Monthly Futures Seasonality, May 2024: Sell in May and Go Away?

Monthly Futures Seasonality, May 2024: Sell in May and Go Away?

Sell in May and go away? Not so fast.

- April proved to be a massive disappointment f for U.S. equity markets.

- May is a bullish month for the S&P 500.

- It's a bearish month for Treasury notes.

After five consecutive months of gains, April proved to be a massive disappointment from a seasonal perspective for U.S. equity markets.

At one point in April, the Nasdaq 100 erased all its gains year-to-date, if only to underscore how poorly price action unfolded despite the promising historical backdrop.

The bull market might be still alive

That said, historical price data still suggests that the bull market may not be dead yet. April marked the end of a five-month winning streak. Since 1950, there have been 30 prior instances of five green months failing to continue the rally into a sixth month.

On average, one month later, the S&P 500 was higher 73% of the time for a gain of 1.9%; three months later, the S&P 500 averaged a gain 3.9%, rallying 83% of the time. The correction seen in April is not unique and does not necessarily suggest that a new bear market has begun, if history is any sort of guide.

What about "sell in May and go away," the popular axiom peddled by financial media? It’s a fun turn of phrase, but nothing more. The May-July window has produced positive returns over the past 10 and 20 years for both the S&P 500 and Nasdaq 100. The appropriate catchphrase should be "buy through July."

Monthly futures seasonality summary – May 2024

Monthly seasonality in S&P 500 (/ES)

May is a bullish month for /ES, on a seasonal basis. Over the past 10 years, it has been the fifth-best month of the year for the index, averaging a gain of 1.01%. Over the past 20 years, it has been the sixth-worst month of the year, averaging a gain of 0.53%.

Monthly seasonality in Nasdaq 100 (/NQ)

May is a bullish month for /NQ, on a seasonal basis. Over the past 10 years, it has been the fourth-best month for the index, averaging a gain of 1.92%. Over the past 20 years, it has been the sixth-best month, averaging a gain of 1.44%.

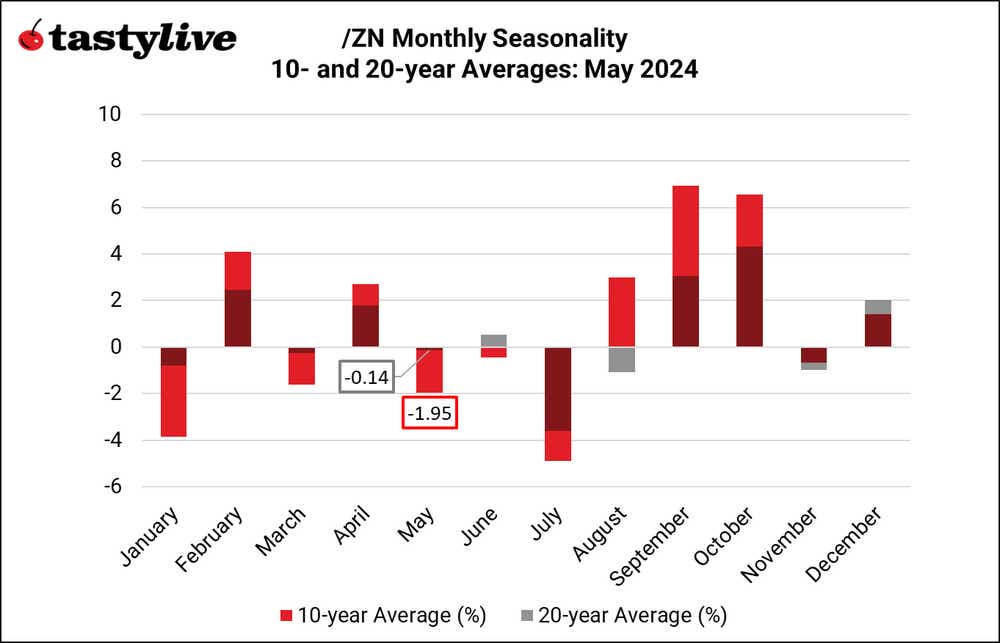

Monthly seasonality in Treasury notes (/ZN)

May is a bearish month for /ZN, on a seasonal basis. Over the past 10 years, it has been the third-worst month of the year for the notes, averaging a loss of 1.95%. Over the past 20 years, it has been the sixth-worst month, averaging a loss of 0.14%.

