Nasdaq 100, 10-Year T-Note, Silver, Natural Gas and British Pound Futures

Nasdaq 100, 10-Year T-Note, Silver, Natural Gas and British Pound Futures

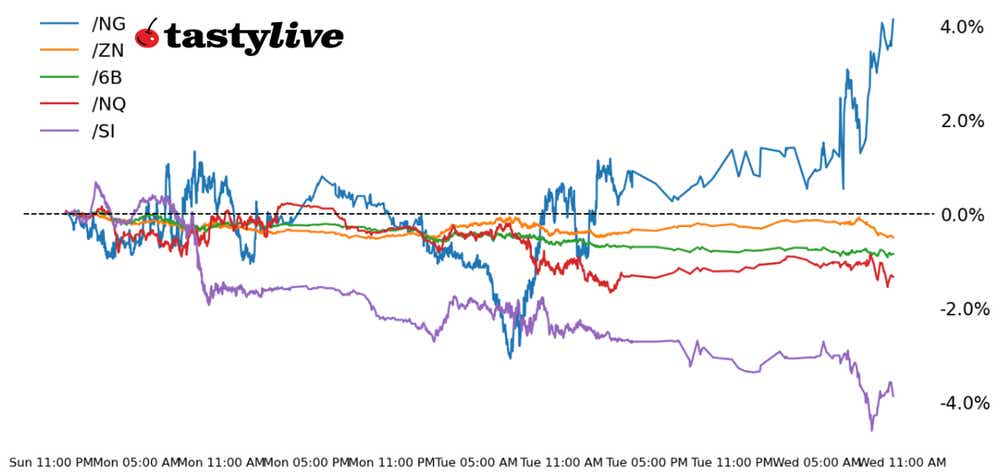

This Morning’s Five Futures in Focus

- Nasdaq 100 E-mini Futures (/NQ): +0.34%

- 10-Year T-Note Futures (/ZN): +0.32%

- Silver Futures (/SI): -1.00%

- Natural Gas Futures (/NG): +0.95%

- British Pound Futures (/6B): -0.10%

Relief has arrived, at least for now. Today’s pre-market trading action has seen the four major U.S. equity market futures rebound amid a bounce in bonds, which are once again being led higher by the long-end of the curve. Chinese property market concerns were quelled overnight after the People’s Bank of China announced it would step up policy adjustments to help the economy gather momentum. Meanwhile, the U.S. government shutdown is inching closer by the minute.

Symbol: Equities | Daily Change |

/ESZ3 | +0.37% |

/NQZ3 | +0.34% |

/RTYZ3 | +0.49% |

/YMZ3 | +0.27% |

A brutal day on Tuesday has not continued into today, at least so far. Led higher by the Russell 2000 (/RTYZ3), all U.S. equity market futures are trading modestly higher. Nevertheless, significant technical damage lingers across the board: the S&P 500 (/ESZ3) has potentially carved out a head and shoulders topping pattern; and the Nasdaq 100 (/NQZ3) broke through its August swing low to fall out of a multi-month range. If "the trend is your friend," then the trend is still lower.

Strategy: (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 14400 p Short 14500 p Short 15100 c Long 15200 c | 28% | +1400 | -600 |

Long Strangle | Long 14400 p Long 15200 c | 44% | x | -8175 |

Short Put Vertical | Long 14400 p Short 14500 p | 63% | +635 | -1365 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.03% |

/ZFZ3 | +0.16% |

/ZNZ3 | +0.32% |

/ZBZ3 | +0.77% |

/UBZ3 | +0.95% |

Price action on Tuesday—gains in the morning only to slump badly as the day moved forward—may be setting up for a sequel today. Bonds are rallying across the curve, with the 30s (/ZBZ3) and ultras (/UBZ3) leading the way to the topside. Two fewer projected Federal Reserve interest rate cuts in 2024 coupled with a higher long-term Fed rate have shocked the market over the past week. There’s no technical evidence to suggest the lows are in yet.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 106.5 p Short 110.5 c Long 111 c | 47% | +218.75 | -281.25 |

Long Strangle | Long 106 p Long 111 c | 35% | x | -812.50 |

Short Put Vertical | Long 106 p Short 106.5 p | 81% | +109.38 | -390.63 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.52% |

/SIZ3 | -1.00% |

/HGZ3 | -0.37% |

Silver (/SIZ3) is moving lower for a third day this morning as the threat of more Fed rate hikes sinks in for investors. While the metal is a traditional safe-haven asset, traders continue to sell the metal as Treasury yields and the dollar strengthen. U.S. jobless claims and GDP data due tomorroww could influence those rate hike bets but likely not enough to cause a major shift in sentiment.

Strategy (29DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22.75 p Short 22.8 p Short 23.2 c Long 23.25 c | 12% | +215 | -35 |

Long Strangle | Long 22.75 p Long 23.25 c | 46% | x | -4730 |

Short Put Vertical | Long 22.75 p Short 22.8 p | 56% | +120 | -135 |

Symbol: Energy | Daily Change |

/CLZ3 | +1.67% |

/NGZ3 | +0.95% |

Natural gas (/NGZ3) is trading about 1% higher with the October contract set to expire today. Prices have traded lower over the past several weeks as U.S. weather patterns become milder going into the fall season. Crude oil (/CLZ3) is trading above $92 per barrel this morning, putting the commodity into fresh highs for 2023. Traders are watching storage levels at Cushing, Oklahoma, the key U.S. pricing point for West Texas Intermediate crude oil. Strong exports and refinery activity have drained the storage hub to its lowest point in nearly two years.

Strategy (61DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.1 p Short 3.15 p Short 3.45 c Long 3.5 c | 18% | +400 | -100 |

Long Strangle | Long 3.1 p Long 3.5 c | 43% | x | -4630 |

Short Put Vertical | Long 3.1 p Short 3.15 p | 54% | +250 | -250 |

Symbol: FX | Daily Change |

/6AZ3 | -0.27% |

/6BZ3 | -0.10% |

/6CZ3 | +0.05% |

/6EZ3 | -0.17% |

/6JZ3 | -0.07% |

It’s more of the same in foreign exchange (FX) markets, whereby the U.S. Dollar is continuing its steady climb into fresh yearly highs versus a basket of its major counterparts. The British Pound (/6BZ3) is on track for its worst month in over a year going into October as the Bank of England’s recent move to hold interest rates continues to plague the currency. While traders will receive a few data prints for the U.K. economy this week it likely won’t be enough to move the needle on its rate outlook.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.195 p Short 1.2 p Short 1.23 c Long 1.235 c | 41% | +181.25 | -131.25 |

Long Strangle | Long 1.195 p Long 1.235 c | 37% | x | -643.75 |

Short Put Vertical | Long 1.195 p Short 1.2 p | 75% | +87.50 | -225 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.