NVDA Earnings Preview: Huge Expectations

NVDA Earnings Preview: Huge Expectations

By:Mike Butler

Can they beat expectations again?

- Nvidia is set to report quarterly earnings on Nov. 21 after the stock market closes at 3:20 CDT.

- They are expected to report an earnings-per-share (EPS) of $3.39 on $16.11 billion in revenue.

- The EPS figure is significantly higher this quarter compared to last quarter's expectation of $2.07 per share.

- The revenue figure is significantly higher this quarter compared to last quarter's expectation of $11.09 billion.

Nvidia earnings preview

If you're reading this article, you probably already know that Nvidia (NVDA) has had a stellar 2023. The tech stock opened the year at $210.00, and reached its new all time high of $504.60 today, Nov. 20.

Nvidia has been the darling of the artificial intelligence craze, spiking almost $100 after their earnings announcement in May 2023. The stock has rallied almost $100 this month alone, and there are big expectations for the stock this earnings season. I was shocked to see just how much the EPS and revenue figures have increased compared to last quarter.

The current EPS expectation of $3.39 is over 50% higher than the previous quarter's expectation of $2.07 per share.

The current revenue expectation of $16.11 billion is also almost 50% higher than the previous quarter's expectation of $11.09 billion. Just staggering numbers from the chip maker, and it seems as though they'll need to exceed these numbers yet again and post a strong guidance for next year if they want to keep this stock price sky high.

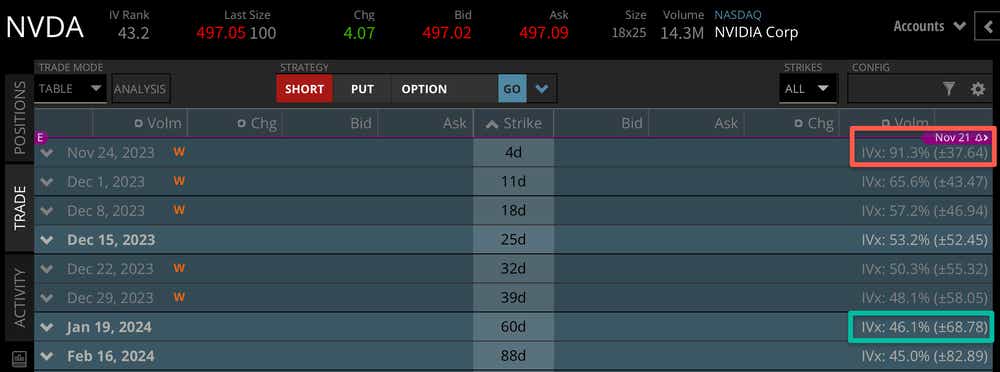

The stock price's expected move through this week based on current implied volatility is +-$37.64, which is just over 7% of the current stock price. This is a pretty large expected move for such a high-priced stock. This weekly expected move makes up over 50% of the expected move through the January 2024 monthly cycle, so there is a lot of market movement expected from this earnings announcement alone.

Bullish on NVDA stock for earnings

It's no surprise to see NVDA going straight to the moon after the surge of AI demand, and the expectation is that earnings will be very impressive this quarter. If that rings true, and they announce strong expectations for things to continue into next year, we could see little bearish resistance and the stock move higher.

Bearish on NVDA stock for earnings

Interestingly enough, it seems there is a lot of fear for downside movement this earnings quarter. At the end of the day, a massive increase in EPS and revenue expectations puts pressure on the company to deliver and paint a positive light. If they miss at all, or exhibit weak guidance for future quarters, we could easily see "profit taking" and long positions closed, which could put downside pressure on the stock.

There is still some turbulence in the sales relationship with China, which NVDA is closely tied to. This adds a layer of complexity to things, but negative political press is usually not good for single name equities regardless of who they are or what they produce. If there is shakiness on the earnings call, we could see the stock move lower.

Tune in to Options Trading Concepts Live at 11 a.m. CDT on Nov. 21 for a full options strategy breakdown for NVDA stock ahead of earnings after the close!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.