S&P 500 Dips and Yields Jump as May Jobs Growth Beats

S&P 500 Dips and Yields Jump as May Jobs Growth Beats

Also, 10-year T-note, gold, crude oil and Japanese yen futures

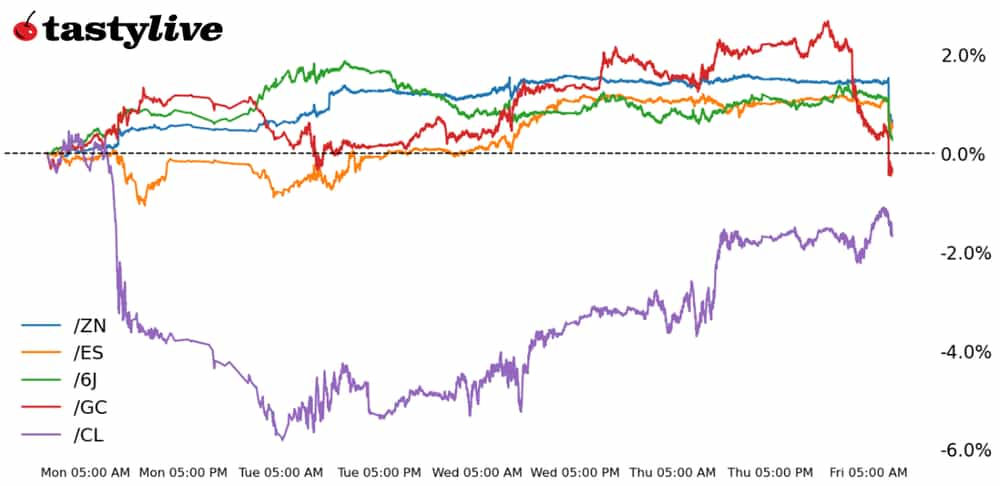

S&P 500 E-mini futures (/ES): -0.47%

10-year T-note futures (/ZN): -0.91%

Gold futures (/GC): -2.24%

Crude oil futures (/CL): -0.04%

Japanese yen futures (/6J): -0.74%

The U.S. labor market may not be moderating, raising new questions about the expected path of Federal Reserve policy for the remainder of 2024.

The nonfarm payrolls report showed a headline gain of 272,000 vs. the consensus forecast of 185,000, and the two-month revision saw prior payrolls trim 15,000 jobs. The household employment survey indicated the unemployment rate (U3) rose to 4% against a forecast of holding at 3.9% because workers reported 408,000 fewer jobs than in April. The labor force participation rate dropped from 62.7% to 62.5%.

The wage figures showed signs of unexpected reacceleration. Average hourly earnings increased by 0.4% month-over-month (m/m) and 4.1% year-over-year (y/y), above forecasts of 0.3% m/m and 3.9% y/y.

Overall, the May U.S. jobs report produced an initial drop in both stocks and bonds as the combination of hotter payrolls growth and hotter wage pressure reduced odds of Fed interest rate cuts later this year. Yesterday, 39-basis points (bps) of cuts were discounted. Today, markets are pricing in 29-bps.

Symbol: Equities | Daily Change |

/ESM4 | -0.47% |

/NQM4 | -0.42% |

/RTYM4 | -1.20% |

/YMM4 | -0.40% |

S&P 500 futures (/ESM4) sold off following this morning’s jobs report. The 5,300 level is in focus for traders, with prices ahead of the open trading around 5,333 after a 0.55% drop. Traders are waiting to see if prices fade the initial move, which has sometimes turned out to be the case this year following the NFP print. After today, focus turns to next week’s action, when the consumer price index (CPI) and the Fed decision will likely provide some very tradeable price action.

Strategy: (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5125 p Short 5150 p Short 5650 c Long 5675 c | 65% | +250 | -1000 |

Short Strangle | Short 5150 p Short 5650 c | 71% | +1762.50 | x |

Short Put Vertical | Long 5125 p Short 5150 p | 87% | +125 | -1125 |

Symbol: Bonds | Daily Change |

/ZTU4 | -0.25% |

/ZFU4 | -0.69% |

/ZNU4 | -0.91% |

/ZBU4 | -1.52% |

/UBU4 | -1.82% |

The 10-year T-note futures contract (/ZNU4) dropped 0.78% after the jobs report, its biggest one-day percentage decline since April 10. The move reverses the past three days of gains and pushes the underlying yield to 4.428%. While yields remain well below the recent April swing high of 4.739, the higher yields could keep risk assets out of favor until next week when we see inflation data. However, bond traders may be jumpy about that figure, given today’s data showing wage gains.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106.5 p Short 107 p Short 112 c Long 112.5 c | 65% | +125 | -375 |

Short Strangle | Short 107 p Short 112 c | 71% | +453.13 | x |

Short Put Vertical | Long 106.5 p Short 107 p | 89% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCQ4 | -2.24% |

/SIN4 | -4.41% |

/HGN4 | -2.79% |

The rise in yields post-NFP is sinking gold prices this morning, with the metal down more than 2%, nearly matching its largest drop in May. The metal remains rangebound, contained above 2,300 near the swing low from early May. For traders who believe the level will hold, a premium selling strategy, such as selling a put spread or an iron condor, may prove attractive. China stopped buying gold last month, according to a government report. That may put additional pressure on the metal through the New York session.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2200 p Short 2225 p Short 2450 c Long 2475 c | 64% | +700 | -1800 |

Short Strangle | Short 2225 p Short 2450 c | 71% | +2610 | x |

Short Put Vertical | Long 2200 p Short 2225 p | 85% | +330 | -2170 |

Symbol: Energy | Daily Change |

/CLN4 | -0.04% |

/HON4 | +0.17% |

/NGN4 | +0.57% |

/RBN4 | +0.10% |

Crude oil contracts (/CLN4) trimmed some of its pre-NFP strength and is trading slightly lower on the session, down 0.04%. A strong U.S. labor market doesn’t appear to be enough of a reason for traders to continue the recent two-day buying streak in the commodity that followed an earlier selloff that saw oil break below its range it carved out through May. A report from China showed crude oil imports fell, which worked against the fundamental case for oil prices.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 73 p Short 73.5 p Short 77 c Long 77.4 c | 24% | +370 | -130 |

Short Strangle | Short 73.5 p Short 77 c | 54% | +3,350 | x |

Short Put Vertical | Long 73 p Short 73.5 p | 62% | +170 | -330 |

Symbol: FX | Daily Change |

/6AM4 | -0.86% |

/6BM4 | -0.45% |

/6CM4 | -0.40% |

/6EM4 | -0.52% |

/6JM4 | -0.74% |

Japanese Yen futures (/6JM4) fell after the U.S. dollar moved higher alongside yields this morning. Prices fell to around 0.006387, putting the currency about 0.4% higher than the late May swing low. If prices continue to decline to that level, it will likely mark a make-or-break moment that could bring intervention risks back into focus. Japanese monetary officials meet next week, and markets expect the central bank to trim its bond buying. This could leave a volatile backdrop in place for the currency through next week.

Strategy (28DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0063 p Short 0.00635 p Short 0.00655 c Long 0.0066 c | 33% | +250 | -375 |

Short Strangle | Short 0.00635 p Short 0.00655 c | 42% | +700 | x |

Short Put Vertical | Long 0.0063 p Short 0.00635 p | 71% | +100 | -525 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.