Netflix is Outperforming the Market and Could Continue Higher

Netflix is Outperforming the Market and Could Continue Higher

By:Tom Preston

But meanwhile the market sees continued risk to the upside

With warmer weather around the corner, you’d think people would be enjoying the great outdoors, but Netflix’s (NFLX) performance would suggest that’s not the case. It’s been outperforming the broader market because everyone is glued to screens watching Bandidos.

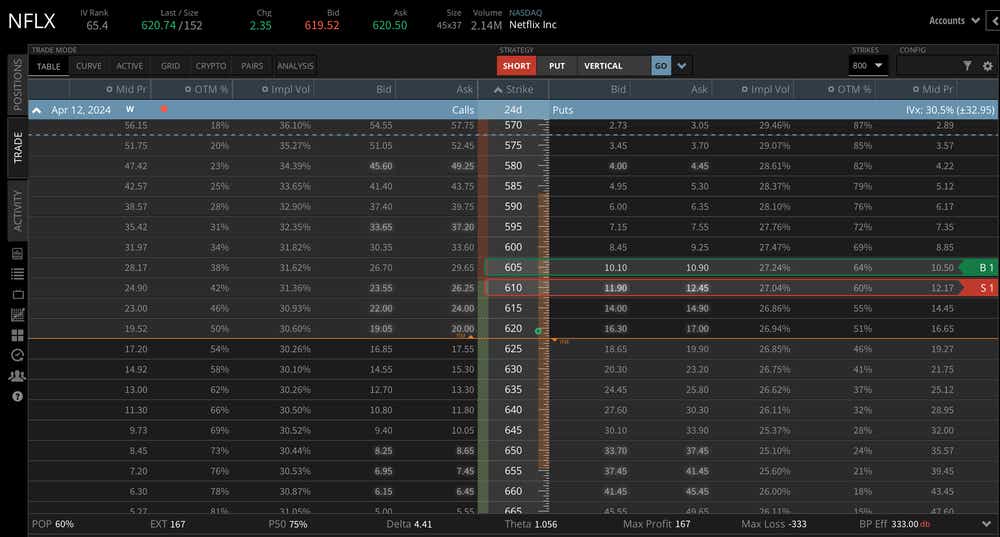

NFLX’s dominance in streaming entertainment could keep it moving higher if revenues are strong in its upcoming earnings. NFLX’s out-of-the-money (OTM) calls are trading over equidistant OTM puts, indicating the market sees continued risk to the upside.

That might be enough for a trader to consider a bullish strategy. NFLX’s implied volatility (IV) has been increasing along with the stock, mainly because of earnings coming in the middle of April, and its 30% overall IV and 65% IV rank make its options good candidates for short premium strategies.

If you think NFLX might continue to rally in the next couple of weeks and don’t want to take risk through earnings, the short put vertical that’s long the 605 put and short the 610 put in the April weekly expiration with 23 days to expiration (DTE) is a bullish strategy that collects a credit 1/3 the width of its strikes, has a 75% probability of making 50% of its max potential profit before expiry and that generates $1.05 of positive daily theta.

Tom Preston, tastylive chief market strategist, is responsible for the brokerage’s trading strategy, client-facing trading software and futures trading products. He contributes to Luckbox magazine and writes tastylive's Cherry Bomb newsletter. He's been trading options since 1992.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.