Three Trade Ideas and What You Need to Know About Trading in October

Three Trade Ideas and What You Need to Know About Trading in October

Yield plays, Utilities and yes, Nvidia

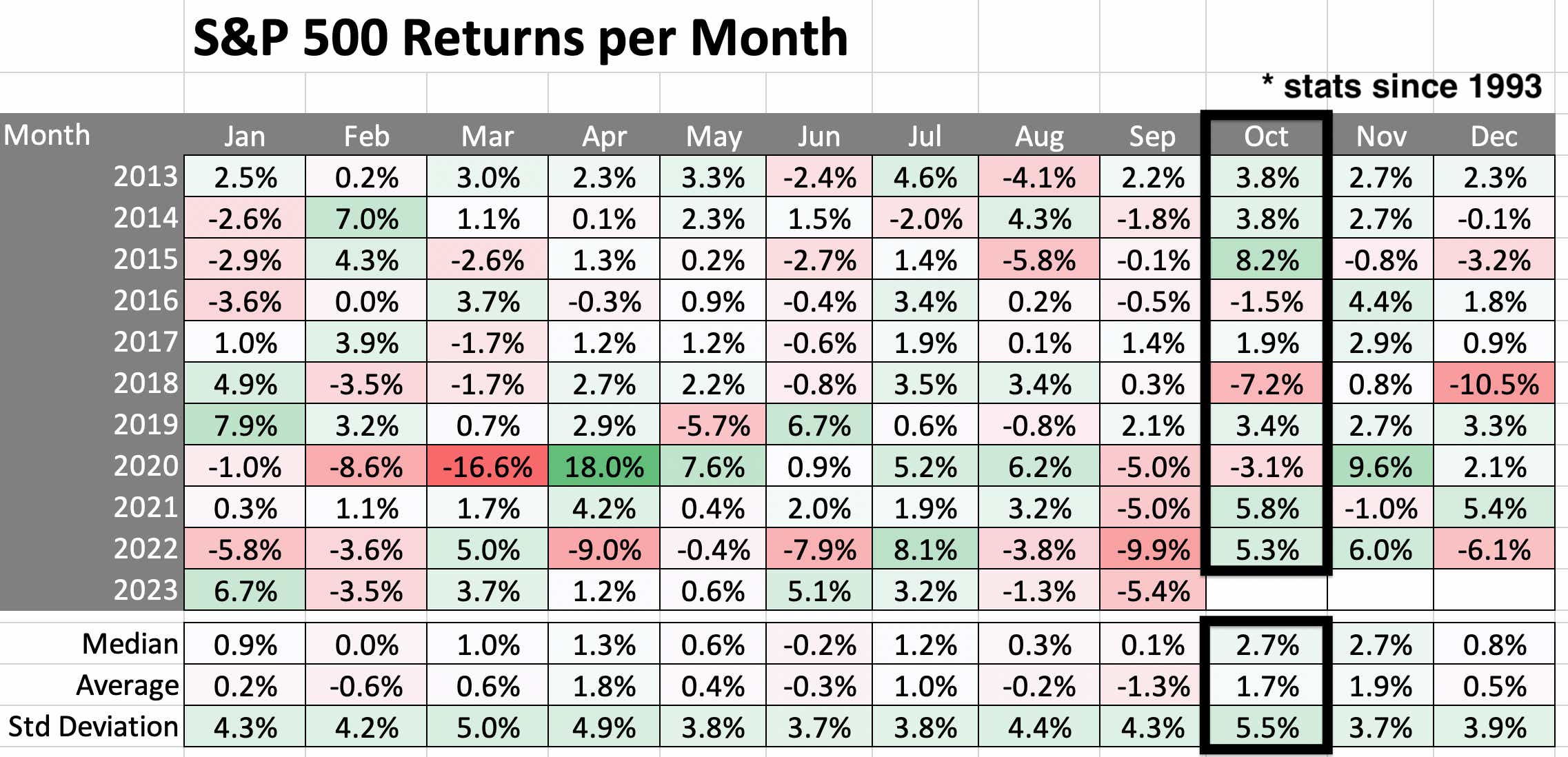

Displayed below are the month-to-month returns in the S&P 500, alongside the corresponding statistics for the past 30 years.

Upon analyzing the data, October emerges as the standout month, boasting the highest median return of 2.7%. It also exhibits an average monthly return of 1.7%. Furthermore, October showcases a standard deviation of 5.5%, indicating significant volatility.

