Gold Stuck in a Range, Silver Finding Support

Gold Stuck in a Range, Silver Finding Support

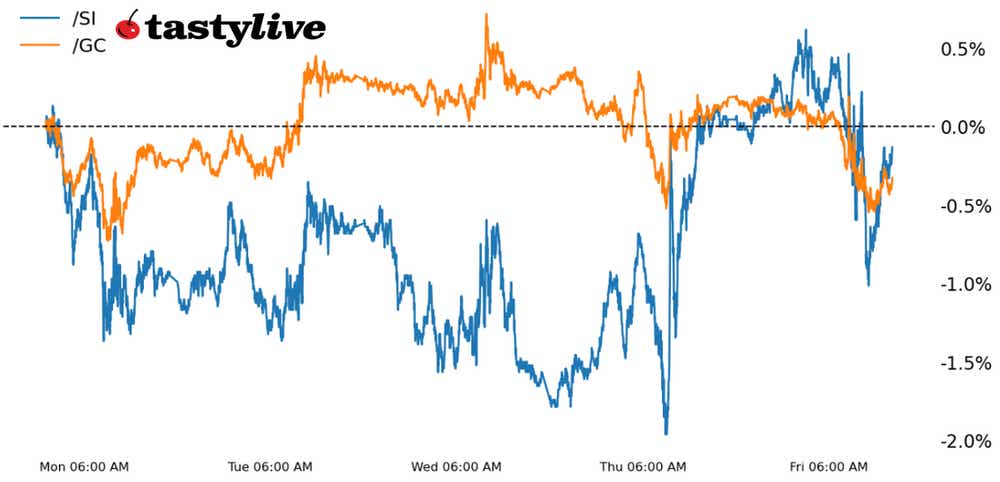

U.S. Treasury yields have pushed higher, but gold and silver prices are holding up well

- Gold prices (/GCJ4) have continued to trade sideways, consolidating in either a symmetrical triangle or rectangle.

- Silver prices (/SIH4) produced a technical reversal signal yesterday.

- Even though they’re still down year-to-date, there is a case to be made that precious metals are faring well considering the recent rise in U.S. Treasury yields.

Another push higher by U.S. Treasury yields amid a continued deterioration in Fed rate cut odds for March—now a mere 17.5%—remains burdensome for precious metals.

But the case can be made that gold (/GCJ4) and silver prices (/SIH4) are holding up well in what should be an otherwise discouraging environment. Technically, recent ranges have held, although a deterioration in volatility necessitates a different approach to trading /GCJ4 and /SIH4.

/GC Gold price technical analysis: daily chart (August 2023 to February 2024)

Gold prices form a triangle

Gold prices (/GCJ4) remain in a familiar area, continuing to funnel into the vertex of a symmetrical triangle that’s been forming since November.

An earlier triangle breakout proved lackluster, but this wasn’t a surprise, as it was previously noted that “a shift outside of the triangle may not invalidate the view that a sideways consolidation may be prevailing.” Such is the case for /GCJ4, as directionless, rangebound trading has prevailed.

Only a move below the early-November swing low at 1976.1 or the late-December swing high at $2,171.50 would invalidate the current perspective.

/SI Silver price technical analysis: daily chart (August 2023 to February 2024)

A bullish wedge for silver?

Unlike /GCG4, /SIH4 has seen a bit more meaningful downside, but there is also resiliency here.

While 2s (/ZTH4) and 10s (/ZNH4) have hit fresh yearly lows today, /SIH4 has not. /SIH4 has found support at the uptrend from the October 2023 and January 2024 lows. A bullish falling wedge may be coming together dating back to mid-October. A bullish daily key reversal yesterday suggests a near-term bottom may have been reached.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.