Performance Analysis: Static and Dynamic Spreads

Performance Analysis: Static and Dynamic Spreads

By:Kai Zeng

Maximizing returns and managing risks require understanding the nuances of different options trading strategies

- Static and dynamic spreads are two popular approaches for trading SPY options.

- Dynamic spreads tend to generate slightly higher returns compared to static spreads.

- Dynamic spreads also carry the potential for larger losses due to their wider wings.

Understanding the nuances of different options trading strategies is crucial for maximizing returns and managing risks.

In the case of trading SPDR S&P 500 ETF Trust (SPY) options, two popular approaches are static and dynamic spreads, specifically selling put spreads. Comparing the performance of these strategies gives traders valuable insights for refining their trading methods.

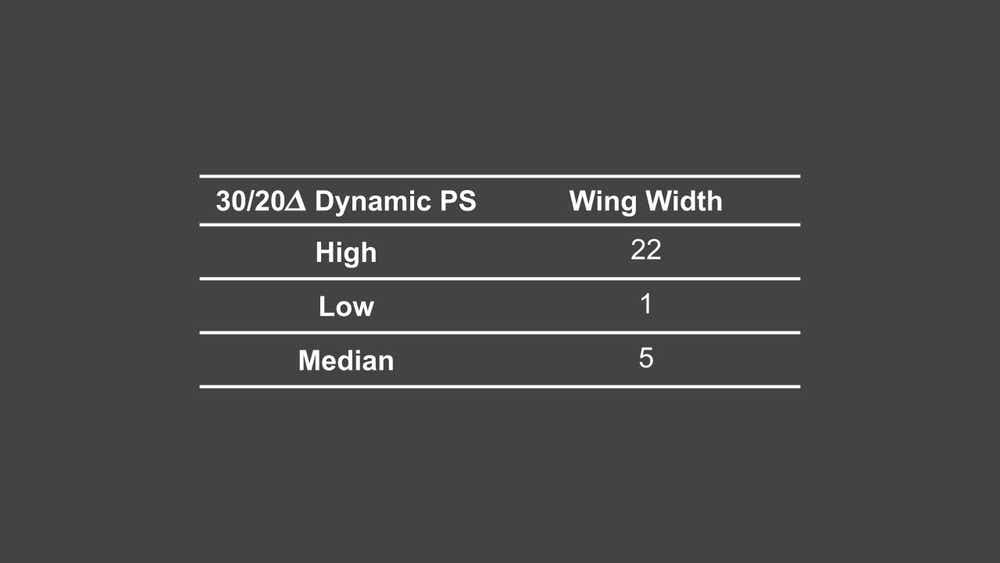

Traders typically sell put spreads with deltas between 20 and 30 and buy wings of various widths to match their desired risk level. Our findings indicate that the median wing width for 30/20 delta SPY put spreads is just below 5, which is comparable to a 5-wide static put spread on average.

Comparison of spreads

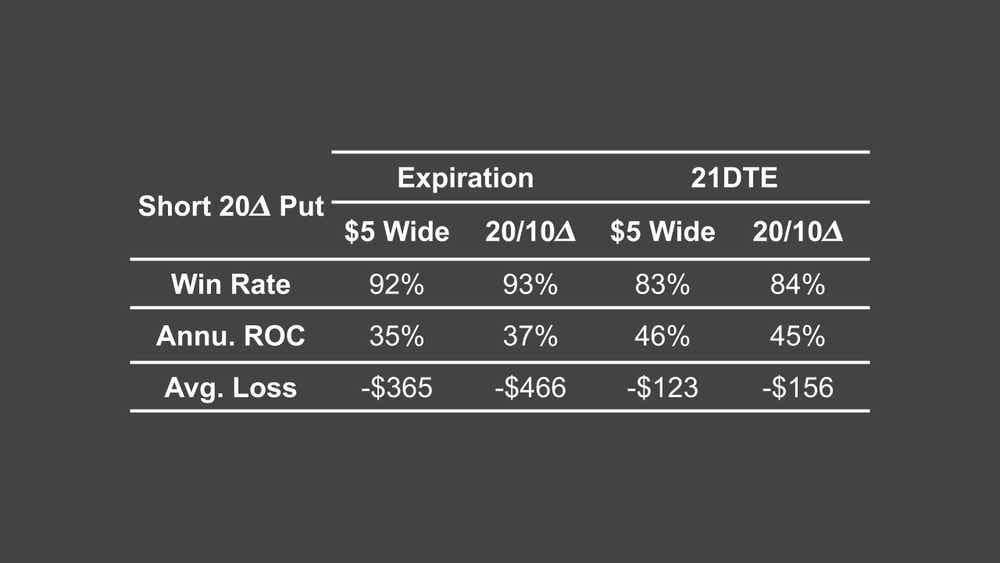

This information lets us compare the performance of SPY 30/20 delta put spreads (dynamic) and 30-delta $5-wide put spreads (static) with 45 days to expiration. We can then analyze the similarities and differences between these strategies under two management approaches: holding to expiration or closing at 21 days to expiration (DTE).

The results show that dynamic spreads tend to generate slightly higher returns compared to static spreads, but they also carry the potential for larger losses due to their wider wings. However, when considering the overall performance, dynamic spreads closely mirror that of static spreads.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

What if we move strikes further out?

Now, let's consider moving the strikes further out to 20/10 delta put spreads.

The median wing width for these spreads is slightly greater than five, like a five-wide static put spread. Our study reveals that dynamic spreads with wider wings can sometimes result in heavier losses compared to static spreads.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

On average, smaller delta dynamic spreads (20/10 delta) have wider wings than larger delta spreads (30/20 delta), leading to slightly larger losses.

However, these smaller delta spreads often have exceptionally high success rates, making them an appealing choice for traders who can handle the associated risk.

One consistent finding is that managing positions at 21 DTE consistently outperforms holding them until expiration. This approach not only improves return rates but also provides better control over potential losses.

The key takeaway for traders is that while the returns of dynamic and static spread strategies are quite similar, dynamic spreads offer a slight edge in terms of returns. However, this comes with the caveat of increased average losses due to the wider wings. Implementing a disciplined approach by managing trades at 21 DTE proves to be an effective method for improving returns and maintaining control over losses in both scenarios.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.