Nasdaq 100 Surges as Bond Yields Reverse Lower

Nasdaq 100 Surges as Bond Yields Reverse Lower

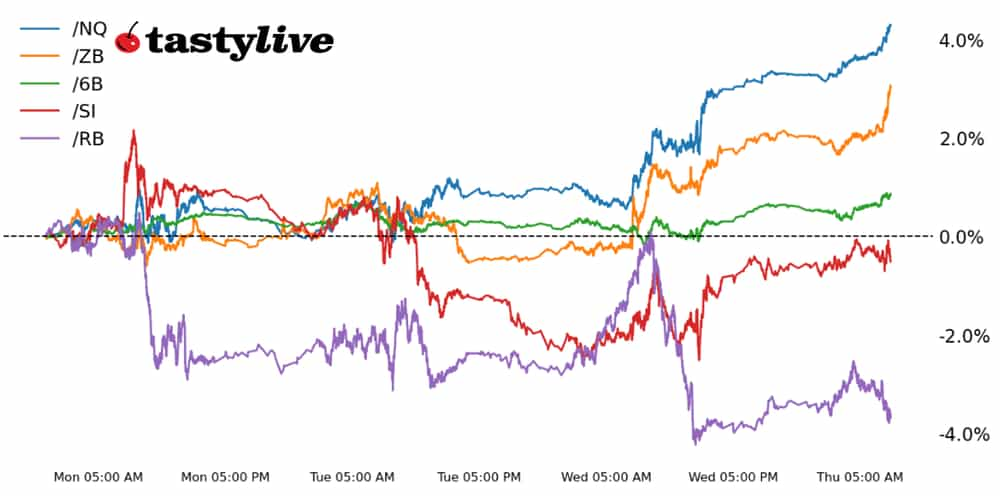

Also, 30-year T-bond, silver, gasoline, and British pound futures

- Nasdaq 100 E-mini futures (/NQ): +1.38%

- 30-year T-bond futures (/ZB): +1.81%

- Silver futures (/SI): +1.54%

- Gasoline futures (/RB): +0.52%

- British pound futures (/6B): +0.72%

The clearest signs yet from the Federal Reserve that the rate hike cycle is finished has breathed life into stocks and bonds. The collapse in U.S. Treasury yields across the curve, led by the long-end, has given considerable room for both the Nasdaq 100 (/NQZ3) and Russell 2000 (/RTYZ3) to trade nearly 1.5% higher ahead of the opening bell. Elsewhere, the U.S. dollar is being dragged lower alongside yields, even as the Bank of England kept rates on hold and decried calls for rate cuts as coming “much too early.”

Symbol: Equities | Daily Change |

/ESZ3 | +0.93% |

/NQZ3 | +1.38% |

/RTYZ3 | +1.43% |

/YMZ3 | +0.68% |

Equity traders are bidding the indexes higher, with the E-mini Nasdaq 100 futures (/NQZ3) taking the lead alongside the Russell. A sixth weekly rise in U.S. jobless claims encouraged traders to take on some risk ahead of tomorrow’s jobs report, with Treasury yields moving lower and clearing a path for equities.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 14600 p Short 14700 p Short 15500 c Long 15600 c | 29% | +1355 | -645 |

Long Strangle | Long 14600 p Long 15600 c | 43% | x | -10040 |

Short Put Vertical | Long 14600 p Short 14700 p | 67% | +565 | -1435 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.04% |

/ZFZ3 | +0.36% |

/ZNZ3 | +0.76% |

/ZBZ3 | +1.81% |

/UBZ3 | +2.54% |

Another rise in U.S. weekly jobless claims is helping to guide yields higher on the view that it will fur ther pressure the Federal Reserve. 30-year T-bond futures (/ZBZ3) are soaring this morning, up the most on a daily percentage basis since March. All eyes are on tomorrow’s jobs report, when analysts expect to see 180,000 jobs were added in October. A weaker-than-expected report would likely push rates lower.

Strategy (22DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 110 p Short 110.5 p Short 114.5 c Long 115 c | 38% | +312.50 | -187.50 |

Long Strangle | Long 110 p Long 115 c | 37% | x | -1671.88 |

Short Put Vertical | Long 110 p Short 110.5 p | 71% | +156.25 | -343.75 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.53% |

/SIZ3 | +1.54% |

/HGZ3 | +0.64% |

Falling bond yields are clearing the path for silver futures (/SIZ3), which are moving about 1.5% higher this morning after the Federal Reserve’s interest rate decision crossed the wires yesterday. A U.S. labor report showed jobless claims rose for the sixth week ahead of tomorrow’s non-farm payrolls report (NFP). With short-term concerns around monetary policy in the back seat, precious metals are more likely to move on broader market sentiment, specifically around the direction of bond yields.

Strategy (54DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 23.1 p Short 23.2 p Short 23.7 c Long 23.8 c | 11% | +440 | -60 |

Long Strangle | Long 23.1 p Long 23.8 c | 46% | x | -7505 |

Short Put Vertical | Long 23.1 p Short 23.2 p | 56% | +235 | -265 |

Symbol: Energy | Daily Change |

/CLZ3 | +0.87% |

/HOZ3 | +1.85% |

/NGZ3 | -1.83% |

/RBZ3 | +0.52% |

Despite the Energy Information Administration (EIA) reporting a surprise inventory build in gasoline stocks yesterday, gasoline futures (/RBZ3) were up slightly, about 0.52%, this morning. Still, prices are down nearly 4% this week as economic fears grow, which could throttle gasoline demand further. Meanwhile, several major refiners are returning from maintenance outages, which is boosting supply at a time when seasonal demand typically drops.

Strategy (xDTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | x | x | x | x |

Long Strangle | x | x | x | x |

Short Put Vertical | x | x | x | x |

Symbol: FX | Daily Change |

/6AZ3 | +1.15% |

/6BZ3 | +0.72% |

/6CZ3 | +0.60% |

/6EZ3 | +1.13% |

/6JZ3 | +0.63% |

British Pound futures (/6BZ3) rose after a hawkish pause from the Bank of England (BoE), leaving rates at 5.25%. The decision wasn’t unanimous, with three of the nine members on the monetary policy committee voting for a hike to 5.5%. Rate traders continue to price in a cut as soon as August, and Gilt yields remain lower, suggesting the move in the Pound may fade if U.S. Treasury yields stop falling.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.195 p Short 1.2 p Short 1.24 c Long 1.245 c | 53% | +125 | -187.50 |

Long Strangle | Long 1.195 p Long 1.245 c | 31% | x | -356.25 |

Short Put Vertical | Long 1.195 p Short 1.2 p | 84% | +62.50 | -250 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.