Can SKEW Rank Compete with IVR? The Answer Might Surprise You

Can SKEW Rank Compete with IVR? The Answer Might Surprise You

By:Kai Zeng

The SKEW index measures the impact of distribution asymmetry as a proxy of tail risk, while the VIX assesses the impact of overall volatility risk

The SKEW index, akin to the VIX index, serves as a tool for investors to gauge market volatility and investor sentiment. A crucial distinction between the VIX (the Chicago Board Options Exchange's CBOE volatility index) and SKEW index lies in their measurements. The SKEW index measures the impact of distribution asymmetry as a proxy of tail risk, while the VIX assesses the impact of overall volatility risk. Unlike the VIX, the SKEW index focuses on large market movements by examining farther out-of-the-money (OTM) options.

The SKEW value typically fluctuates between 100 and 150, with an average of 126 over the past decade. A higher SKEW value implies a higher perceived tail risk.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

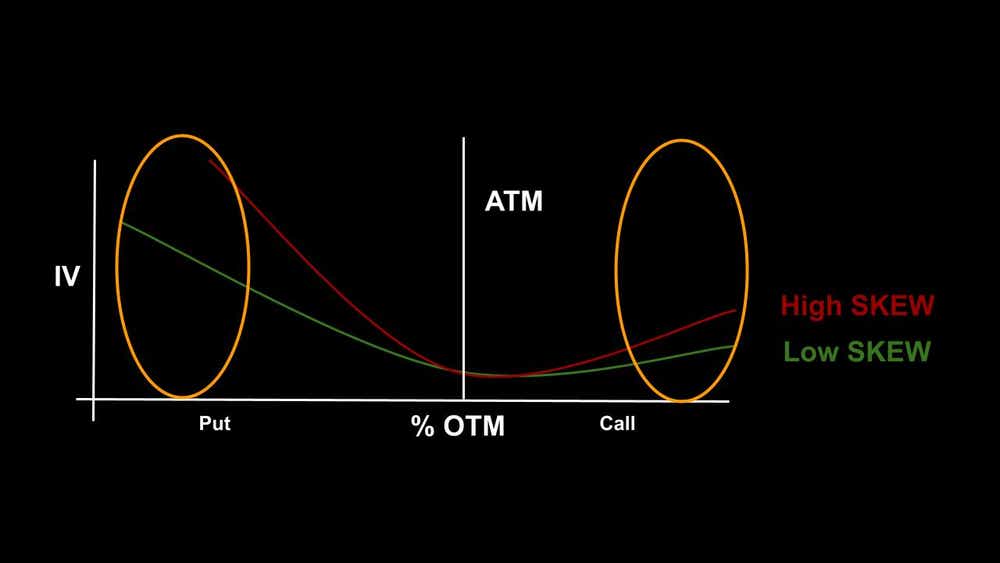

This concept leads us to the idea of establishing a SKEW rank, comparable to the implied volatility (IV) rank, which could serve as a potential trading signal. The SKEW rank is defined in a similar manner to the IV rank. Here is the formula:

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

So here comes the question— could this be a superior trading signal than the familiar IV rank?

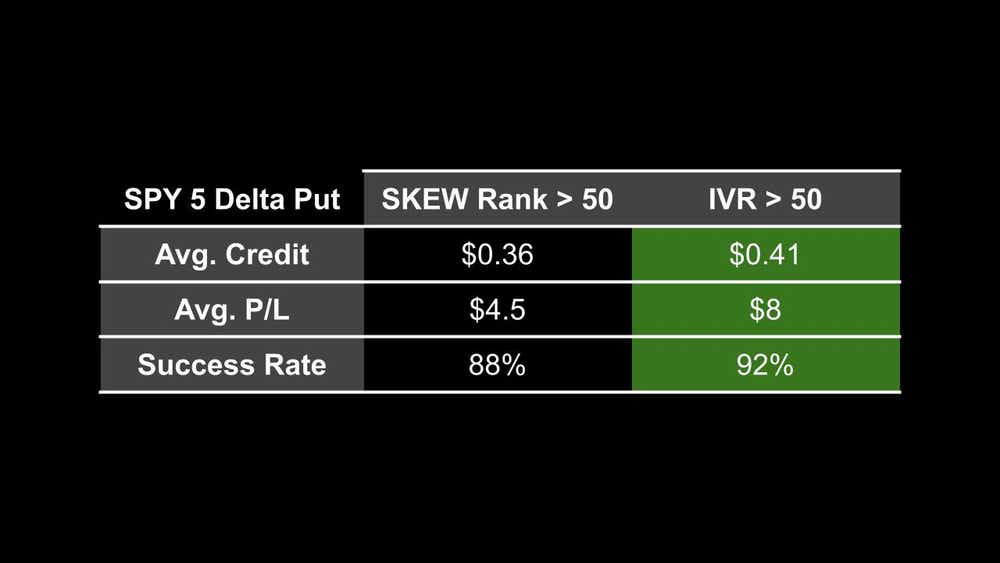

To answer this, a study was conducted evaluating 45 days-to-expiration (DTE) OTM puts of the SPDR S&P 500 ETF (SPY). Two scenarios were assessed: 2 delta (2 standard deviations) and 2.5 delta (2.5 standard deviations) puts. Small deltas were chosen for this analysis because the SKEW index focuses on tail risks, which have a very low probability of occurrence. The performance was compared when the IV rank was greater than 50 and the SKEW rank was greater than 50, with management at 21 DTE.

The study revealed that the 5 delta puts performed better with the IV rank than with the SKEW rank. By using the classic IV rank, traders can collect more credit and achieve a better average P/L with a significantly higher success rate.

With an even smaller delta at 2.5, the puts attracted slightly more credit when entered at a high SKEW rank, but they did not outperform those entered at a high IV rank.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

The results suggest that the IV rank is a more reliable indicator for option premium sellers. It provides consistent performance and is applicable to any OTM option. Furthermore, the IV rank is simple to use and readily available on almost all options trading platforms.

In conclusion, while the SKEW index is a unique tool for measuring tail risk using deeply OTM options, it may not be the most effective indicator for premium sellers. Conversely, the IV rank, with its consistent performance and applicability to all deltas, proves to be a more valuable tool for options traders.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.