Off the Charts: OAT-Bund Spread

Off the Charts: OAT-Bund Spread

The S&P 500 up 4.06% for the month to date

Each week, buy-side and sell-side analysts produce reams of charts and data visualizations to help contextualize price action across asset classes. These data can help shape one’s thinking, offering evidence for increased conviction or criticism about currently held beliefs. Likewise, they may offer insight into relative risk/reward opportunities in various markets. These are the five charts that had an impact on my views on markets this week.

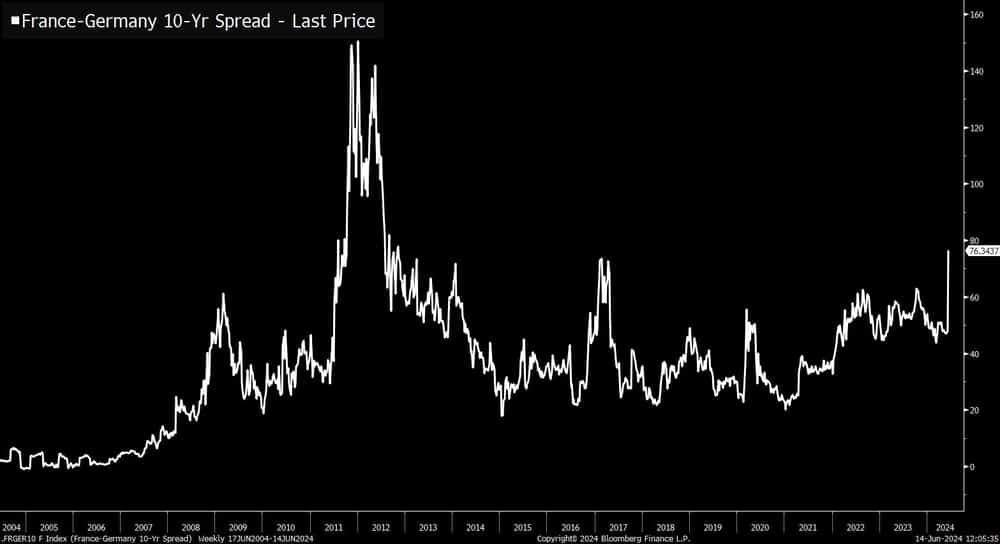

1) A record week for the French/German 10-year spread

Takeaways: The French OAT-German Bund 10-year yield spread widened by a record 30.2 bps over the week. At no point during the global financial crisis or Eurozone debt crisis did the perceived risk around French debt grow as quickly as it has in recent days.

Trade implications: The euro (/6EU4) and the MSCI Eurozone ETF (EZU) were likewise hit this week, with the former dropping 0.88% and the latter paring 6.8%. In what appears to be a redux of the fear that built into the 2017 French elections, traders are fearful of fear itself.

Once the risks of a non-centrist policy shift in France were benchmarked by markets, assets began to rally back; the initial sell-off took around a month to exhaust itself. The jump in volatility this week (/6EU4 IVR: 117.4) is tempting but may only be worth fading if you give yourself enough duration (e.g. at least 45 DTE) and the willingness to deal with a further drawdown in the short term.

