Time to Buy the Dip in Gold and Silver?

Time to Buy the Dip in Gold and Silver?

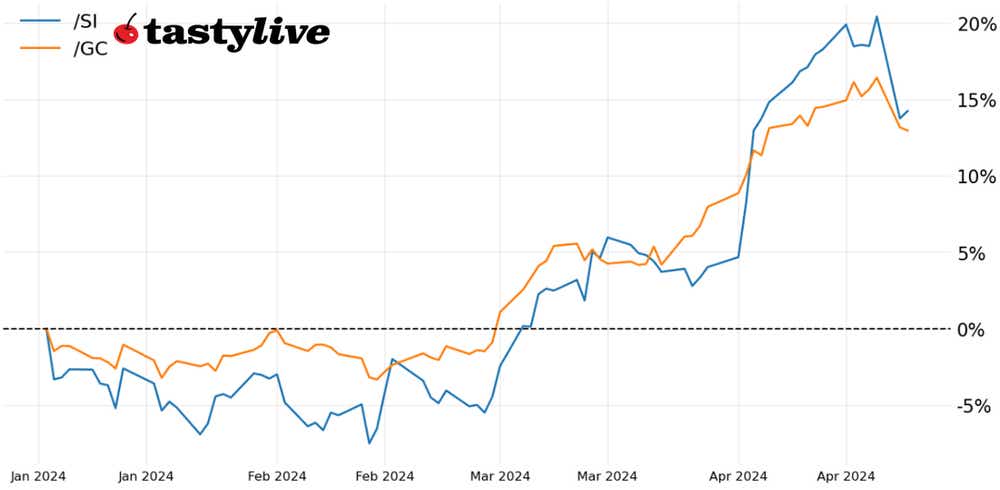

Gold prices up 4.57% for the month so far

- Gold prices pulled back to their one-month moving average, as have silver prices.

- Both metals are up by more than 12.5% year-to-date even after the deleterious start to this week.

- A relaxation in geopolitical tensions coincided with gold or silver giving up their gains since tensions began escalating on April 3 (whereas crude oil has).

Rising inflation pressures and geopolitical tensions have been a boon for precious metals in recent weeks. And despite their setback at the start of the week, gold (/GCM4) and silver prices (/SIK4) are still up by more than 12.5% each year-to-date.

A decline in volatility may be going in tandem with the pullback in precious metals, but this may prove to be a golden opportunity (no pun intended) for precious metals bulls.

When we last checked in on March 27, it we noted “the technical tailwinds remain bullish in the short-term.” That was the low for the rest of the month.

Even after the sharp decline yesterday, it makes sense that a similar dip buying environment may be in place as was the case when we last reviewed the precious metals at the end of March.

/GC Gold price technical analysis: daily chart (May 2023 to April 2024)

Ever since starting their climb at the start of March, gold prices (/GCM4) have not seen a setback below their daily 21-EMA (one-month moving average); the daily 21- and 34-EMA cloud has not been breached.

The pullback this week saw /GCM4 drop into the daily 21-/34-EMA where dip buyers made their presence known. The long lower wick signifies a hammer candlestick, a bullish reversal signal.

For bulls, this may be the pullback they’ve been waiting for if they missed the first two legs higher. The (small) pullback in volatility along with price may be setting up an opportunity for traders to explore long opportunities via at-the-money (ATM) call spreads.

It’s worth noting that gold volatility is a lot lower than implied volatility rank (IVR) suggests, because IVR captures only the past year of data. Historically, gold volatility has been able to climb to levels more than double where they were in recent weeks during times of true market stress.

/SI Silver price technical analysis: daily chart (September 2023 to April 2024)

The last time we checked in on silver prices (/SIK4), we noted that “support may have been found: the daily 21-EMA (one-month moving average) has marked the lows each of the past two sessions." Contextually, the bullish falling wedge has yet to be completed, which ultimately calls for a rally into the December 2023 high of 26.575. For traders who missed the initial move higher, long exposure (via an ATM call spread, given the relatively low volatility) may be appropriate as long as this week’s low of 24.445 holds.”

Indeed, that was the last significant swing low, and bulls were rewarded for not giving up on /SIK4 at trend support.

Back at the daily 21-EMA, /SIK4 may now be presenting traders with an opportunity to get in long at trend support once again. Volatility metrics have been crushed over the past two weeks (from IVRs north of 100 to where they are now at 55.4), making bullish options plays relatively cheaper than where they were earlier this month. It thus remains for traders who missed the initial move higher, long exposure (via an ATM call spread) may be appropriate as long as this week’s low of 26,715 holds.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.