Trading Occidental Petroleum Like Warren Buffett

Trading Occidental Petroleum Like Warren Buffett

An understanding of the investment guru’s strategy can inform your OXY trades

Occidental Petroleum produces significant volumes of oil and natural gas in the Permian Basin in Texas. Fans of the Houston Astros may even have noticed the Occidental patch (OXY) on the team’s jerseys. But shares have largely traded sideways in 2023 and closed in November just north of $60 per share.

Occidental has an average price of $74.00 from Wall Street analysts. It has attractive fundamentals with a Piotroski F score of 7, a low enterprise value to earnings before interest and tax (EV/EBIT) of 10x, and its net margin is north of 18%, historically strong against the industry and its relative historical performance.

And then there’s Warren Buffett. His company, Berkshire Hathaway, has permission to purchase up to 50% of OXY. This year, it increased its stake to over 28%.

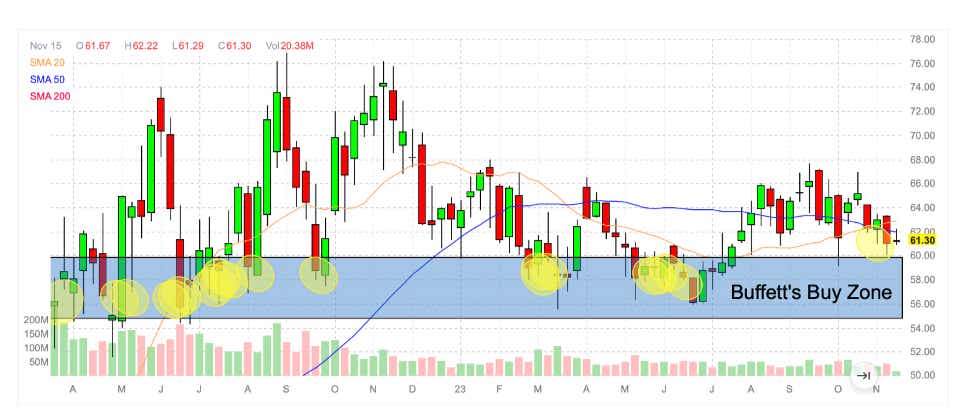

Understanding Buffett’s buying patterns can lead to a successful trade. Occidental hasn’t been an outperformer over the last 12 months, and it has bottomed out thrice during that period.

Down three times

First came a bottom during the massive hedge fund dump of oil contracts and energy stocks in June 2022. Second, during the Gilt Crisis and broader global liquidity crunch in October 2022. And third, in October 2023 during a lack of financial interest in oil from commodity traders because of recessionary concerns. During each period, Berkshire has acquired more OXY stock.

Berkshire didn’t buy shares near the 52-week high. Instead, the company quietly built its positions in a very specific range between $56 and $60 over the last 18 months.

That’s the Buffett “Buy Zone.” The following chart provides a recap of Buffett’s OXY buying since March 2022.

Traders can take advantage of these buying patterns and so can long-term investors looking to enter the stock at a preferred entry price.

How to Trade OXY

Traders can sell credit spreads on OXY when shares hit oversold or fall to near the range where Buffett has acquired shares.

They can start by going out 45 to 55 days on OXY and finding an attractive price on the options chain where they’d be content to own the stock. Because Buffett has consistently bought above $56 per share or higher, the $55 put could be an attractive sale.

On the final day of November, the January 19, 2024, OXY $55.00 put sold for $0.59, while the $52.50 put sold for $.26.

The selling a put spread with those figures required $217 in margin to make $33 over 53 days. That equates to a 15.2% return with a probability of profit of 83.8%.

If Occidental shares trade sideways, the value of the spread will decay. As a result, the trader would make money. Long-term investors may be happy to buy shares under $55 if the stock pulls back. This trade offers an annualized return of 109%—meaning traders can sell this spread repeatedly and target nice gains on lower-risk strategies.

Garrett Baldwin is the Editor-at-Large of Luckbox Magazine and author of the financial blog Postcards from the Florida Republic on Substack. He is an economist who studies market anomalies, liquidity, and monetary policy. @FloridaRepCap

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.