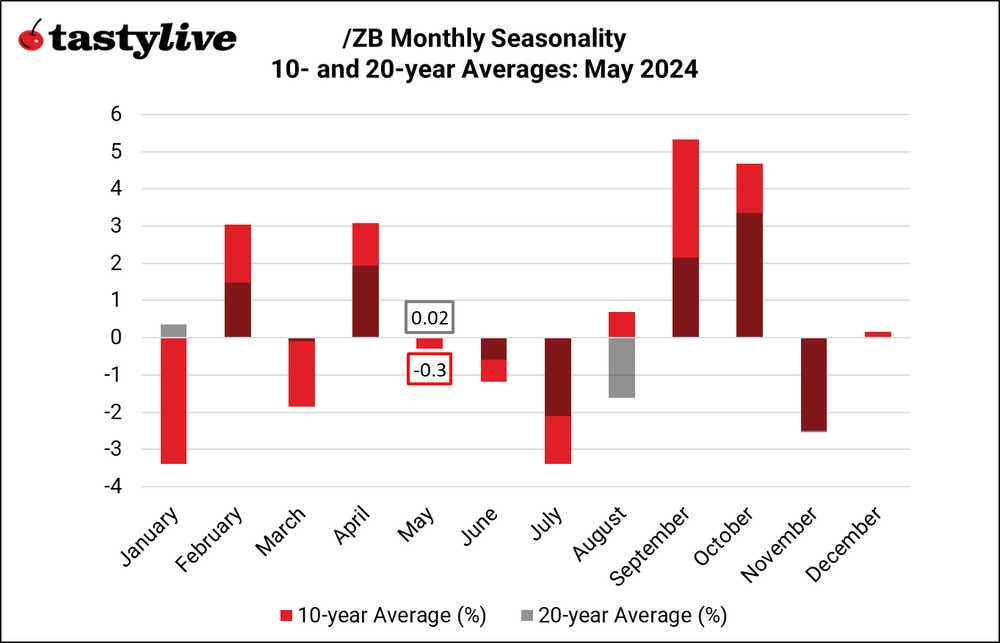

Monthly seasonality in Treasury bonds (/ZB)

May is a neutral month for /ZB, on a seasonal basis. Over the past 10 years, it has been the sixth-worst month for the bonds, averaging a loss of 0.3%. Over the past 20 years, it has been the sixth-best month of the year, averaging a gain of 0.02%.

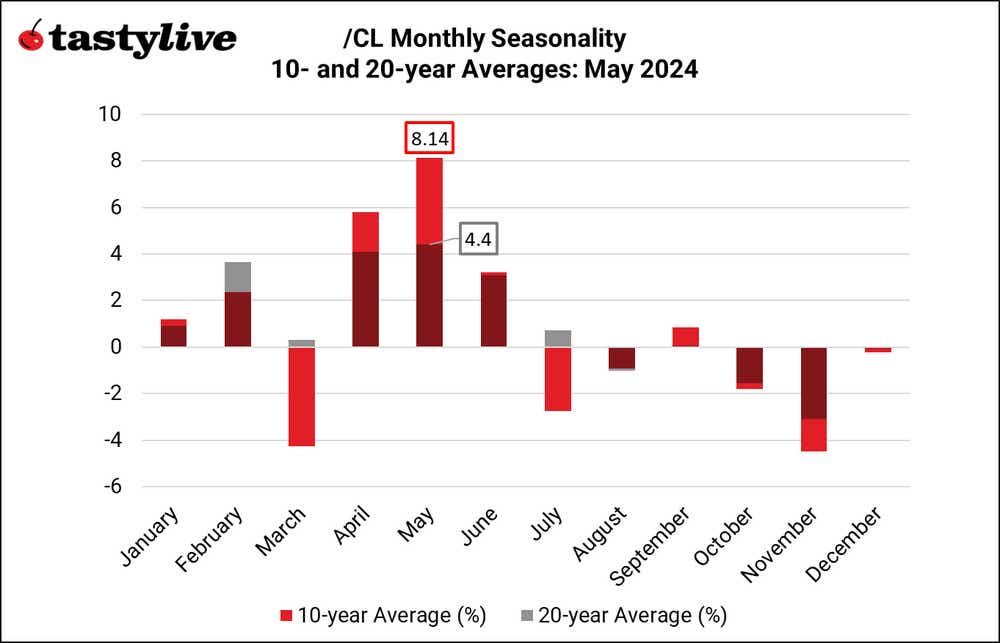

Monthly seasonality in crude oil (/CL)

May is a very bullish month for /CL, on a seasonal basis. Over the past 10 years, it has been the best month of the year for crude, averaging a gain of 8.14%. Over the past 20 years, it has also been the best month, averaging a gain of 4.4%.