Considering these historical trends, it is logical to expect a month characterized by substantial fluctuations and volatility.

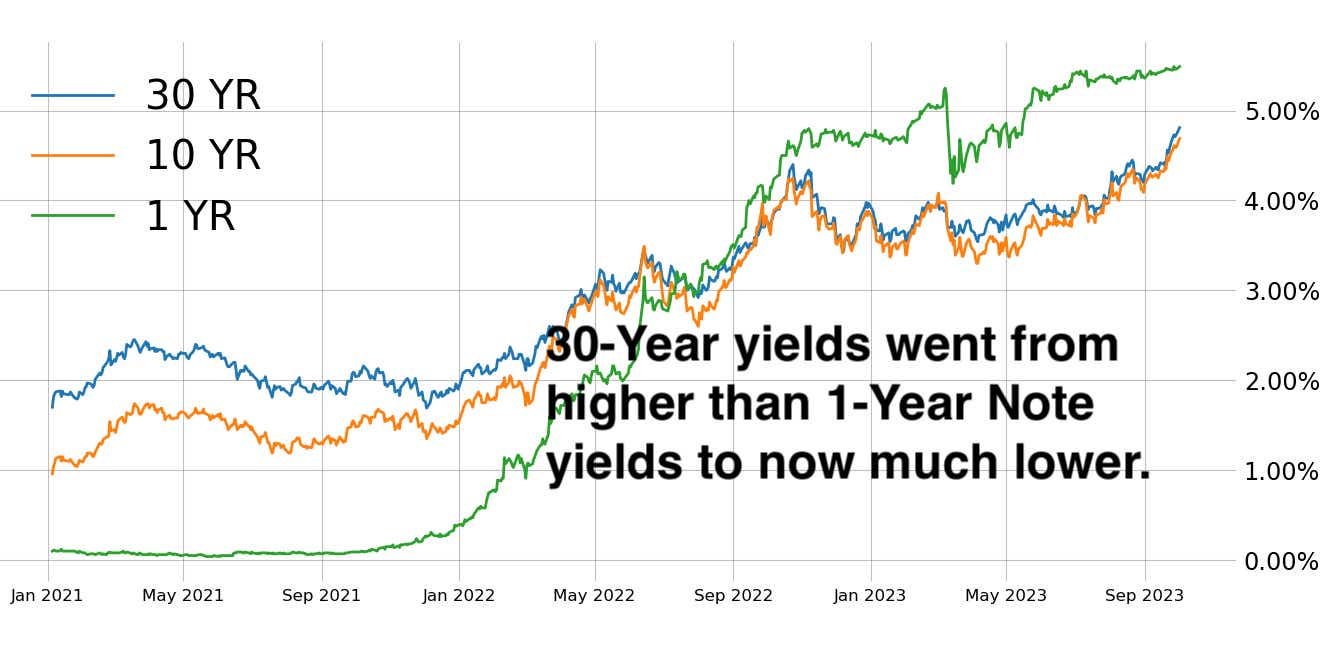

Yield Inversion

One-year note yields have moved from a near 0% to a 5.5% yield in just two years. Meanwhile, 30-year bonds have moved from 2% to 4.75% in the same time period.

