Heating Oil Futures Outlook: Are Prices Ready to Turn?

Heating Oil Futures Outlook: Are Prices Ready to Turn?

The commodity falls to critical support levels. Are bulls ready to charge?

- Weak fuel demand across the U.S., Europe and Asia are pushing heating oil futures lower.

- Crude oil prices (/CLZ3) have risen by 1%, but the crack spread suggests weak demand in the downstream oil market.

- Short positioning in heating oil may indicate a potential price turnaround if accompanied by a tightening physical market.

Heating oil futures (/HOZ3) are trading down by $0.272 per gallon, or 0.98%, through mid-day Thursday trading, extending weakness from earlier in the week as data points show fuel demand decreasing across the United States, Europe and Asia.

The move puts prices on track to drop over 7% to extend its weekly losing streak to a fourth consecutive loss.

Meanwhile, crude oil prices (/CLZ3) are on track to break the recent string of losses, trading 1% higher. That is pushing the crack spread for heating oil and crude oil to near the lowest level since July and signals demand weakness from the downstream oil market.

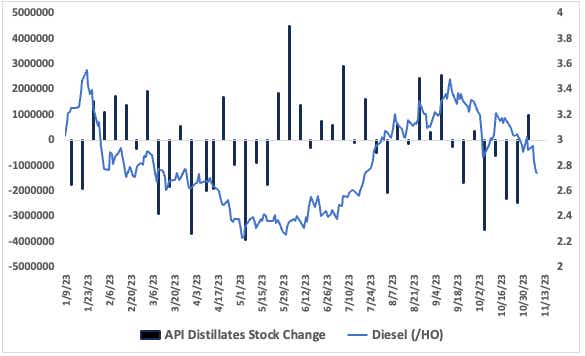

Traders are flying partially blind this week, with data from the Energy Information Administration on hold this week amid a systems upgrade. However, the American Petroleum Institute (API), a non-government entity, reported a 980,000-barrel build for the week ending Nov. 2. That was the first inventory build in over five weeks.

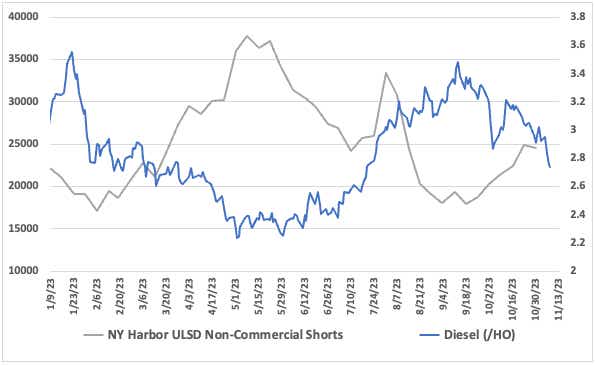

Meanwhile, speculators on the short side have trimmed their bets by 399 contracts for the week ending Oct. 31, according to the Commitments of Traders (COT) report from the CFCT. That brings the short position for non-commercial traders to 24,548, including options, which is the first decrease in short positioning in over six weeks for the trading cohort.

Signs of short exhaustion are bullish for the commodity, as it may signal a turnaround in prices. But this behavior in the futures and options markets would also need to come with a tightening physical market to spark a notable rally. That said, traders should keep a close eye on inventory data and demand factors, as that could bode well for prices if it forces shorts to further contract their positions.

Heating oil technical outlook

Heating oil prices are currently at the 200-day simple moving average (SMA). A break below the high-visibility MA would likely induce further weakness. Alternatively, if prices hold, it could set the base for the next move higher. However, short-term momentum remains negative below the 26-day exponential moving average (EMA), along with a weakening moving average convergence divergence (MACD). Traders should wait for prices to consolidate around the SMA before taking a long position.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.