Nasdaq 100 Pointing Higher for Fourth Straight Day

Nasdaq 100 Pointing Higher for Fourth Straight Day

Also, five-year T-note, silver, crude oil and euro futures

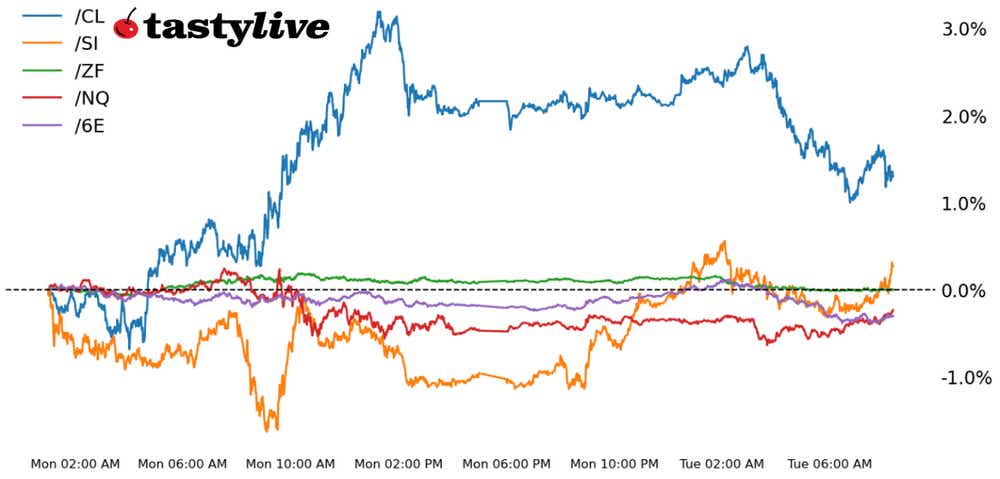

- Nasdaq 100 E-mini futures (/NQ): +0.17%

- Five-year T-note futures (/ZF): -0.12%

- Silver futures (/SI): +0.62%

- Crude oil futures (/CL): -1.34%

- Euro futures (/6E): -0.17%

A U.S. Treasury two-year note auction represents the only meaningful event risk on the calendar for today’s session, portending what may be a quieter day of trading. U.S. equities are experiencing a set of conditions similar to those of yesterday, when the Russell 2000 (/RTYH4) led the majors. Elsewhere, yields are ticking higher, helping to support the U.S. dollar, while precious metals are reversing some of yesterday’s losses.

Symbol: Equities | Daily Change |

/ESH4 | +0.10% |

/NQH4 | +0.17% |

/RTYH4 | +0.77% |

/YMH4 | -0.17% |

The record closes in the S&P 500 (/ESH4) and Nasdaq 100 (/NQH4) may not last long, as both indexes are pointing higher ahead of the cash open today. Once again, however, capital rotation appears to be in play, as the small-cap heavy Russell 2000 (/RTYH4) is easily outpacing its peers for the second day in a row. The earnings calendar is modest the rest of the day, with Netflix (NFLX) earnings after the closing bell.

Strategy: (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16900 p Short 17100 p Short 17900 c Long 18100 c | 39% | +2110 | -1890 |

Long Strangle | Long 16900 p Long 18100 c | 38% | x | -5285 |

Short Put Vertical | Long 16900 p Short 17100 p | 70% | +965 | -3035 |

Symbol: Bonds | Daily Change |

/ZTH4 | -0.05% |

/ZFH4 | -0.12% |

/ZNH4 | -0.20% |

/ZBH4 | -0.44% |

/UBH4 | -0.64% |

A two-year note auction later today may inject some volatility into the front-end of the yield curve, where the two-year note (/ZTH4) is pointing modestly lower. The biggest moves remain at the long-end of the curve, with 30s (/ZBH4) and ultras (/UBH4) producing the biggest moves thus far today. The 2s10s spread is less inverted at -27-basis points (bps).

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106.75 p Short 107 p Short 108.5 c Long 108.75 c | 40% | +132.81 | -117.19 |

Long Strangle | Long 106.75 p Long 108.75 c | 39% | x | -445.31 |

Short Put Vertical | Long 106.75 p Short 107 p | 80% | +70.31 | -179.69 |

Symbol: Metals | Daily Change |

/GCG4 | +0.16% |

/SIH4 | +0.62% |

/HGH4 | +0.74% |

Silver is outperforming gold prices this morning, with futures (/SIH4) up about 0.62% ahead of the opening bell. The metal has struggled over the past several weeks as markets recalibrate rate cut bets for the Federal Reserve. Technically speaking, silver is trading below its key moving averages and broke below the November swing low on yesterday’s move but if bulls decide to capitalize on today’s move, we may see those levels recaptured.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 21.75 p Short 21.9 p Short 23 c Long 23.15 c | 30% | +470 | -280 |

Long Strangle | Long 21.75 p Long 23.15 c | 42% | x | -3135 |

Short Put Vertical | Long 21.75 p Short 21.9 p | 66% | +250 | -500 |

Symbol: Energy | Daily Change |

/CLH4 | -1.34% |

/HOH4 | -1.34% |

/NGH4 | -1.79% |

/RBH4 | -2.14% |

Crude oil prices (CLH4) reversed lower overnight following yesterday’s gains as traders assess supply flows around the world amid rising geopolitical tensions. A drone strike on a Russian fuel export terminal earlier this week sent prices higher but increased flows from Norway and restarted production from Libya is helping to cool fears of a supply shock. Traders are watching today’s inventory report from the American Petroleum Institute (API), which is expected to show a draw of about 3 million barrels because of last week’s cold snap that shuttered production in northern states.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 70 p Short 70.5 p Short 76.5 c Long 77 c | 26% | +360 | -140 |

Long Strangle | Long 70 p Long 77 c | 43% | x | -4390 |

Short Put Vertical | Long 70 p Short 70.5 p | 62% | +180 | -320 |

Symbol: FX | Daily Change |

/6AH4 | +0.21% |

/6BH4 | -0.10% |

/6CH4 | -0.03% |

/6EH4 | -0.17% |

/6JH4 | -0.12% |

Euro futures (/6EH4) remain under pressure after traders started to sell German Bunds overnight. The economic calendar for the Eurozone has a purchasing managers’ index on slate but little else through the week. Meanwhile, a bank lending survey highlighted a tightening in lending standards across Europe and suggested the appetite for credit is likely due for a rebound after becoming exhausted.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.07 p Short 1.075 p Short 1.105 c Long 1.11 c | 49% | +287.50 | -337.50 |

Long Strangle | Long 1.07 p Long 1.11 c | 32% | x | -725 |

Short Put Vertical | Long 1.07 p Short 1.075 p | 82% | +150 | -475 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.