Natural Gas Forecast: Warming Weather Forecasts Melts Relief Rally

Natural Gas Forecast: Warming Weather Forecasts Melts Relief Rally

The natural gas price rally fizzled out on Tuesday as an increasingly bearish backdrop tempered market optimism that saw prices rise from six-month lows. Where next?

- The natural gas rally stalls after bouncing from a monthly low.

- Weather models show an intense warm trend across U.S.

- Technical indicators show profit taking and shorts positions reestablishing.

Natural gas rally fades as bearish fundamentals throttle gains

A four-day rally in natural gas futures (/NGF4) fizzled out on Tuesday as an increasingly bearish backdrop tempered market optimism that saw prices rise from six-month lows.

Prices are over 10% higher than last Wednesday as prices swing between gains and losses through the trading day.

Warm weather hurts natural gas prices

The commodity has been hammered over the last two months, with prices dropping 22% in November. And despite the 10% rally over the last four days, prices are down over 10% this month. Warm weather across the United States and Europe to start the traditional heating season when demand for gas typically rises has stifled demand. Even developments seen as traditional geopolitical risk premium, events in the Middle East aren’t helping boost prices.

At the same time, inventories in the United States and Europe have performed significantly better than expected compared to traditional seasonal trends. According to the U.S. Energy Information Administration (EIA), working gas in underground storage for the lower 48 states is 245 billion cubic feet (bcf) higher than last year and 260 bfc above the five-year average.

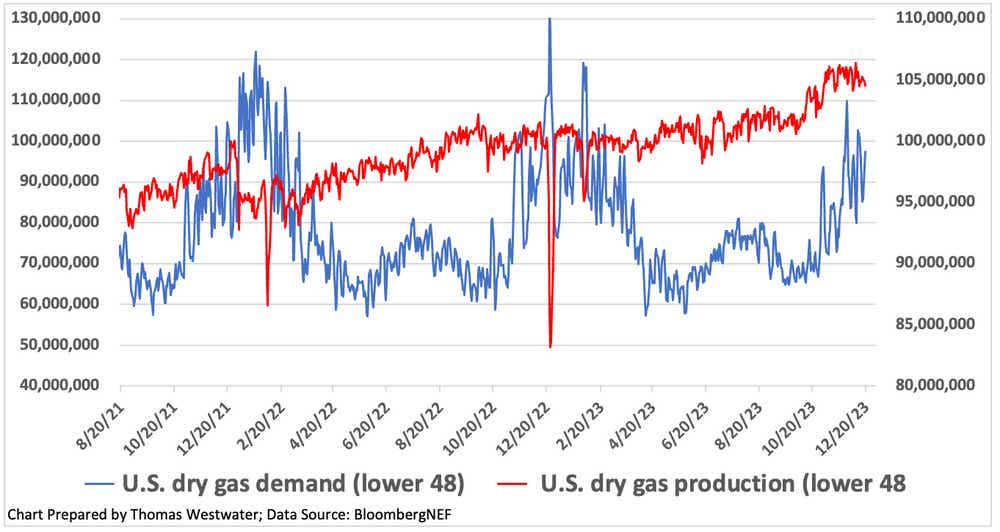

U.S. production is also near record highs. According to data from BloobergNEF, lower-48 gas production was at 104.5 bcf per day (bcf/d), representing a 4.9% increase from a year ago. BNEF data also showed that demand was at 97.4 bcf/d, a 13.5% decline from a year ago. This trend will likely continue when looking at weather forecasts over the next couple of weeks.

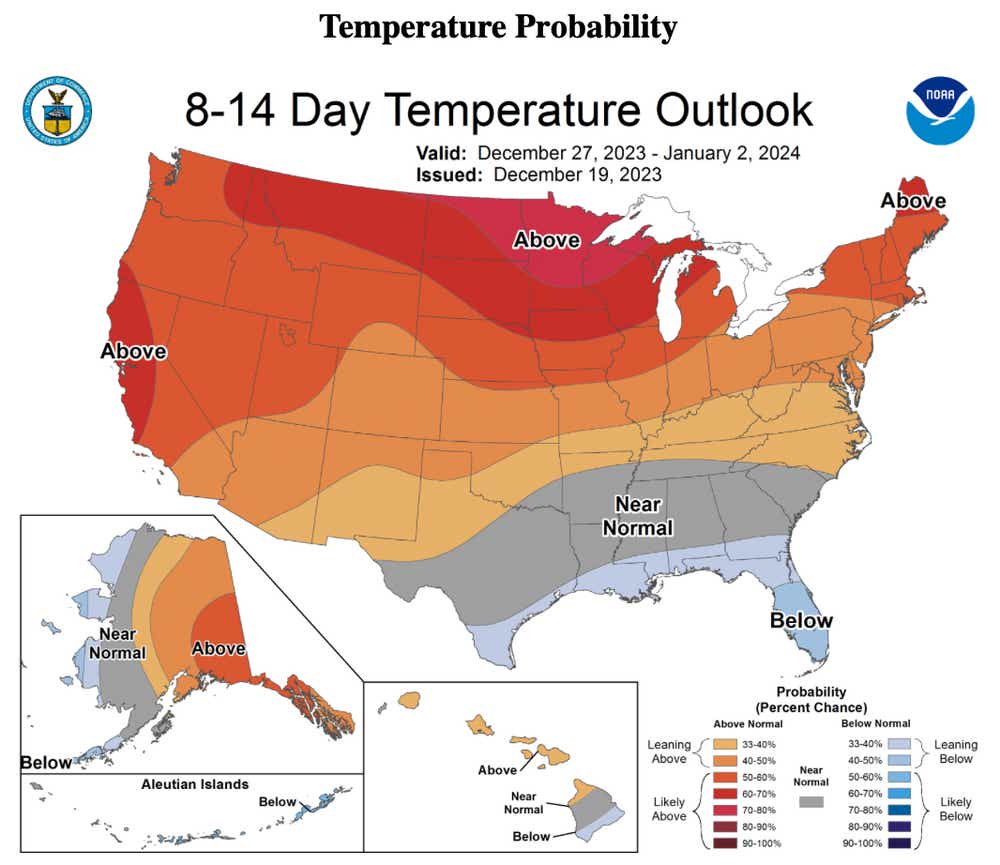

The National Weather Service’s 8 to 14 Day Temperature Outlook shows an above-normal chance for above-average temperatures across much of the continental United States for the reference period. This will likely keep demand subdued over the next several weeks.

Overall, weather trends continue to lean bearish, inventory levels are well above seasonal norms, and demand is trending below production. Given these bearish fundamentals, prices will likely remain rangebound or fall further over the short term.

Read more about recent energy market events.

Natural Gas technical forecast

Prices are trading at the nine-day exponential moving average (EMA) after bouncing off the monthly low last week.

The bullish momentum appears nearly spent, with the Relative Strength Index (RSI) stalling shortly after crossing above the 30 level from oversold conditions.

The technical structure showing quickly exhausted upward momentum shows that it is likely some profit-taking and shorts reestablishing positions. That said, the price might reverse lower in the short term.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.