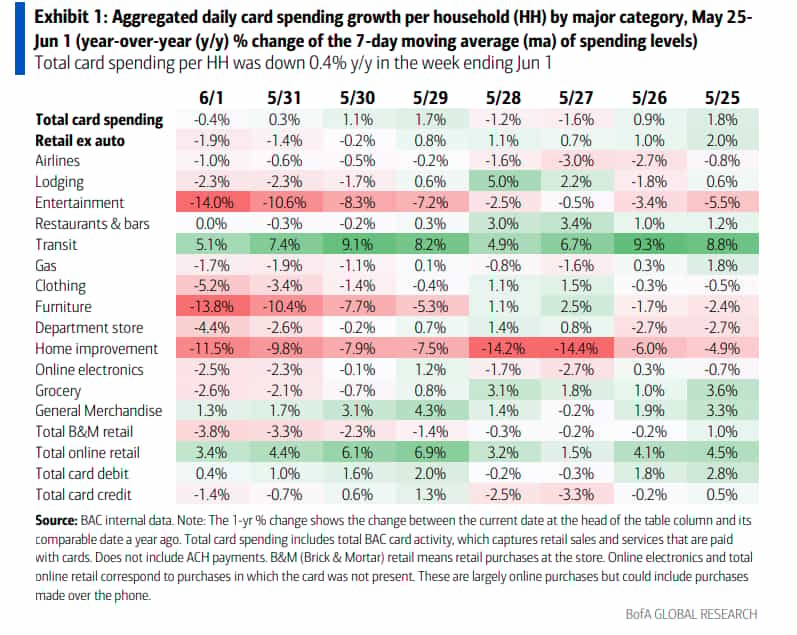

2) The U.S. consumer’s spring slowdown

Takeaways: Total card spending per American household was down by 0.4% year over year (y/y) in the week ending June 1, while retail sales ex-auto are tracking at -1.9% y/y.

Trade implications: There have been some red flags appearing for the U.S. economy in recent weeks, which have been ignored by traders as they cherry-pick the still-good information to justify the "Goldilocks" point of view. Nevertheless, given that the U.S. economy is approximately 70% consumption-based, a slowdown in consumer spending warns of growing weakness.

The May U.S. inflation report came in weaker than expected, but that wasn’t enough to convince the Federal Reserve to keep more than one rate cut penciled in for this year. This means that Fed policymakers may start to take a dovish tack in the coming weeks, which could be a precursor to a September rate cut. Concurrently, 30s ($/ZB) broke out of a multi-year downtrend to the upside this week.

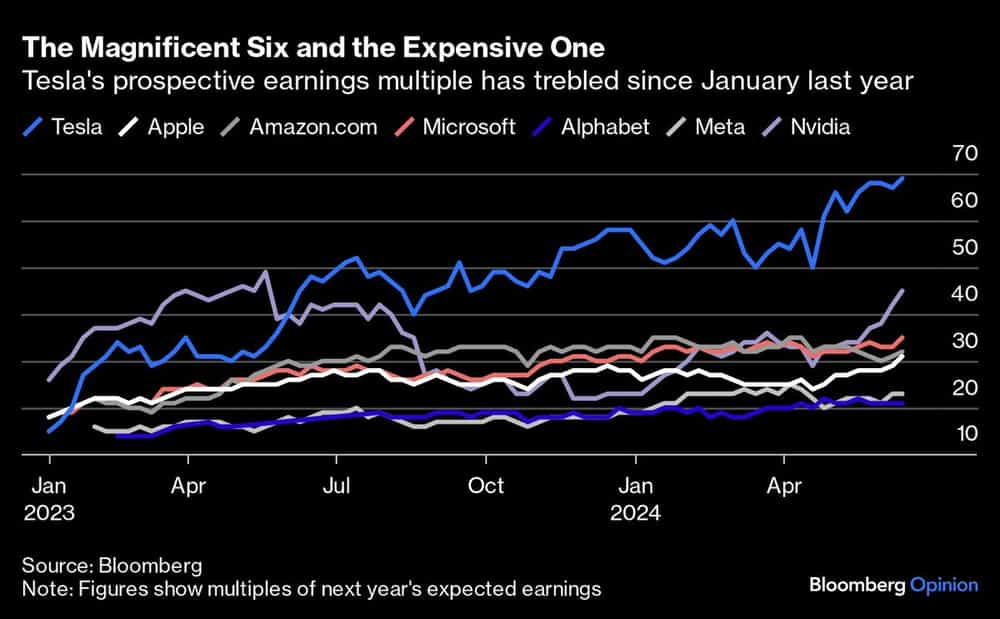

3) Tesla’s valuation is well above its peers

Takeaways: Elon Musk’s pay package was approved (again) by Tesla shareholders this week, potentially marking the end of a chapter of uncertainty over his long-term involvement in the company. TSLA is down 28.36% for the year to date, while its forward P/E ratio has increased to 73.53 at market close Friday.

Trade implications: TSLA staged a small "buy the rumor, sell the news" type of reaction around the Musk compensation play approval. But the reality is that price action has been rather flat for the better part of six weeks.

While that may entice some into directionally neutral strategies, there’s not much volatility on the board and it’s coming in below that of some of the major indexes (TSLA IVR: 22.9; for comparison, Russell 2000 (/RTYU4) IVR: 45.3). That said, if U.S. equities take a leg down broadly, TSLA isn’t exactly well-positioned to weather the storm.

