What Happens Before and After a Stock Joins the S&P 500

What Happens Before and After a Stock Joins the S&P 500

They lean bullish in the month leading up to being added, and volatility declines precipitously after it happens

- Super Micro Computer and Deckers Outdoor are set to join the S&P 500 with the next March Quarterly rebalancing.

- Stocks tend to have bullish moves before they’re added to the S&P 500.

- Volatility tends to contract significantly after stocks are added to the index

Is adding a stock to the S&P 500 a bullish or bearish catalyst? To find out, we’ve looked back at the performance of 68 added in the last five years.

It’s an interesting question because Super Micro Computer (SMCI) is the next stock set to join the S&P 500 this month at the next quarterly rebalancing. The stock has seen a significant rise over the last couple months—up over 300% in 2024 alone and nearly 1,055% over the last year.

Deckers Outdoor (DECK) is also set to join the S&P 500 and has also seen bullish movement, up 35% year to date and up nearly 110% over the past year.

The stocks leaving the index are Whirlpool (WHR) and Zion Bancorp (ZION).

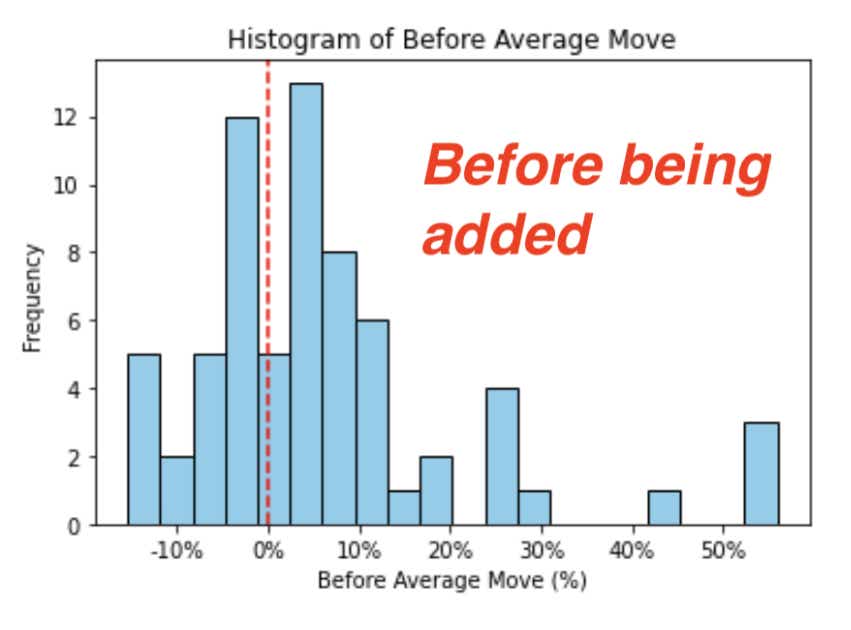

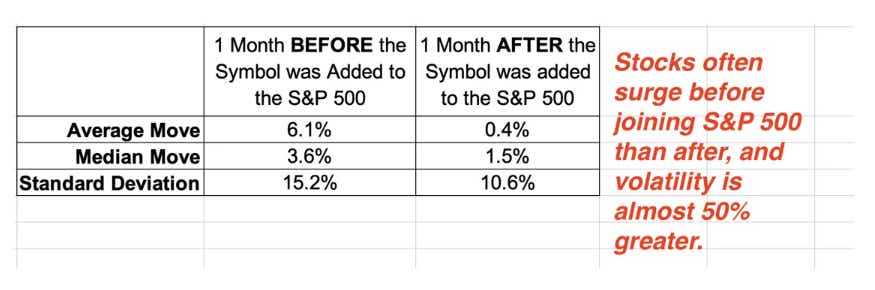

Looking back, we found adding a stock to the S&P 500 is a bullish catalyst BEFORE the rebalancing. Average bullish moves in the 68 stocks we studied were 6.1%, and a median of 3.6%, with the tail events clearly to the upside. We studied the moves in the stock one month before the rebalancing.

How do newly added stocks react after the rebalancing? We took a look at that, too!

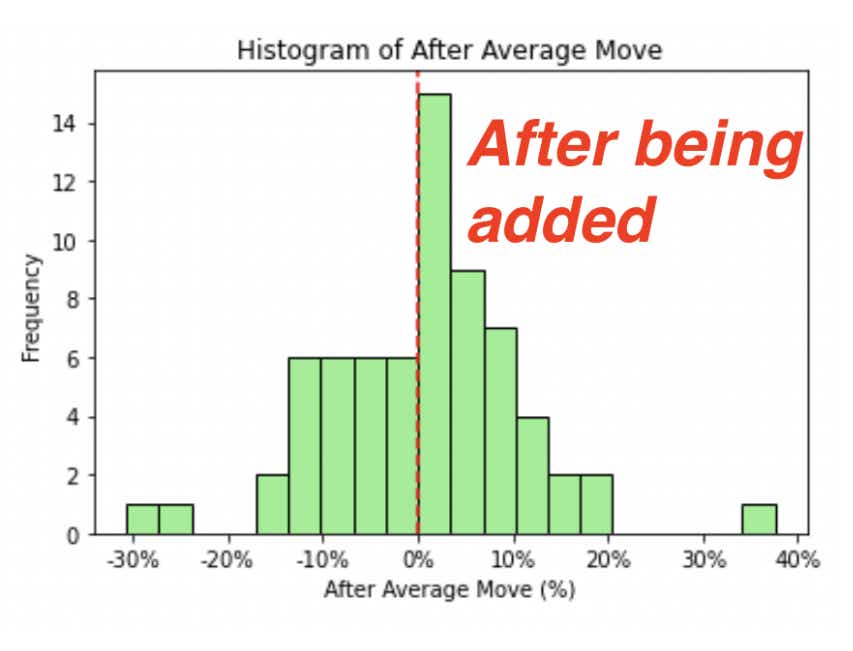

We found volatility contracted significantly in the stocks’ movement after being added to the S&P 500 with an average contraction of nearly 50%. This leads to significantly tighter price movements. A month after being added, the average movement was a nearly flat at 0.4%. It does tend to lean slightly bullish, but much less so when compared before being added. These moves have historically been much more normally distributed.

Here is a breakdown of the histograms. We see a significant lean bullish in the month leading up to the stocks’ addition to the S&P 500, with a much more muted and "normal" movement post-addition. The big takeaway for options traders is that post-addition volatility tends to contract significantly. This data leans toward the "buy the rumor, sell the news" adage—bullish into the event and flat after.

View the full report HERE.

Subscribe to get cutting edge research like this to your inbox weekly though our Cherry Picks Report.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.