auction 30-year bonds today. Later tonight, bond traders will have their eyes on the Bank of Japan rate decision due at 22:00 central daylight time (CDT).

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101.25 p Short 101.375 p Short 103.125 c Long 103.25 c | 63% | +15.63 | -234.38 |

Short Strangle | Short 101.375 p Short 103.125 c | 65% | +109.38 | x |

Short Put Vertical | Long 101.25 p Short 101.375 p | 99% | +15.63 | -234.38 |

Symbol: Metals | Daily Change |

/GCM4 | -0.99% |

/SIN4 | -3.15% |

/HGN4 | -0.67% |

Silver prices (/SIN4) shrugged off the optimistic data that pushed yields lower, something that typically helps precious metals. The Fed’s rate forecast showing only one rate cut for the year seems to be more forefront for gold and silver traders. Prices fell to the 50-day simple moving average, extending a streak of lower highs and lower lows, putting prices at risks of breaking down further on a technical basis. The April swing high around the 29 level may serve as a decisive mark for traders to defend.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 26 p Short 26.25 p Short 32.25 c Long 32.5 c | 64% | +345 | -910 |

Short Strangle | Short 26.25 p Short 32.25 c | 72% | +3230 | x |

Short Put Vertical | Long 26 p Short 26.25 p | 86% | +135 | -1115 |

Symbol: Energy | Daily Change |

/CLN4 | +0.18% |

/HON4 | +1.09% |

/NGN4 | -1.54% |

/RBN4 | +0.72% |

Natural gas futures (/NGN4) added to yesterday’s losses, with prices carving out a double top on the daily chart after failing at the previous swing high from May. The commodity losing momentum at that level shows that bulls aren’t quite ready to advance on the trade despite more warm weather in the forecast for the United States, which should boost demand and throttle inventory builds. Today, the Energy Information Administration (EIA) will report inventory data for natural gas stocks.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.3 p Short 2.35 p Short 3.45 c Long 3.5 c | 61% | +170 | -330 |

Short Strangle | Short 2.35 p Short 3.45 c | 72% | +1680 | x |

Short Put Vertical | Long 2.3 p Short 2.35 p | 88% | +60 | -440 |

Symbol: FX | Daily Change |

/6AM4 | -0.30% |

/6BM4 | -0.20% |

/6CM4 | -0.09% |

/6EM4 | -0.16% |

/6JM4 | -0.36% |

After its fifth-worst day of the year, the U.S. dollar is experiencing a modest rebound across the board. Weakness in metals appears to be weighing on the Australian dollar (/6AM4), while the sustained elevation in energy prices remains a problem for the Japanese yen (/6JM4). Unlike after the May 1 Federal Open Market Committee meeting, when the Bank of Japan and Japanese Ministry of Finance intervened in the market, this time around policymakers sat still, perhaps leading to a bit of a letdown among short-term speculators.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00605 p Short 0.0061 p Short 0.0066 c Long 0.00665 c | 63% | +137.50 | -487.50 |

Short Strangle | Short 0.0061 p Short 0.0066 c | 69% | +562.50 | x |

Short Put Vertical | Long 0.00605 p Short 0.0061 p | 96% | +18.75 | -606.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.