Fed Chair Powell Testimony, U.S. CPI Inflation, Consumer Confidence: Macro Week Ahead

Fed Chair Powell Testimony, U.S. CPI Inflation, Consumer Confidence: Macro Week Ahead

By:Ilya Spivak

Can stock markets continue to revel in Fed rate cut speculation even as the U.S. economy turns down?

- Fed Chair Powell is to testify before Congress, with concerns about U.S. economic growth in focus.

- Markets are hoping to see ‘goldilocks’ disinflation in June’s U.S. consumer prices data.

- The UofM consumer confidence survey is to show if lower prices are still a source of cheer.

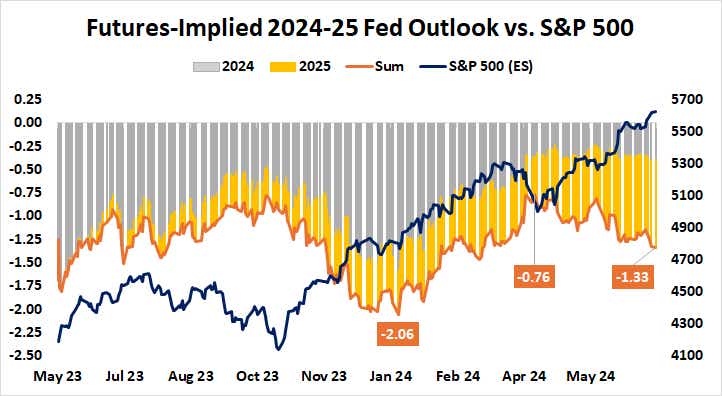

Interest rate cut fever swept financial markets amid thin, holiday-shorted trade last week. Another batch of soft U.S. economic data buoyed Federal Reserve stimulus bets, with rate futures now calling for 133 basis points (bps) in cuts through year-end 2025. That makes for the most dovish setting of median policy expectations in four months.

Wall Street cheered the prospect of cheaper money. The bellwether S&P 500 stock index rose 1.8%, continuing an uptrend fueled by burgeoning rate cut hopes since mid-April. The tech-oriented Nasdaq rose 3.5%. Treasury yields fell by about 3% across maturities. Gold prices added 2.5%, and the U.S. dollar slumped over 1% against its major peers.

Against this backdrop, here are the macro waypoints likely to shape what comes next.

Federal Reserve Chair testimony

The time has come for another round of semi-annual testimony from the head of the U.S. central bank. Jerome Powell will begin a two-day speaking marathon with an appearance in the Senate and then move on to the House of Representatives.

When it comes to the path of interest rates, a well-worn narrative looks likely to reappear. The Fed chair will probably offer a bit of cautious optimism about renewed progress on lowering inflation in recent months, even as he posits that a bit more confidence is needed before easing. That is likely to keep September in play as the start of the cycle.

Discussing the trend in U.S. economic growth might be more eye-catching for investors. Analytics from Citigroup show U.S. data outcomes have increasingly soured, relative to forecasts in the past three months. Last week’s shockingly weak Institute of Supply Management (ISM) reports and watery labor market data are a case in point.

Financial markets might revel in the prospect of future rate cuts, but they tend to be far less receptive when the easing finally arrives. That is because some sort of seemingly intolerable economic negativity is required to spur the central bank to pull the trigger. Risk appetite might cool if Powell’s remarks suggest such a thing is closer on the horizon.

U.S. consumer price index (CPI) data

Once traders have received their marching orders from the Fed chair, their interpretation of the situation will be promptly tested with the release of the latest update on U.S. inflation.

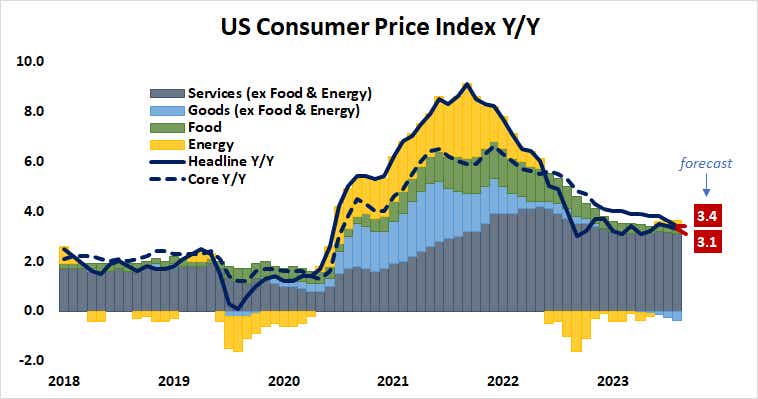

Consumer price index (CPI) data is expected to show headline price growth cooled to 3.1% in June, the slowest in five months. The core measure, which strips out volatile food and energy prices — a focal point for policy officials — is seen holding at 3.4%, unchanged from the three-year low established in May.

As with Powell’s testimony, how markets respond seems likely to depend on whether the numbers continue feeding benign rate cut speculation. A wide miss to the downside that is potent enough to meaningfully pull easing forward in time — pricing in two cuts this year and perhaps even considering a move this month — may leave stocks unsettled.

University of Michigan consumer confidence survey

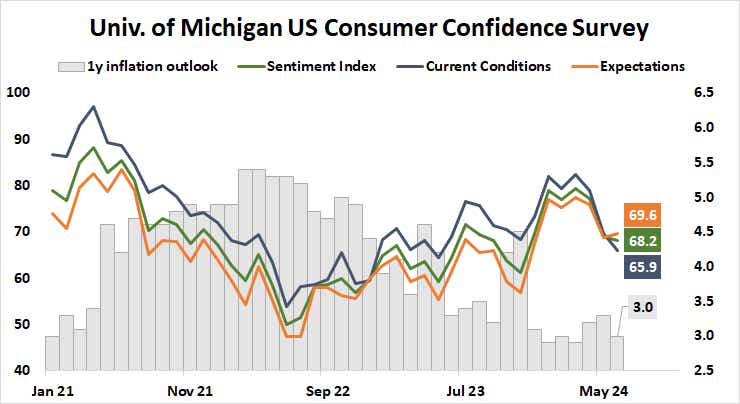

How all this sits with U.S. consumers — the engine driving most economic growth — will round out the story for the week. The University of Michigan (UofM) sentiment survey has told a consistent story in the wake of the COVID-19 pandemic. Consumers’ outlook soured as one-year inflation expectations rose, then started to improve as they turned lower.

The markets may take heart if survey respondents appear to notice disinflation has resumed after a setback earlier in the year. If the relationship breaks down and cooling prices fail to inspire optimism, however, worries about an economic downturn might prevail.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.