How to Trade Next Week’s Avalanche of Earnings Reports

How to Trade Next Week’s Avalanche of Earnings Reports

Look for opportunities with Apple, McDonald’s and Advanced Micro Devices

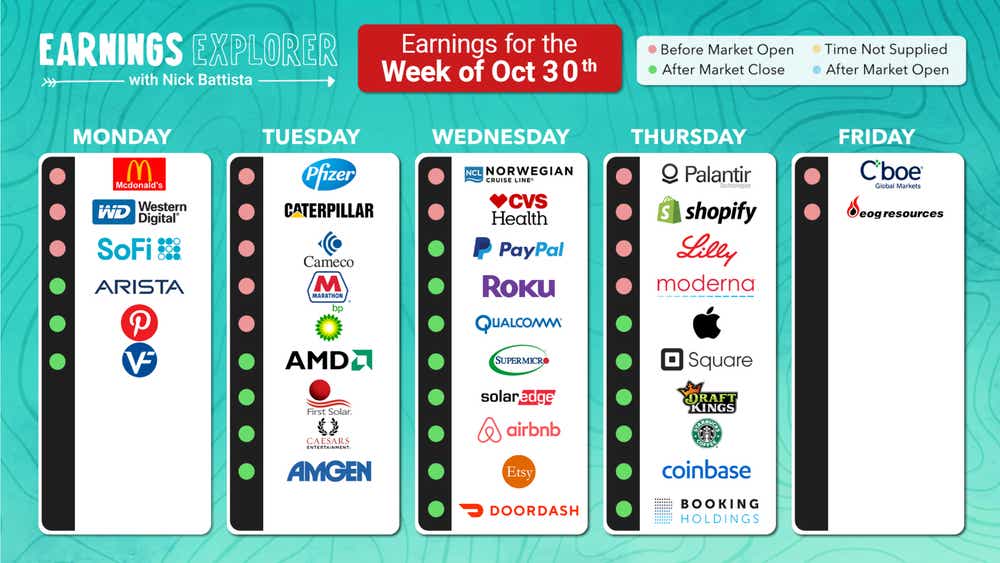

- Technology companies reporting next week include AAPL, ANET, WDC, AMD, ROKU, PYPL, SHOP and QCOM.

- Among the consumer discretionary stocks, look for reports from MCD, PINS and ETSY

- Energy earnings reports are on the way from MPC, BP and CCJ, while healthcare reports will come from CVS, MRNA and LLY.

This coming week is the peak of earnings with 992 stocks reporting. Here are some of the most notable earnings coming up this week:

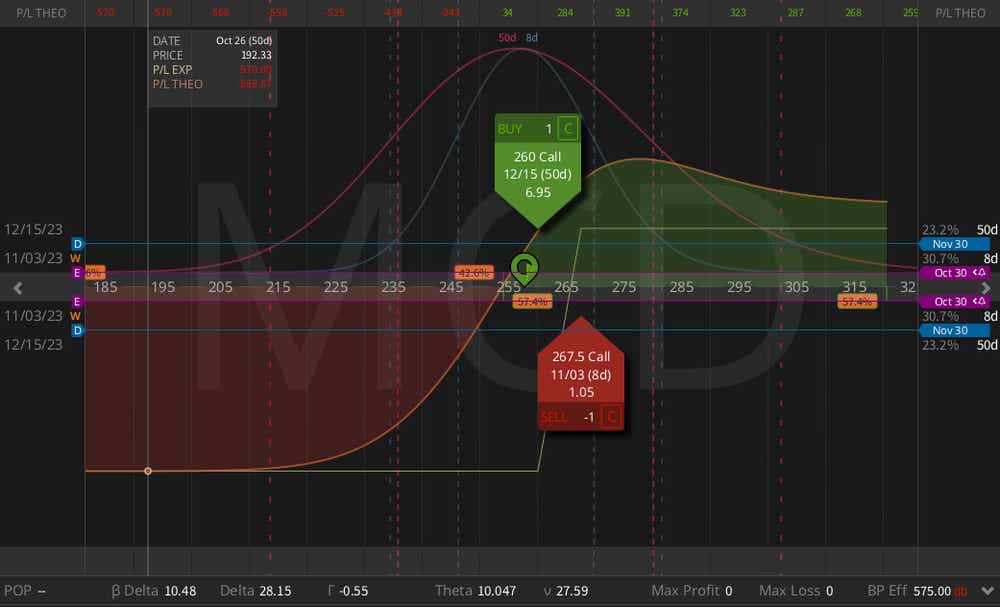

Monday before the open—McDonald’s

McDonald’s (MCD) and lots of other companies in the junk food space have been caught in the Ozempic crosshairs and hit hard over the last couple weeks. Others include Coca Cola (KO), PepsiCo (PEP) and Mondelez International (MDLZ)—just to name a few.

If you think the move might be a bit exaggerated, a long call diagonal provides a cheap way to get some hefty delta exposure. Long the December monthly expiration 260 call, with a short Nov. 3 call at 267.5 provides around 28 long delta for a debit $5.65.

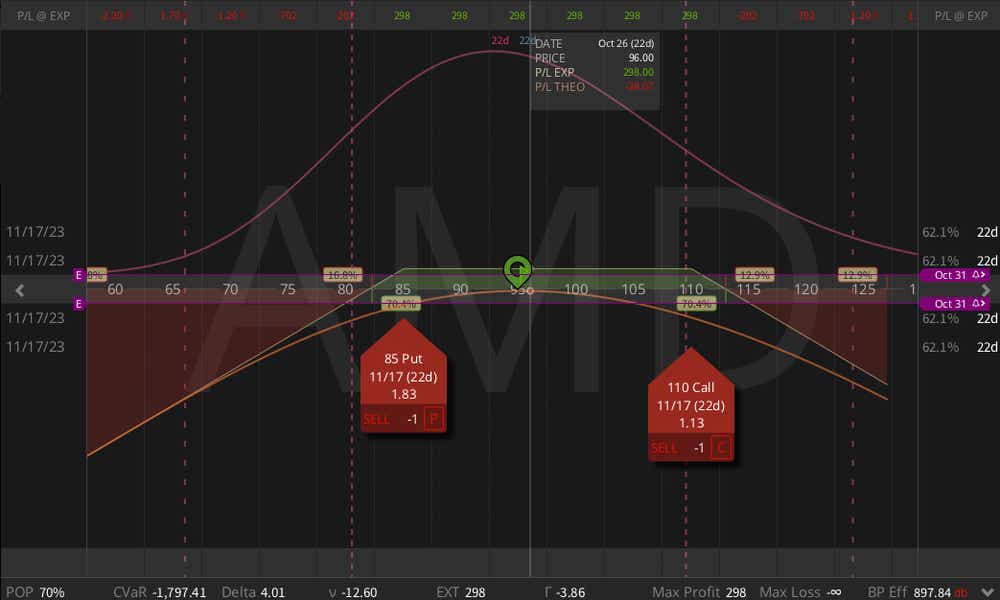

Tuesday after the close—Advanced Micro Devices

Advanced Micro Devices (AMD) has missed out on much of the AI hype and is trading around 95, which is below its 200-day moving average of roughly 99. The stock has high implied volatility, going into earnings the front weekly expiration sits at around 78%, with a roughly +/- $10 standard deviation.

Maybe the pain has already baked in. If you think the stock might stay rangebound, the 85/110 strangle in the Nov. 17 monthly expiration trades at around $3.00, with breakeven point down at around 82 not seen since February.

Thursday after the close—Apple

Apple (AAPL) has to save this market, right? As of today, Apple has reversed all of its Q2 gains and is trading at around $167. Volatility is surprisingly low given the move, with an implied volatility rank, or IVR, at around 48, current volatility is in the middle of its range over the last 52 weeks.

If we are due for a bounce, Apple should lead the way. A long call diagonal, using the 170 long call in the December monthly expiration with the short November 175 call provides around 17 long delta and enough time value to withstand some downside on earnings. At a $3.90 debit, this trade is a cheap way to get long delta exposure.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.