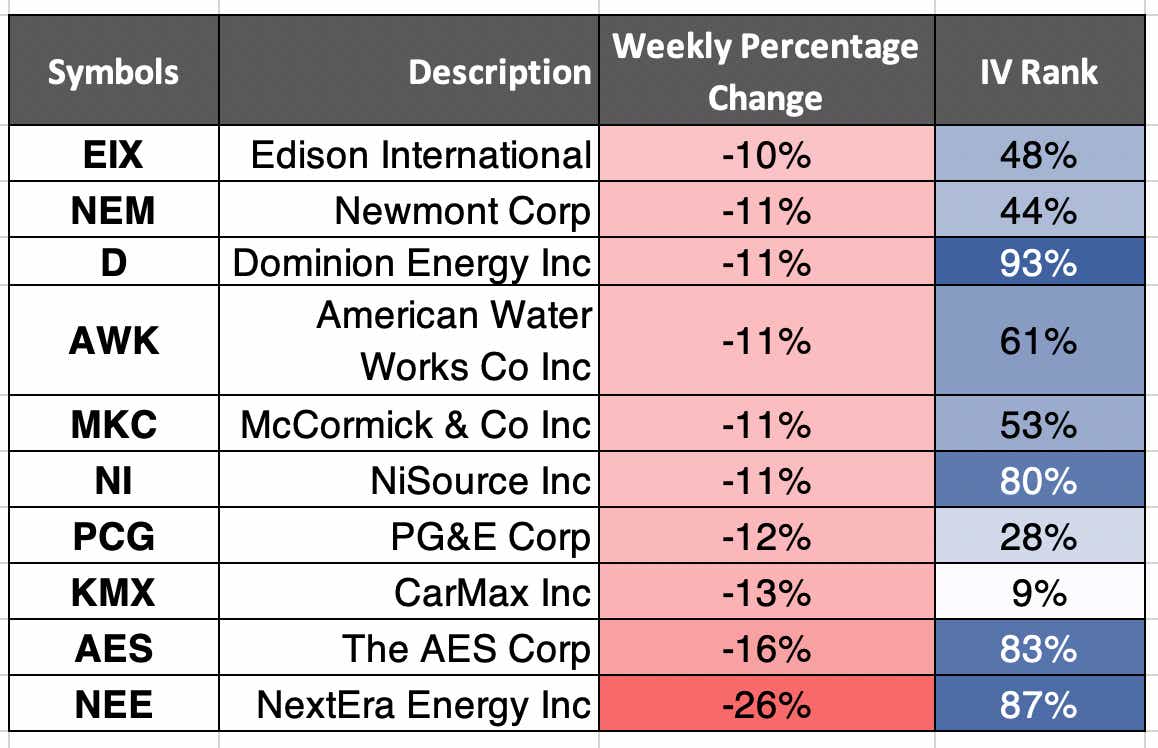

Most of the Biggest Weekly Declines are the Utilities

Not all of the biggest weekly declines are Utilities, but most of them are.

NEE Bullish, Trade #1: We suggest considering a bullish position in NEE, the most depressed stock on our list. For an uncovered position, the NOV monthly expiration 47.5 put trades around $1.30 and uses roughly $670 in buying power. This could offer a return on capital potential of approximately 20% over the coming 45 days, with a 74% chance of success.

NEE Bullish, Trade #2: If you prefer a risk-defined strategy, a poor man's covered call could be a possibility. This would involve buying a December monthly 45 strike call with a delta around 80, and selling a November monthly expiration 55 strike call. This position is expected to maintain approximately a 45 delta long and use around $630 in capital.

