Nasdaq 100 Seeking Ninth Day of Gains

Nasdaq 100 Seeking Ninth Day of Gains

Also, five-year T-note, silver, natural gas and Japanese yen futures

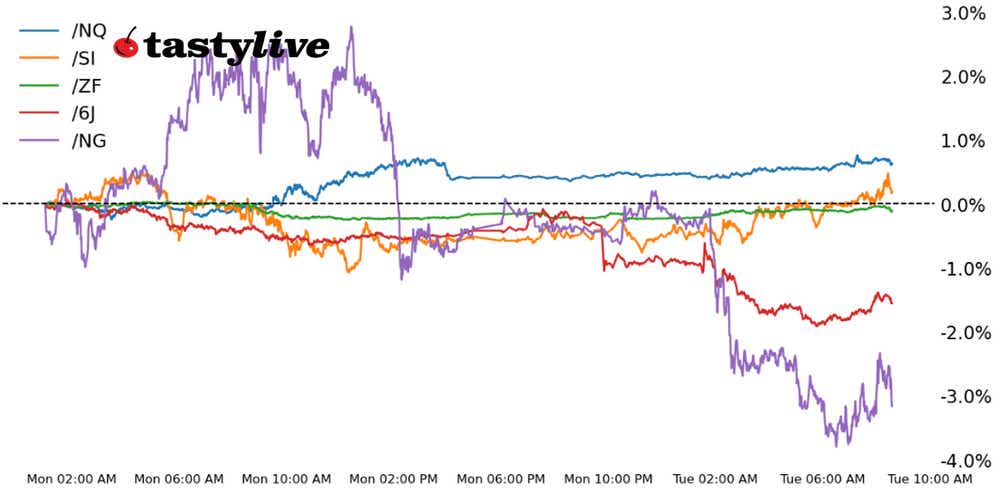

- Nasdaq 100 e-mini futures (/NQ): +0.14%

- 5-year T-note futures (/ZF): +0.11%

- Silver futures (/SI): +0.51%

- Natural gas futures (/NG): -2.92%

- Japanese yen futures (/6J): -0.97%

The Bank of Japan’s steadfast refusal to remove ultra-accommodative monetary policies means there’s one less obstacle in the way of markets through the end of 2023.

U.S. equity futures are moving higher on the back of record inflows to ETFs in recent days. U.S. Treasuries are rebounding after Monday’s minor sell-off. Elsewhere, the announcement of a new maritime coalition aimed at ensuring safe transit through the Red Sea is helping take some pressure out of energy markets.

Symbol: Equities | Daily Change |

/ESH4 | +0.22% |

/NQH4 | +0.14% |

/RTYH4 | +0.85% |

/YMH4 | +0.23% |

Russell 2000 leads stocks higher

U.S. equities are seeking to continue their strong December, this time led higher by the Russell 2000 (/RTYH4). Meanwhile, the Nasdaq 100 (/NQH4) is working on its ninth consecutive day of gains as it looks to carve out another new all-time high.

The S&P 500 (/ESH4) is closing in on its all-time high set in January 2022, less than five points away from clearing that hurdle at the time of writing.

The Santa Claus rally window (the final five days of the year and the first two of the new one) opens this Friday.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16500 p Short 16600 p Short 17400 c Long 17500 c | 35% | +1125 | -875 |

Long Strangle | Long 16500 p Long 17500 c | 42% | x | -6240 |

Short Put Vertical | Long 16500 p Short 16600 p | 68% | +555 | -1445 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.02% |

/ZFH4 | +0.11% |

/ZNH4 | +0.22% |

/ZBH4 | +0.58% |

/UBH4 | +0.85% |

Multiple rate cuts?

Bonds are higher across the curve on Tuesday in the wake of comments from San Francisco President Mary Daly, who noted that it may be necessary for the Federal Reserve to cut rates multiple times in 2024 to prevent inflation from overshooting to the downside.

The long end of the curve continues to be the most volatile while also producing the most sizeable moves: 30s (/ZBH4) and ultras (/UBH4) are up more than 0.5% each. There are no Treasury auctions of note today, but a 20-year bond auction will hit the wires tomorrow.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 107.25 p Short 109.25 c Long 109.5 c | 41% | +125 | -125 |

Long Strangle | Long 107 p Long 109.5 c | 39% | x | -546.88 |

Short Put Vertical | Long 107 p Short 107.25 p | 82% | +62.50 | -187.50 |

Symbol: Metals | Daily Change |

/GCG4 | +0.15% |

/SIH4 | +0.51% |

/HGH4 | +1.25% |

Solver prices outperform

A decline in U.S. Treasury yields and a weaker U.S. dollar are each helping prop up metals markets on Tuesday.

Silver prices (/SIH4) are outperforming their golden counterpart, a contemporaneous indicator of increased speculative appetite across markets (confirming what has been a good day thus far in stocks).

Rising geopolitical risk premia in energy markets may be helping infuse precious metals with a small degree of appeal in the short-term.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 23.65 p Short 23.7 p Short 24.8 c Long 24.85 c | 23% | +190 | -60 |

Long Strangle | Long 23.65 p Long 24.85 c | 44% | x | -4800 |

Short Put Vertical | Long 23.65 p Short 23.7 p | 62% | +105 | -145 |

Symbol: Energy | Daily Change |

/CLF4 | +0.07% |

/HOH4 | +0.01% |

/NGF4 | -2.92% |

/RBH4 | -0.63% |

A new multi-nation coalition aimed at securing passage through the Red Sea may be helping take some geopolitical risk premia out of energy markets on Tuesday.

Of note, natural gas prices (/NGF4) have taken another leg lower, nearing a loss of 3%. Crude oil prices (/CLF4) are effectively unchanged.

The American Petroleum Institute’s (API) weekly crude oil stock change report is due out later today at 4:30 p.m. EST/3:30 p.m. CDT.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.05 p Short 2.1 p Short 2.6 c Long 2.65 c | 39% | +290 | -210 |

Long Strangle | Long 2.05 p Long 2.65 c | 37% | x | -1860 |

Short Put Vertical | Long 2.05 p Short 2.1 p | 65% | +160 | -340 |

Symbol: FX | Daily Change |

/6AH4 | +0.65% |

/6BH4 | +0.83% |

/6CH4 | +0.41% |

/6EH4 | +0.42% |

/6JH4 | -0.97% |

Bank of Japan stands pat

The Japanese yen (/6JH4) has seen a meaningful spill lower on Tuesday in the wake of the December Bank of Japan rate decision.

Despite rumors and murmurs in recent weeks that the BOJ would abandon its long-running QQE with YCC policy, officials decided to stand pat and offered few if any tangible clues for when policy normalization would begin.

Seemingly inconsequential, a decision in the other direction could have upended global bond markets and thrown FX into disarray; that will have to wait for another day.

Strategy (17DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0069 p Short 0.00695 p Short 0.00715 c Long 0.0072 c | 36% | +400 | -225 |

Long Strangle | Long 0.0069 p Long 0.0072 c | 38% | x | -1225 |

Short Put Vertical | Long 0.0069 p Short 0.00695 p | 70% | +237.50 | -387.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.