Will the Rally Continue in 2024 for Marathon Digital Stock?

Will the Rally Continue in 2024 for Marathon Digital Stock?

By:Mike Butler

The largest bitcoin mining company in the U.S. will have to contend with the halving of the cryptocurrency

- Marathon Digital Holdings is a popular stock for traders looking for bitcoin exposure at a lower price.

- From Nov. 1, 2023, to the end of the year, MARA stock rallied from $9.00 to $29.67.

- The implied volatility of the stock this year is over 100%, telling us the stock has an implied range that's greater than the current stock price.

What does Marathon Digital Holdings do?

Marathon Digital Holdings (MARA), the largest bitcoin mining company in the United States, earned nearly 11,000 BTC in 2023. The company operates its own mining pool, known as "MaraPool.” It builds custom firmware, designs mining infrastructure and invests in hardware to make mining more efficient. When possible, it even establishes its Bitcoin (BTC) miners near sustainable energy sources, including wind, solar, hydro, nuclear and biofuel. Marathon Digital also holds bitcoins itself. As you might imagine, the companys believes in the long-term value of BTC. This makes MARA stock a high-beta trading instrument for traders and investors looking to gain exposure to Bitcoin in alternative ways.

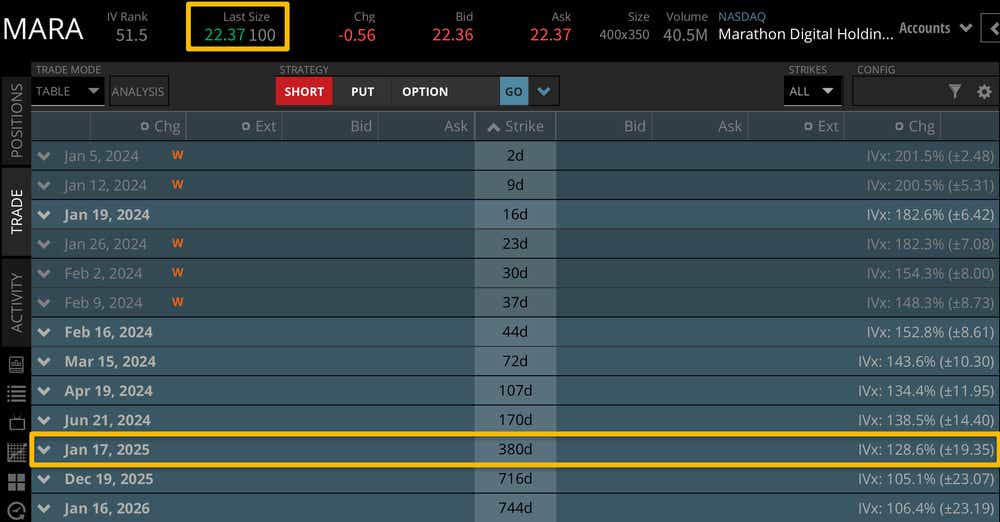

MARA stock has had a wild run recently, jumping from $9 to a high of $29.67 in just two months. From open to close in 2023, MARA stock rose 452.71%. While the company has already had an incredible run, the stock market projects even more volatility for 2024, as seen by the 128.6% implied volatility through the Jan. 17, 2025, options cycle.

This level of price movement should come as no surprise considering the massive rally MARA stock had in 2023, and traders should expect big swings in this stock moving forward. MARA stock is expected to have stock price range of +-$19.35 from the current price of $22.37 through Jan. 17, 2025.

A bullish case for MARA stock

As Thomas Westwater pointed out in his Bitcoin exchange-traded funds (ETF) update, there is a lot of bullish chatter in the crypto space right now. A bitcoin ETF could be live in a matter of weeks, which means a whole new pool of capital could flow into bitcoin exposure. One of bitcoin's main draws is the finite supply of bitcoin itself, which means a big influx of demand could result in a spike in the price of bitcoin. Some analysts have the future price of Bitcoin for 2024 in the six figure range. It will be interesting to see how volatile bitcoin and bitcoin-related products are in 2024.

A bearish case for MARA stock

One consideration that cannot be overlooked is the bitcoin halving set to take place in April 2024. The result is the reward for mining Bitcoin will be cut in half. Since 2020, network participants validating transactions have received a reward of 6.25 BTC per block successfully mined. This reward will fall to 3.125 this year when the halving takes place. IT means Marathon Digital will result in half the reward for the same amount of mining. The halving will surely hurt the revenue generated for Marathon Digital but, in theory, this should increase the price of Bitcoin over time based on basic supply and demand. It will really come down to how the market perceives this change in dynamics and whether Marathon Digital can offset its reduced production with bitcoin investment gains if the price of bitcoin does, in fact, rise this year and beyond.

Tune in to Options Trading Concepts Live every market day at 11 a.m. CDT for a look at Crypto markets and more!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.