The “Freaking Reason” Behind Sosnoff’s 21-Day (0DTE) Rule

The “Freaking Reason” Behind Sosnoff’s 21-Day (0DTE) Rule

On a recent episode of tastylive's Market Measures, the legendary options trader shares research highlighting the rationale of managing 45-day trades around the 21-day mark

- For 45-day options, there is a level of predictability and lower risk during the initial period after trade initiation. This supports a strategy of early management, around the 21-day mark, to lock in gains and reduce exposure.

- Zero DTE options require vigilant monitoring and swift action given their short lifespan and the high volatility associated with their trading windows. The strategy here revolves more around high-stakes, timely interventions.

- 45-day options suit traders who prefer a methodical approach to trading, providing ample time to analyze and act according to market changes with a somewhat moderate risk.

- Zero DTE options are more lined up for aggressive traders who thrive in rapid, dynamic trading environments and are comfortable with higher risk and the potential for quick, significant gains.

In a recent episode of Market Measures on tastylive, Tom Sosnoff unpacked some intriguing insights into zero days to expiration (zero DTE) options compared to the more traditional 45-day options.

This discussion, as always, was aimed at equipping traders with sharper tools for their trading arsenal. Here’s what we learned.

Zero DTE options are an increasingly popular flavor among traders, especially those looking for swift movement and outcomes in their trading strategies. Essentially, these are options that are set to expire on the day they are traded, giving them a short lifespan roughly equating to the number of trading hours in a single day—approximately 6.5 on average. This contrasts sharply with the 45-day options that have been a staple among many traders, providing a much longer window of opportunity and exposure.

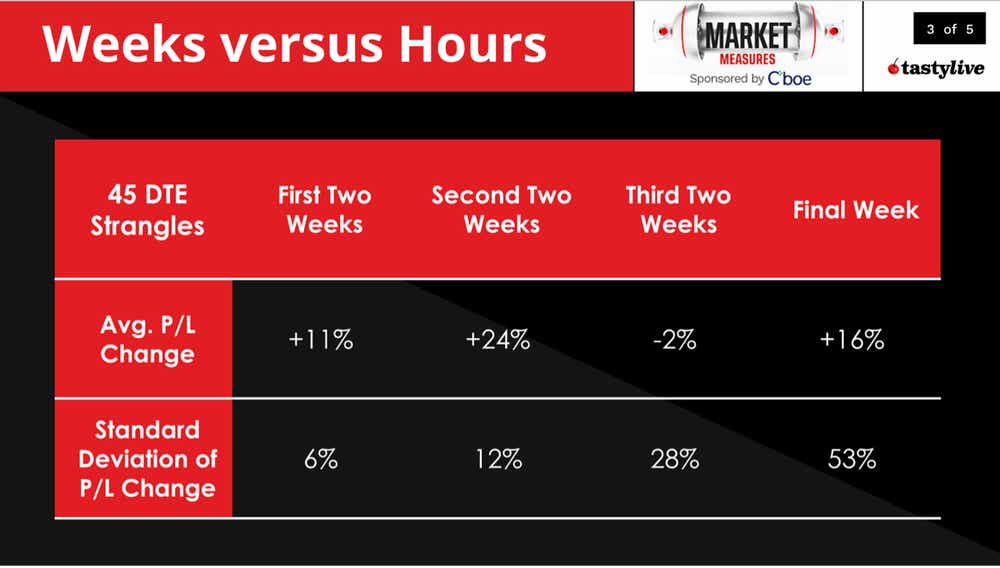

Tom’s analysis began with an examination of performance metrics over these differing timescales. Using data stretches of one year for zero DTE and fifteen years for the 45-day options, he delved into selling strangles, specifically starting with options that held a 20 delta at initiation.

The findings were quite revealing. For 45-day options, the initial two weeks saw an average profit and loss (P&L) change of about 11%. Interestingly, this figure rose to 24% in the second two-week period, making it the most profitable phase before dropping sharply (-2%) in the subsequent weeks and leveling off at a 16% increase in the final week.

This pattern underpins the tastytrade strategy of managing 45-day trades around the 21-day mark, capitalizing mostly on the gains accrued in the first four weeks where the standard deviation of risk is markedly lower compared to returns.

Zero DTE dynamics

Switching gears to zero DTEs, the dynamics were notably different. The peak earning period was in the second two-hour window of the trading day, marking a stark contrast in how the returns are distributed over the trading span.

The initial hours generally presented significant risk and volatility, reflecting the challenging nature of managing such short-lived options effectively. The peak earning period was the final hour of the trader day.

One critical takeaway from Tom's analysis is the significance of timing and risk management in trading distinct types of options. The 45-day options provide a reasonably consistent return over a more extended period. However, allowing for strategic adjustments and risk assessment, the zero DTE options demand an elevated level of alertness and swift decision-making, pegged heavily on the ability to predict and react to very immediate market movements.

For traders accustomed to one format or the other, the research highlights the necessity of understanding these nuanced differences. The 45-day trades often yield most of their returns early in the cycle, presenting a less risky and more manageable scenario for traders who stay on top of their positions and opt to manage or close out based on the observed standard deviations of risk.

Conversely, zero DTE trades offer a high-octane trading environment where significant returns can manifest within hours—if one can navigate the accompanying high volatility. This necessitates a more hands-on approach and potentially suits a different trader psychology and risk tolerance.

Both strategies have their virtues and can be tailored to fit various trading styles and objectives. Whether you are entrenched in the fast-paced world of zero DTE or the more methodical 45-day trades, the key lies in leveraging this deep-dive research to refine your approach, minimize risks, and optimize returns.

View a brief summary of the discussion here and the entire Market Measures segment here.

Jacob Perlman, mathematician and quantitative researcher at tastylive.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.