Don't Blame Japan for Falling Stock Markets. It's All About the Fed.

Don't Blame Japan for Falling Stock Markets. It's All About the Fed.

By:Ilya Spivak

The land of the rising sun was first large financial market to face sellers’ wrath, but events there didn’t set the sell-off in motion

- Stocks swooned on Monday, and many are looking to Japan for an explanation.

- In fact, recession fears after July’s dovish tone shift at the Fed are the likely culprit.

- The yen’s sharp rally amid the sell-off is “business as usual” carry trade unwinding.

As traders try to unpack what happened to bring on the blistering rout across global stock markets at the start of this week, the focus has turned to Japan. That’s understandable. Japanese shares fell by an eye-watering 12% on Monday, marking the single worst day since 1987. Violent sell-offs in European and U.S. markets followed.

The Japanese yen surged in tandem, rising as much as 3.2% against the U.S. dollar intraday. But it trimmed some of those gains following better-than-expected U.S. service sector data from the Institute of Supply Management (ISM), which gave some modest relief to the greenback. Nevertheless, the yen was up 1.6% by the daily close.

Had the currency held up at its midday highs, the rise would have amounted to the biggest one-day increase since mid-March 2020, when stock markets around the world were melting down amid the onset of the COVID-19 pandemic. This time, the MSCI All-Country World stock index (ETF: ACWI) shed 2.6%, the biggest one-day drop in two years.

Did Japan break global stock markets?

Japan’s dubious honor of being the first large financial market to face sellers’ wrath amid such extreme volatility seems to be feeding speculation that the entire episode—including on Wall Street—was somehow set in motion by events there. A look at the evidence suggests otherwise.

First, that Monday’s rout appeared to begin in Japan proves hardly anything. The start of the global trading day tracks the international dateline, beginning in the East with Asia-Pacific (APAC) markets and ending in the West with the close in North America.

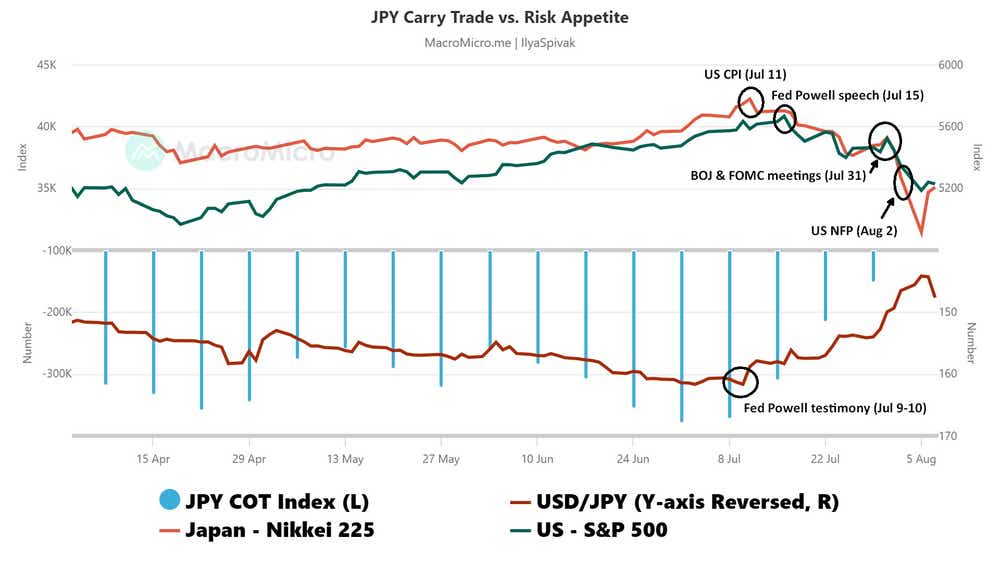

Next, painting Monday’s bloodbath as a kind of “beginning” seems misleading. It came after two days of heavy selling on Thursday and Friday of the previous week. That came courtesy of U.S. economic data, with a disappointing jobs report following weak ISM manufacturing survey (as expected).

The bellwether S&P 500 stock index fell 1.9% on Friday, priming APAC markets for a catch-up sell-off once trading resumed on Monday and local traders got their chance at a reaction. Moreover, U.S. and Japanese markets have been trading lower in tandem since mid-July as a dovish shift in tone at the Federal Reserve fueled fears about recession.

Is something wrong with the Japanese yen?

That very backdrop drove the Japanese yen higher simultaneously. The currency tends to rise when markets panic and trigger the unwinding of “carry trades,” where borrowing cheaply in the low-yielding yen is used to finance purchases of higher-paying assets. So, its gains were to be expected.

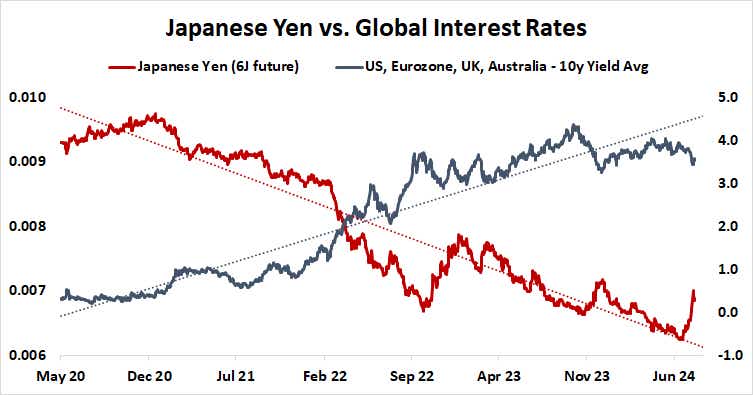

Japan’s benchmark overnight interest rate has sat near 0% for decades as inflation has remained anemic despite expansive central bank stimulus. That is mainly a function of demographics. The oldest population in the world is well past its peak consumption years, on average. That has grounded demand, price growth, and borrowing costs.

Not surprisingly, this has cultivated a strong inverse relationship between the yen and global interest rates. The more attractive the returns appear outside Japan, the greater the pull to borrow the Japanese currency and use it to invest in greener pastures. Exiting such bets amid a sell-off amounts to covering yen shorts, driving the unit higher.

So, the yen’s outsized rally on Monday echoed the intensity of market-wide de-risking—instead of something emerging from Japan itself. As with the stock sell-off, this is a trend that has been developing for weeks, long before Monday’s debacle or even the surprise rate hike from the Bank of Japan (BOJ) on July 31.

Here, too, it’s all about the Fed.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.