Crude Oil Challenges Resistance; Has Natural Gas Bottomed?

Crude Oil Challenges Resistance; Has Natural Gas Bottomed?

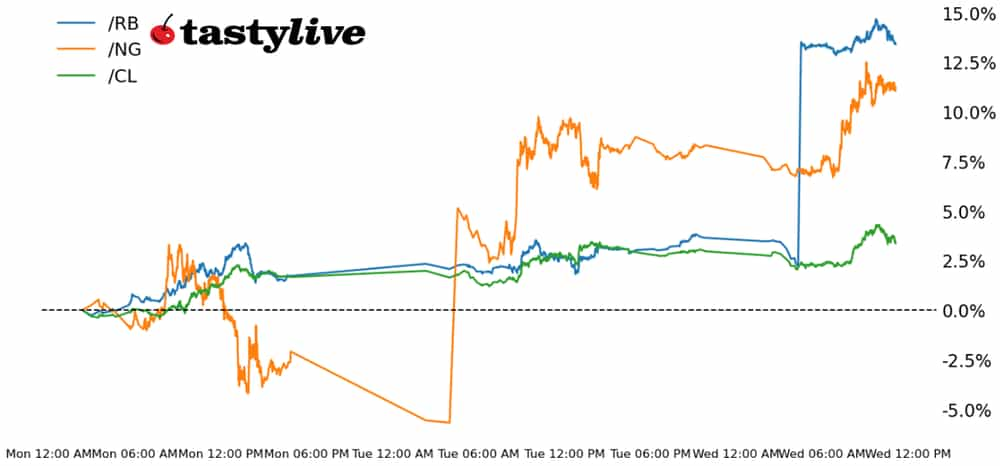

Gasoline futures are near their highest level since September. That’s key because consumers often gauge inflation by the price gallon.

- Crude oil prices (/CLJ4) are probing resistance in place since mid-November 2023.

- Natural gas prices (/NGJ4) have jumped in recent days as concern about the supply glut eases.

- Is more inflation forthcoming? Gasoline futures (/RBJ4) are just off their highest level since September 2023.

Market update: crude oil up 3.27% month-to-date

The fundamental story for energy markets is a mess. In recent weeks, the International Energy Agency has issued daunting forecasts, projecting that energy supply in 2024 will outstrip energy demand. OPEC+ remains disorganized and ineffective. The Chinese economy remains mired in a slump, even as the government has opened the stimulus spigot.

Yet turmoil in the Middle East (supply chains) and stronger growth from the United States is seemingly offsetting downside risks for energy markets in the short-term. Positioning remains a factor as well, where net-longs in crude oil futures entered the year near their lowest levels in over a decade—back to the start of recorded data. Similarly, natural gas futures positioning is at levels similar to where it was back in mid-December 2023, which provided ample fuel for a short covering rally.

The narrative tug-and-pull, alongside extreme positioning levels, has ultimately proven supportive for energy markets in February. As we wind down the month, crude oil prices are bumping up against resistance, while natural gas prices are attempting to carve out a meaningful bottom.

/CL Crude Oil Price Technical Analysis: Daily Chart (August 2023 to February 2024)

Crude oil prices (/CLJ4) have been rangebound between 68 and 80 for the better part of the past four months, but that may change soon. Unlike previous rallies into the 78/80 area, /CLJ4 has sustained its move higher since the start of the month; unlike rallies in November and December 2023 and January 2024, /CLJ4 wasn’t immediately rejected upon its recent attempt at 78/80. This may portend to an increased likelihood that bulls are able to take control and end the multi-month consolidation.

That said, a breakout higher from here may have limited upside. Swing highs in September and October 2023—even following the outbreak of the Israel-Hamas war—were carved out around 84/86. Sitting close to the middle of the broader range dating back to September 2023, it may be appropriate for traders to look toward short strangles (short 70 put plus short 84 call) or iron condors (long 68 put/short 70 put plus short 84 call/long 86 call) instead of speculating on whether or not the area around 78/80 holds or breaks as resistance in the short-term.

/NG Natural Gas Price Technical Analysis: Daily Chart (July 2023 to February 2024)

Natural gas prices (/NGJ4) produced a bullish outside engulfing bar, or daily key reversal, at the lows last week. Since then, the technical structure of /NGJ4 has improved meaningfully, closing back above its daily 5-EMA (one-week moving average) for the first time since Jan. 12. Today’s rally to the daily 21-EMA (one-month moving average) marks the first such occurrence since Jan. 18. Slow stochastics are trending higher through their median line, and MACD is trending higher (albeit still in bearish territory). Volatility is relatively low (IV Index: 72%; IV Rank: 20.4), making long ATM (at-the-money) call spreads more appealing than short put spreads as a way to express a directionally bullish bias on /NGJ4.

/RB Gasoline Price Technical Analysis: Daily Chart (July 2023 to February 2024)

Gasoline prices (/RBJ4) have traded sharply higher since the start of the year, a little-discussed but important development nonetheless. Why? They are a flashing advertisement for inflation pressures for consumers and a significant input cost for businesses. Given the shift in /RBJ4 this year, it stands to reason that prices at the pump are likely to rise toward $3.30 per gallon (national average) over the coming weeks. /RBJ4, while a thinly traded product, offers meaningful perspective into how the short-term path of headline consumer price index (CPI) and personal consumption expenditures (PCE) may develop over the coming months—posing as a headwind to the Federal Reserve’s efforts to quash inflation.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.