Euro at Risk Despite Rising CPI as Markets Envision ECB Rate Cuts

Euro at Risk Despite Rising CPI as Markets Envision ECB Rate Cuts

By:Ilya Spivak

The euro may fall as German and Eurozone inflation data helps make the case for interest rate cuts in 2024 despite pushback from the European Central Bank

- The euro scored strong two-month gains thanks to a weak U.S. dollar and hawkish ECB.

- Incoming German and Eurozone-wide inflation data will test the currency’s resilience.

- Traders may ignore a headline CPI jump and focus on domestic weakness, hurting the euro.

The euro enjoyed its best two months in a year in November and December of 2023, rising 4.4% against the U.S. dollar.

A broadly weaker greenback seemed to contribute most of the impetus for the move. The currency slumped as markets priced in a swift interest rate cut cycle from the Federal Reserve, eroding its yield advantage.

The European Central Bank (ECB) contributed a bit of the heavy lifting. While the Fed embraced the markets’ dovish repositioning at its December conclave, ECB President Christine Lagarde and the central bank’s Governing Council pushed back on similar speculation.

Euro sent higher as the ECB tries to resist rate cut pressure

Speaking at the press conference following the Dec. 14 policy meeting, Lagarde said the central bank “should absolutely not lower our guard” in the fight against inflation, adding that officials “did not discuss rate cuts at all”. That sent the euro sailing higher to close with a gain of over 1% on that day alone.

At the same time, Lagarde said the ECB expects base effects to push up inflation in December and will make for a slower disinflationary process in 2024. The markets seem to agree. Experts expect the consumer price index (CPI) measure of German price growth to have increased 3.9% year-on-year last month, up from a rate of 2.3% in November.

CPI data coming this week

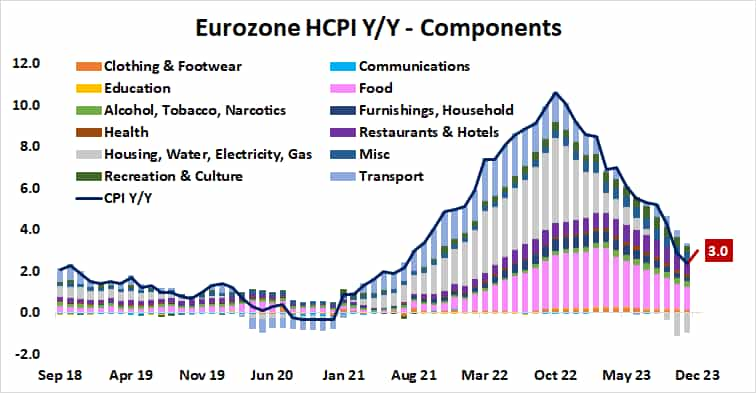

Region-wide CPI statistics are due later this week are projected to follow Germany’s lead. Inflation is seen rising to 3% year-on-year in December from 2.4% in the prior month. That would mark the highest reading in three months and the largest one-month pickup since October 2022.

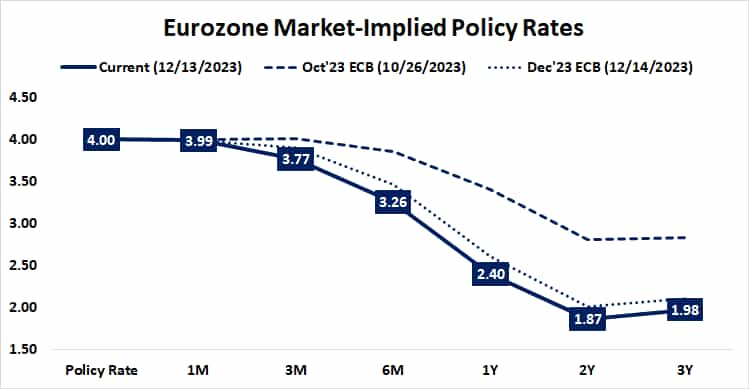

Nevertheless, the markets are dubious about the ECB’s hawkish appetite. The priced in policy path has continued to inch in a move dovish direction following December’s meeting rather than backtracking on November’s meaty adjustment. Analysts expect the first 25-basis-point (bps) cut no later than April.

Six cuts in total–amounting to 150 bps or 1.5% in rate reduction–are already reflected in market pricing. The probability of a seventh one is implied at 68%, giving it better-than-even odds and implying that traders see the path of least resistance as biased in a dovish direction.

Financial markets to the ECB: we don’t believe you

Investors’ disbelief seems rooted in the ECB’s own guidance. Back at the December ECB presser, Lagarde said that officials are “particularly attentive to domestic inflation” and that they “don’t have a recession in [their] baseline” for how the economy is expected to perform. All this was punctuated by a commitment to be “data dependent."

As it happens, the data seems to be telling a story about externally driven price growth and economic contraction. Food prices – where the ECB’s actions have little influence–remain the biggest contributor to headline CPI. Filtering them and energy costs–the “base effect” culprit–leaves price growth of just 2.3%.

Meanwhile, leading purchasing managers index (PMI) data shows that Eurozone economic activity shrank for a sixth consecutive month in December, with both manufacturing and the service sector in retreat. This suggests that a recession in the currency bloc is probably already underway.

With that in mind, the euro seems vulnerable as December CPI data prints this week. Traders may look through the widely expected jump in headline readings to focus on where they are coming from. If discounting external and base influences leaves domestic prices looking weak amid the downturn, the rate cut hopeful may drive the currency lower.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.