Stocks Face Dark December if Markets Struggle Despite Rate Cut Hopes: Macro Week Ahead

Stocks Face Dark December if Markets Struggle Despite Rate Cut Hopes: Macro Week Ahead

By:Ilya Spivak

A dark December may follow if stock markets struggle despite still more evidence that central banks from Australia, Canada and the U.S. are moving closer to cutting interest rates

- Analysts expect central banks in Australia and Canada to join the global dovish policy turn.

- U.S. economic data may point to labor market weakness, underpinning Fed rate cuts.

- If stocks struggle despite signs of oncoming stimulus, a dark December looms ahead.

Dramatic moves in the bond market defined financial markets last week. Interest rates plunged across maturities as two- and ten-year Treasuries recorded sharp gains.

The move reflected a sharply dovish adjustment in monetary policy expectations. Most critically, the markets now see a 25-basis-point (bps) Federal Reserve interest rate cut by May and 125bps (or 1.25%) in total easing next year.

The uplift to risk appetite from this seemingly strong adjustment was ominously modest. The bellwether S&P 500 stock index added a soggy 0.71% while the high-flying Nasdaq idled. In seemingly counter-intuitive fashion, the dollar strengthened, and crude oil fell. A strong rise in gold was perhaps the most “textbook” reaction.

Below are the key macro waypoints for traders in the week ahead.

Reserve Bank of Australia (RBA) interest rate decision

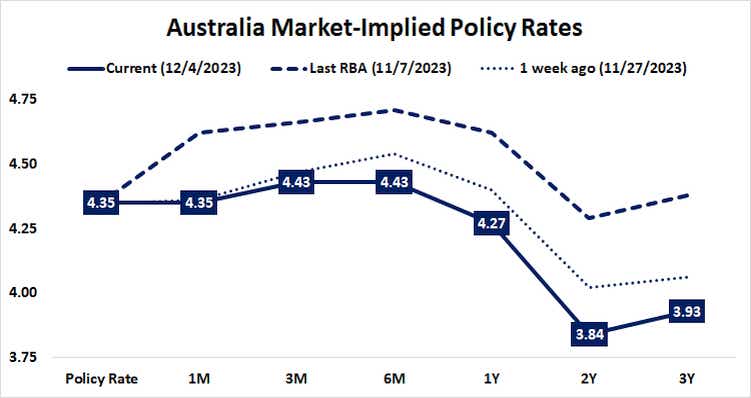

Australia’s central bank is expected to keep its target interest rate unchanged at this week’s policy meeting. The expected policy path priced into the markets has moved in a decidedly dovish direction since the RBA last met a month ago. Bets on further tightening have fallen away. A 25bps rate cut is likely by the end of 2024.

The pain afflicting Australia’s economy is deepening. November’s purchasing managers index (PMI) data points to the fastest contraction since August 2021, the worst of the COVID-driven downturn. Data released just last week showed deeper disinflation and slower credit growth than expected in October.

If this translates into a softening of the hawkish tone in the RBA policy statement, traders may pull forward rate expectations. The markets may cheer the sight of another major central bank pivoting toward accommodation, nudging stocks higher as yields decline.

On the other hand, stocks and bonds alike enjoyed blistering gains in November after the markets concluded that the Fed has ended its rate hike cycle. That loosened credit conditions globally. Next, the markets’ focus may turn to the sharp slowdown that is prompting the policy pivot. In this world, a dovish RBA turn is a “risk off” signal.

Bank of Canada (BOC) interest rate decision

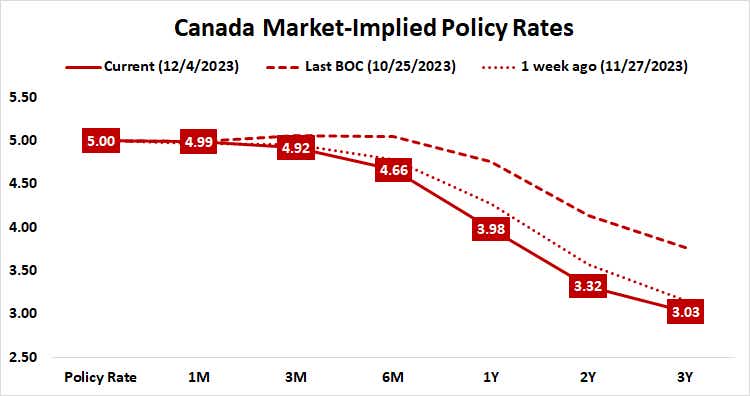

The next test of the markets’ evolving perspective on the global turn in monetary policy will come from Canada. The priced-in path ahead for Governor Tiff Macklem and company bear a striking resemblance to the path analysts expect from the Fed—and with good reason. Canada’s business cycle is intimately aligned with that of its southern neighbor.

Analysts expect no further rate hikes. The first 25bps rate cut is due to appear no later than April. Three of them are fully baked into the outlook for 2024, with a 19% probability of a fourth. Here too, a sharply dovish adjustment played out in November. Also on trend, PMI data points to accelerating contraction in economic activity.

As with the RBA, the markets’ reaction in the face of still more evidence of a broad-based reversal in the direction of interest rates worldwide will be telling. If last month’s celebration of cheaper money gives way to worries about the onset of recession, the year may well end painfully for stocks as well as growth-geared commodities and currencies.

U.S. employment data

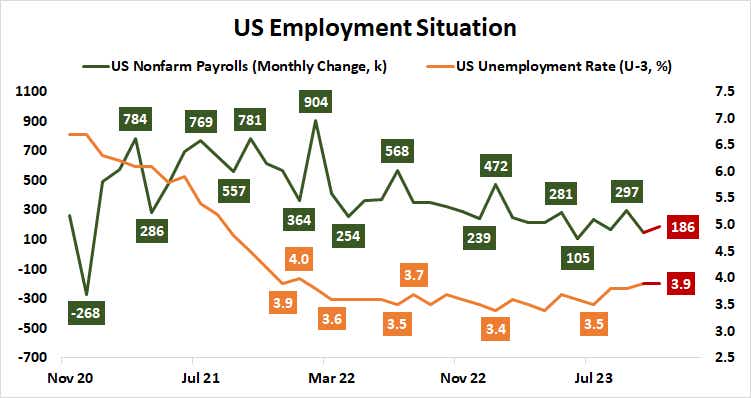

On the U.S. economic data front, a series of key releases tracking the labor market culminate with November’s payrolls and unemployment figures Friday. Before that, the Job Openings and Labor Turnover Survey (JOLTS) is expected to show that vacancies hit a three-month low in October while the Institute of Supply Management (ISM) updates the pace of hiring in the service sector, a key input into the Fed’s policy calculus.

The banner release at the end of the week is projected to see 186,000 jobs added to nonfarm payrolls, a mild pick-up from October’s 150,000. The jobless rate is seen steady at 3.9% while average hourly earnings growth–a measure of wage inflation–slows to a 29-month low of 4% year-on-year.

Leading PMI data from S&P Global suggests employment across the manufacturing and service sectors shrank in tandem for the first time since mid-2020 in November. Echoes of that weakness on display in this week’s news-flow may help underpin last month’s tectonic move in monetary policy bets.

As elsewhere, the decisive question to be answered now is whether the markets remain in a mood to be delighted by the prospect of cheaper money ahead, or shuddering at the thought of why that will come about.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.