Strategic Metal Investments for Portfolio Balance

Strategic Metal Investments for Portfolio Balance

By:Kai Zeng

Owning gold and silver may not protect against downturns, but it helps spread the risk

- Gold sometimes moves in sync with the market, but the alignment is minimal.

- Precious metals like gold and silver provide excellent opportunities to diversify a portfolios.

- Copper exhibits low correlations not just with the S&P 500 but also with other metals.

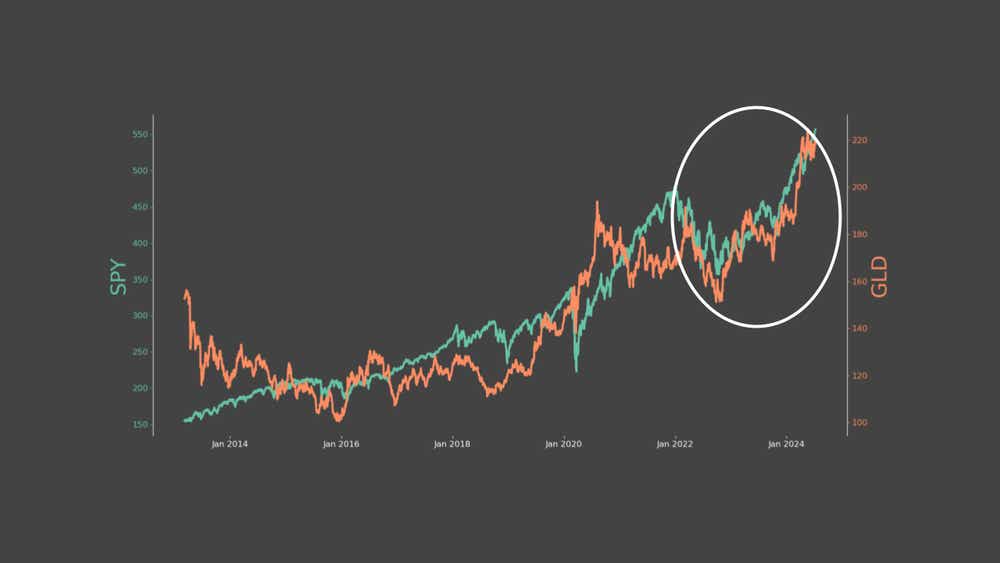

Gold has long been considered a safe-haven investment, but recent trends have shown some shifts. Post-pandemic, the correlation between gold (GLD) and the S&P 500 has become more frequently positive.

However, the current correlation stands at 0.25, with a four-year average of 0.16. These figures indicate low to non-correlation, suggesting that while Gold sometimes moves in sync with the market, this alignment is minimal. Over a 20-year span, gold’s correlation with the S&P 500 is practically zero, reinforcing that gold does not consistently follow market patterns. Therefore, gold may not be the optimal choice for hedging against market downturns, but it certainly holds value for portfolio diversification.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

When evaluating other precious metals like silver (SLV), platinum (PPLT) and copper (CPER), their correlation with the S&P 500 over the last three years has also been low. Silver and gold share a higher correlation with each other, which means they often move in tandem. In contrast, copper exhibits low correlations not just with the S&P 500 but also with other precious metals. This makes copper a unique asset, offering diversification benefits without being heavily influenced by market swings.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Over a 20-year timeframe, the pattern remains consistent: These metals exhibit low to no correlation with the overall market, underscoring their role as diversification tools instead of hedges against market risk.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

For traders aiming to diversify their portfolios, precious metals like gold and silver provide excellent opportunities. While they may not offer significant protection against market downturns, their low correlations with equity markets help in spreading risk. On the other hand, copper stands out for its distinct low correlation with both the market and other metals, making it a valuable addition for traders looking to mitigate risk through diversification.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.