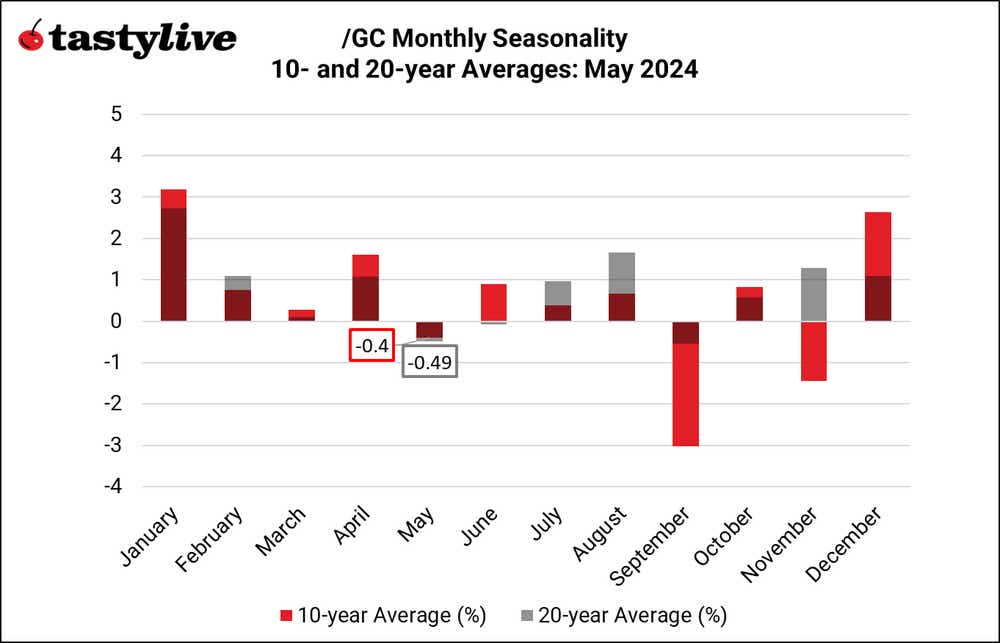

Monthly seasonality in gold (/GC)

May is a bearish month for /GC, on a seasonal basis. Over the past 10 years, it has been the third-worst month of the year for the precious metal, averaging a loss of 0.4%. Over the past 20 years, it has been the second-worst month, averaging a loss of 0.49%.

Monthly seasonality in the euro (/6E)

May is a very bearish month for /6E, on a seasonal basis. Over the past 10 years, it has been the fourth-worst month of the year for the pair, averaging a loss of 0.51%. Over the past 20 years, it has been the worst month, averaging a loss of 0.97%. Note: the time series for Euro futures (/6E) does not extend beyond 2018; the data series has been backfilled using EUR/USD spot rates as a proxy.

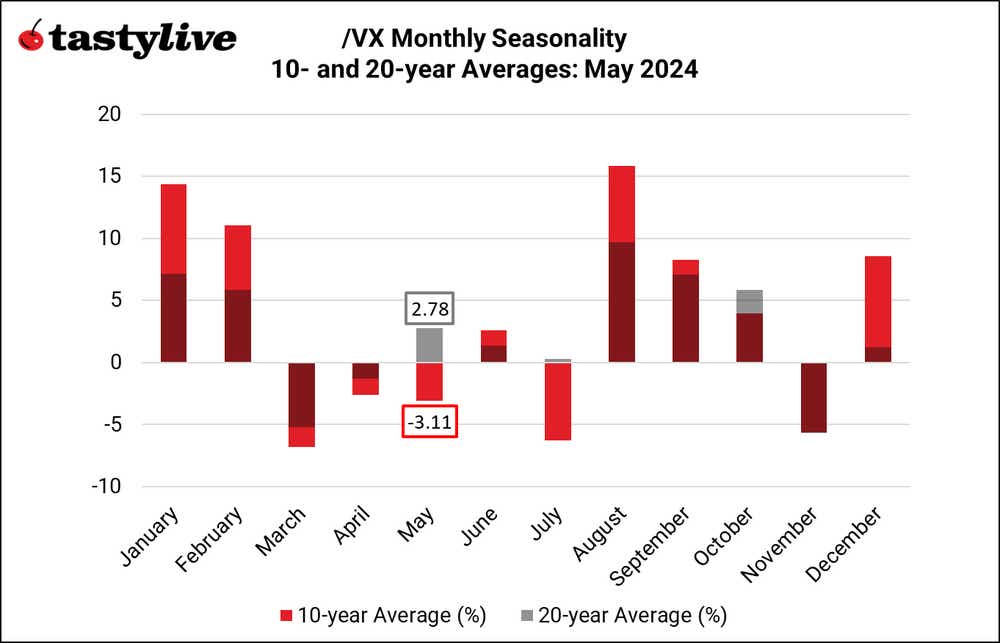

Monthly seasonality in VIX (/VX)

May is a neutral month for /VX, on a seasonal basis. Over the past 10 years, it has been the fourth worst month of the year for volatility, averaging a loss of 3.11%. Over the past 20 years, it has been the sixth-best month, averaging a gain of 2.78%.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.