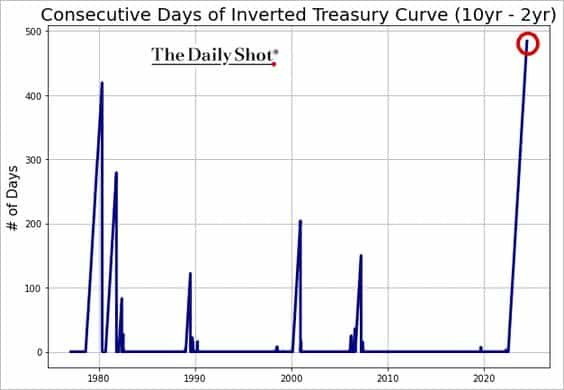

4) 2s10s spread inversion continues

Takeaways: The U.S. Treasury 2s10s spread (10-year yield minus the two-year yield) has been inverted (below 0) for nearly 500 days, the longest streak ever.

Trade implications: The 2s10s spread opened the year down almost 40 bps, and that’s where it has remained for the better part of the past six months.

The long-awaited steepener has yet to arrive, leading to frustration for traders who have tied up capital; the opportunity cost of watching a position do nothing while other assets increase double digits can skew one’s psychological approach, leading to chasing or even worse, "revenge trading."

The news gets worse for those that remain, Recent Fed policy shifts hint at a bull flattener being the next evolution of the yield curve.

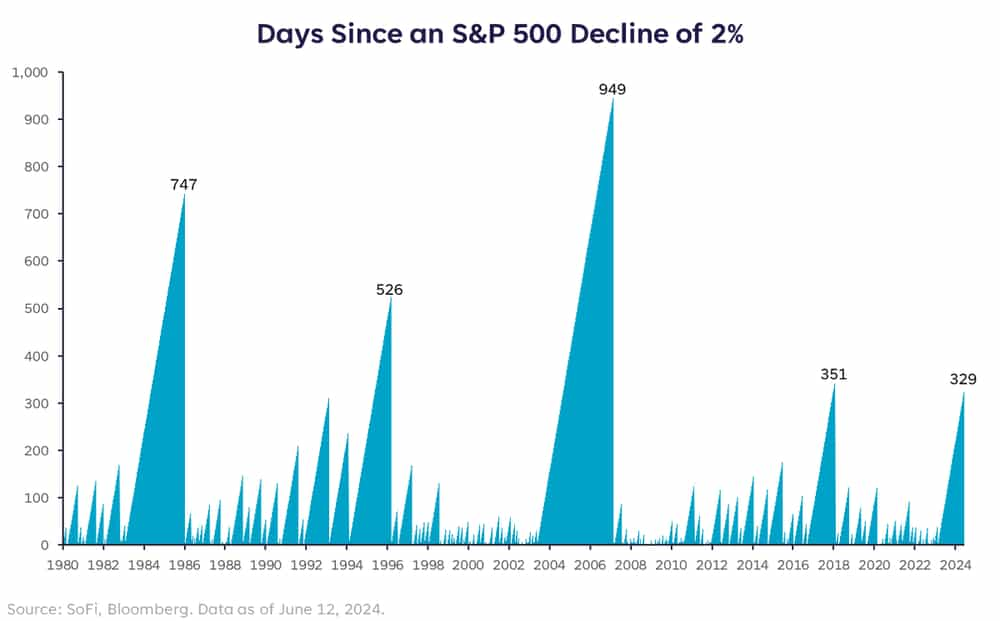

5) The S&P 500 is streaking in typical bull fashion

Takeaways: The S&P 500’s streak without a decline of at least 2% extended to 329 days at the close on Friday.

Trade implications: Bears will tell you that stocks have gone too far, too fast, and it’s time for a meaningful market correction to shake out irrational market participants. And yet, history says this time isn’t different. There have been four other instances since 1980 in which the S&P 500’s daily streak exceeded the current stretch. Moreover, outside of the mid-2000s stretch that culminated in the global financial crisis, the other three instances represented "buy the dip" (or "sell the vol") opportunities on the other side.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.