Gold and Silver Continue to Shine

Gold and Silver Continue to Shine

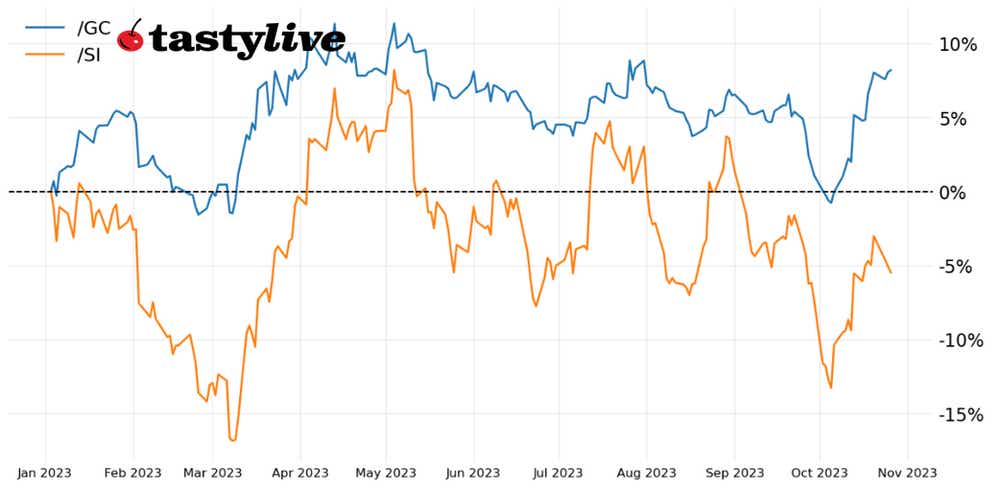

Gold prices up 7.03% month-to-date

- Gold and silver prices have seen gains build throughout October.

- Stability in U.S. Treasury yields coupled with a geopolitical risk premium have reinforced the recent rally.

- The path of least resistance remains higher, at least in the short-term.

It’s been a whirlwind month for precious metals, and the tailwinds don’t appear to be letting down anytime soon.

Although the Federal Open Market Committee (FOMC) is in its communications blackout window, markets seem to understand that the Federal Reserve will not hike rates again this cycle. Geopolitical risks stemming from the Israel-Hamas war linger.

Even though U.S. Treasury yields remain elevated, they have stabilized somewhat, and the U.S. dollar has traded sideways for several weeks. Even so, gold (/GC) and silver (/SI) have collectively clocked their second-best month of 2023, only outpaced by March when the regional banking crisis erupted (and there’s still time to overtake March’s performance).

Technically, /GCZ3 and /SIZ3 have made meaningful progress, and are continuing to exhibit strong technical structures that suggest that path of least resistance remains higher in the short-term.

/GC gold price technical analysis: daily chart (October 2022 to October 2023)

Gold prices (/GCZ3) are on the cusp of their highest close since the end of July, tacking on over +7% month-to-date. After pivoting above the late-September swing high near 1970, /GCZ3 has found support at former resistance and is holding up well against its daily five-day exponential moving average (EMA).

Momentum is a bullish flush: the daily exponential moving EMA envelope is in bullish sequential order. moving average convergence/divergence (MACD) is trending higher above its signal line. Slow stochastics are nestled in overbought territory. Should the rally continue, the next resistance comes at the July high near 2028.6.

/SI silver price technical analysis: daily chart (September 2022 to October 2023)

/SIZ3 has not clocked the same monthly gain as its golden counterpart but is up more than +9.8% off its monthly low. /SIZ3 has stabilized above the 50% Fibonacci retracement of the September 2022 low/May 2023 high range, which served as support from June through September, offering confirmation that a major bottom has formed. Attention remains on “the daily outside engulfing bar high formed September 29 at 23.805.”

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.