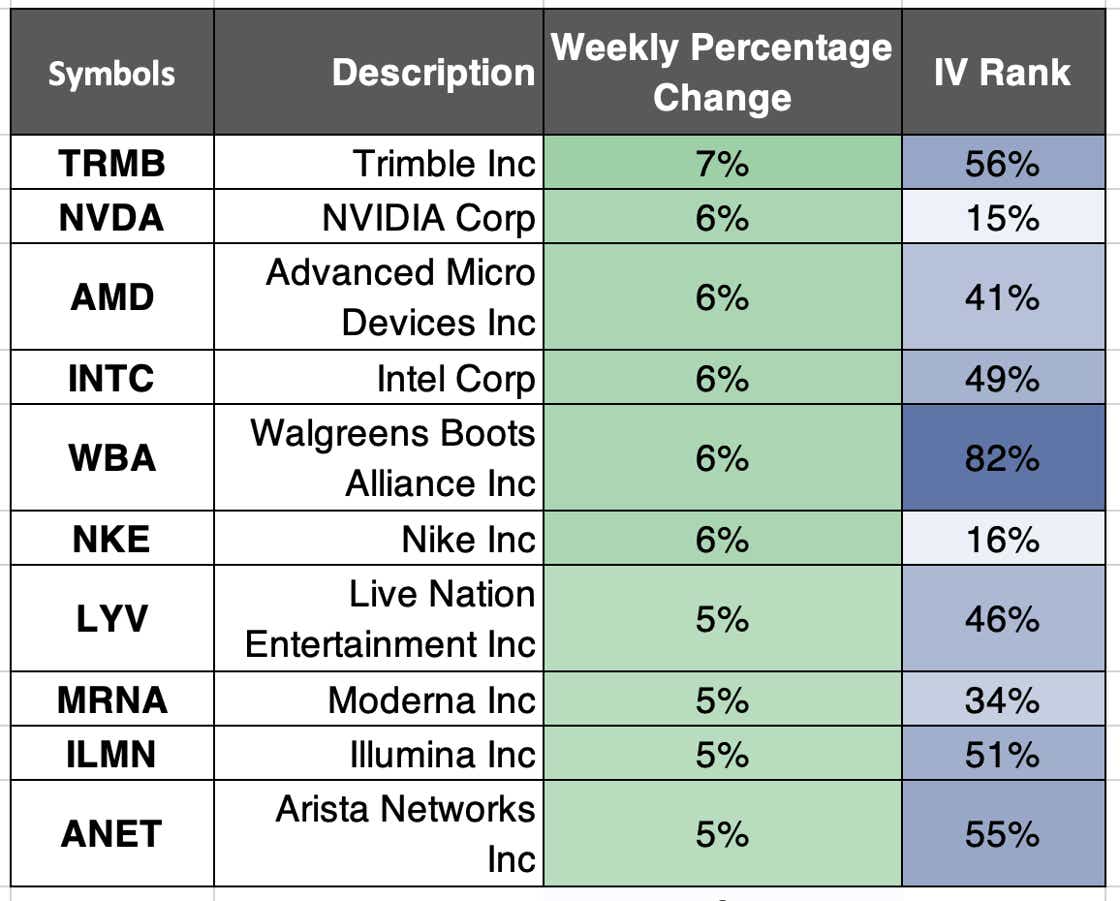

Best Weekly Performing Stocks

Tech tops the list.

NVDA Bearish, Trade #3: NVDA is the best-performing stock of the year and the second best this week. If you believe its rise might be exaggerated, consider the 475/485 short call spread in the November monthly expiration, which is trading at roughly $2.70. This trade has a success probability of 72% and breaks even just past its all-time high, with a potential return on capital of around 30%.

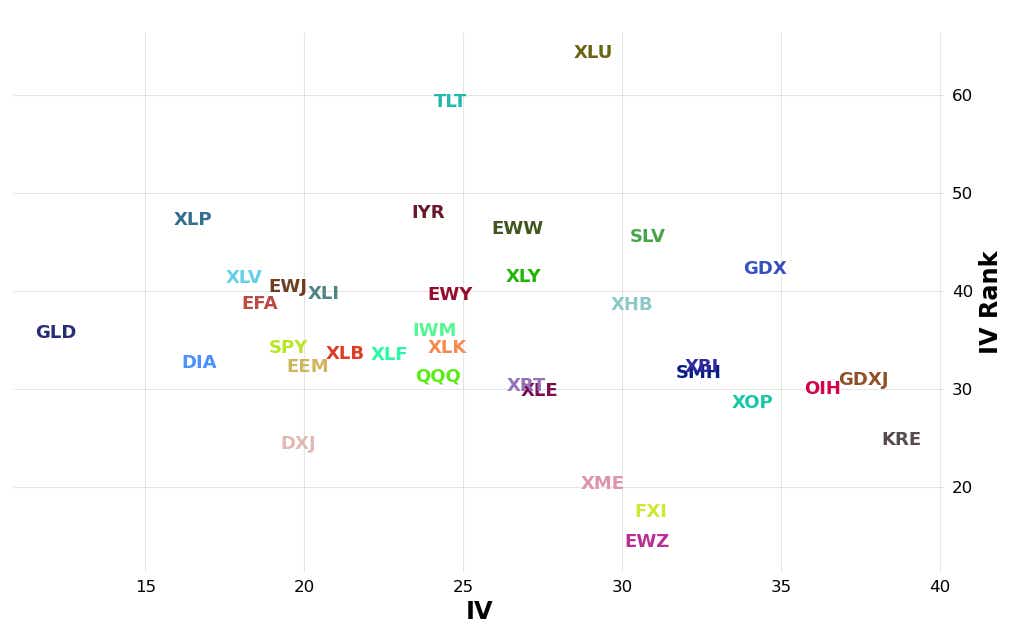

IV Rank plotted against IV

XLU (Utilities exchange-traded fund, or ETF) and TLT (20-Year Bond ETF) have the highest IV (implied volatility) ranks right now. The largest expected movement can be seen right now in KRE (regional banking ETF), GDXJ (small cap gold miners ETF) and OIH (Oil Services ETF).

Michael Rechenthin (aka “Dr. Data”), managing director of Research and Development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.