Will NIO's Q3 Numbers Reverse the Stock Price's Recent Slide?

Will NIO's Q3 Numbers Reverse the Stock Price's Recent Slide?

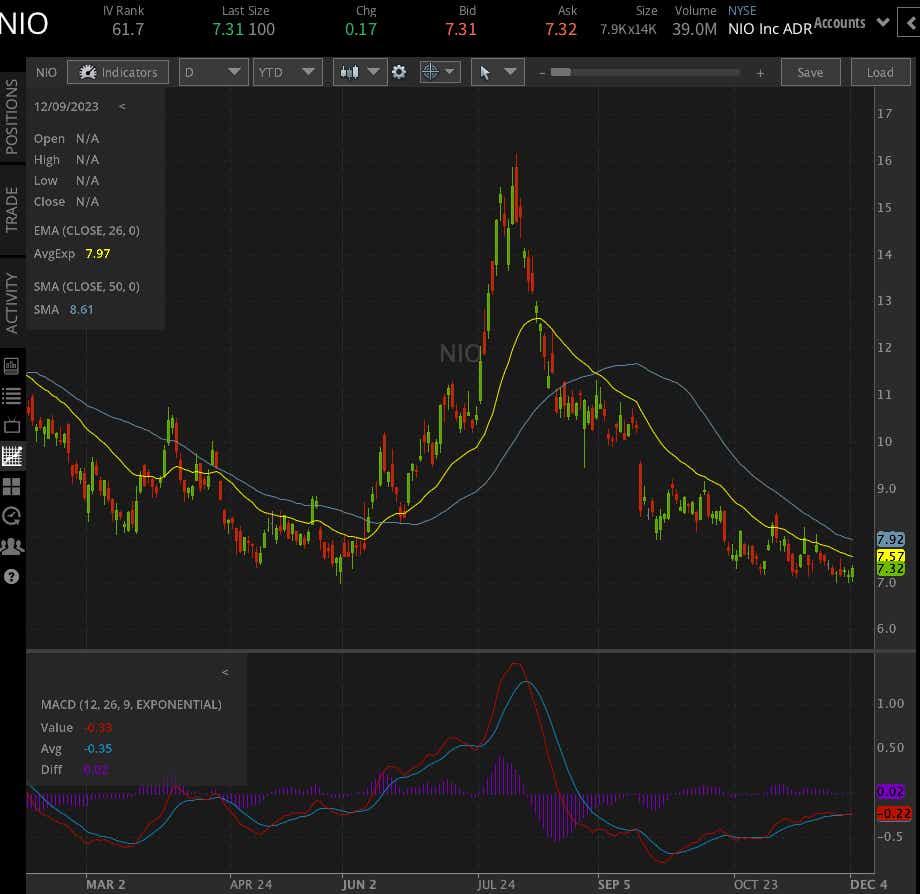

The Chinese automaker is down 27% year-to-date—potential investors will be examining margins and expenses

- NIO is scheduled to report earnings tomorrow.

- Investors are eying the company’s operating margins and costs.

- Uncertainty among investors has pushed the company’s IVR into the 60s.

Nio (NIO) is set to report earnings figures for its fiscal third quarter tomorrow before market open. The Chinese electric-vehicle maker, once thought of as the “Chinese Tesla Killer,” has lost more than 50% since early August, when the stock reached its highest level since October 2022. On a year-to-date basis, NIO is down 27%. Will earnings help reverse the recent losses?

NIO: What do investors expect?

According to Bloomberg figures, investors are looking for adjusted earnings per share (EPS) to cross the wires at -$2.53 on $19.4 billion in revenue. On a GAAP (generally accepted accounting principles) basis, some one-time charges are likely to drag that figure lower, with the consensus showing an expected -$2.97 EPS.

However, we can look at deliveries to provide more timely data. In an update provided last week, NIO said it delivered 15,959 vehicles in November, about the same as in October. Investors seem okay with that since it puts year-over-year growth around 75%. That is likely why the stock is up over 2% today after the news despite a down market. Although sales are much lower than in August, with 19,329 deliveries, growth will likely have to continue accelerating in the coming months to impress.

Cost management is also vital, which takes us to margins—something investors are keen on. Falling battery costs will likely help NIO the most and may launch its gross margin percentage on vehicles above 10%. Currently, analysts expect 10.23%, which would be a 65% increase from Q2’s 6.2% margin.

Can NIO survive increased competition?

The Chinese electric vehicle industry isn’t an easy, and that shows in the numbers. According to China Passenger Car Association data, NIO barely made it into the top ten EV sellers. Li Auto, another domestic EV producer, has nearly double the market share of NIO.

Meanwhile, other brands, like Tesla, have slashed prices amid falling demand. NIO took months to respond to price cuts by other brands, which likely hurt sales. Still, the company is focused on delivering as many vehicles as possible through several measures, such as raising sales commissions for its staff and streamlining dealerships.

On the last earnings call, CEO William Li stated a target of 20,000 vehicles per month in the fourth quarter. Investors really want to hear if progress has been made on reducing the order backlog, which has caused customers to cancel orders and go with different producers.

If that could be remedied in short order, it could encourage upward momentum in the stock’s price. One recent move by the Chinese government will likely help NIO speed up production. On Monday, China added NIO to its list of approved vehicle manufacturers. That will allow the company to control its production more directly, which is currently handled by Anhui Jianghuai Automobile Group.

Trading NIO earnings

NIO currently holds an Implied Volatility Rank (IVR) of 60.3 today, and the January monthly option is pricing in a move of +/- 1.01. While the low stock price isn’t that attractive for options sellers, taking a directional approach through call or put buying shouldn’t cost too much for those looking to speculate.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.