Stocks Face Risks to Recovery in FOMC Minutes, U.S. and China CPI Data: Macro Week Ahead

Stocks Face Risks to Recovery in FOMC Minutes, U.S. and China CPI Data: Macro Week Ahead

By:Ilya Spivak

Stocks send a bullish signal after U.S. jobs data, but signs of a “higher for longer” Fed and weakness in China menace markets in the week ahead

- It looks like Wall Street marked a pointedly risk-on reversal after September’s U.S. jobs report.

- FOMC meeting minutes, U.S. CPI report to inform “higher for longer” Fed rates outlook.

- China’s inflation figures may stoke global recession fears as demand still looks anemic.

Wall Street responded to last week’s release of stronger-than-expected U.S. labor market data. An increase of 336,000 in nonfarm payrolls in September dwarfed expectations for a more modest 170,000 rise. The prior two months’ results were also revised higher by a cumulative 119,000.

The markets’ initial response followed a “good is bad” dynamic as heavily foreshadowed ahead of the release, but risk appetite began to rapidly recover just two hours later, with the bellwether S&P 500 posting the strongest daily rally in a month. This considered re-think and demonstrative departure from recent price behavior may mark a critical turning point for stocks and similarly minded assets.

Here are the key macro waypoints for traders in the week ahead:

Federal Open Market Committee (FOMC) meeting minutes

September’s meeting of the Federal Reserve’s policy steering FOMC committee proved to be a pivotal turning point for financial markets. Traders walked away from the gathering with the conclusion that the U.S. central bank intends to hold interest rates higher for longer, delaying a much-hoped-for rate cut cycle.

Officials are waiting for the impact of already-executed rate hikes to accumulate as higher borrowing costs filter into the economy. They hope to squeeze out enough of the inflation trapped by sticky wages in the labor market to put price growth on a clear path to the Fed's 2% objective. The Fed has estimated that it can take 12 to 18 months for the full adjustment to occur after a single rate change.

As it stands, the outlook priced into interest rates futures reflects stasis from here until the first 25-basis-point (bps) cut arrives, no later than July of next year. Two more such cuts—bringing the total to 75 bps in easing—are penciled in for the remainder of 2024.

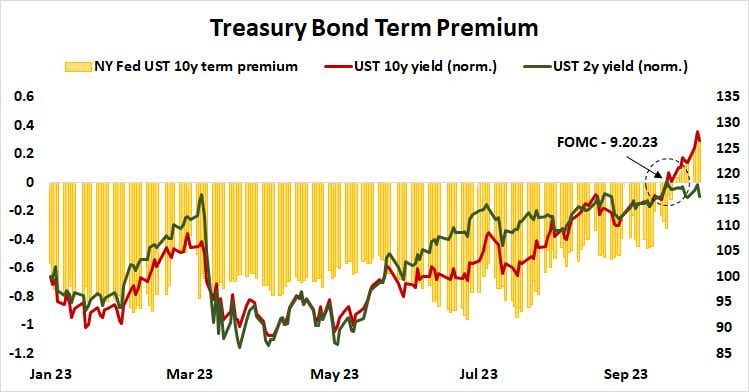

The markets’ response seemed telling. While near-term yields held steady, reflecting the belief that the Fed’s rate hike cycle has ended, longer term borrowing costs pushed higher. The move looks to have been driven by growing term premium in the Treasury bond market, which has turned positive for the first time in over two years.

That speaks to rising uncertainty as markets worry about delaying stimulus at a time when the threat of global recession has become increasingly acute. Traders will be eager to parse the FOMC minutes for further guidance. Stocks may wobble as yields and dollar rise If they walk away with a reinforced sense of the Fed’s inflation-fighting focus.

U.S. consumer price index (CPI) data

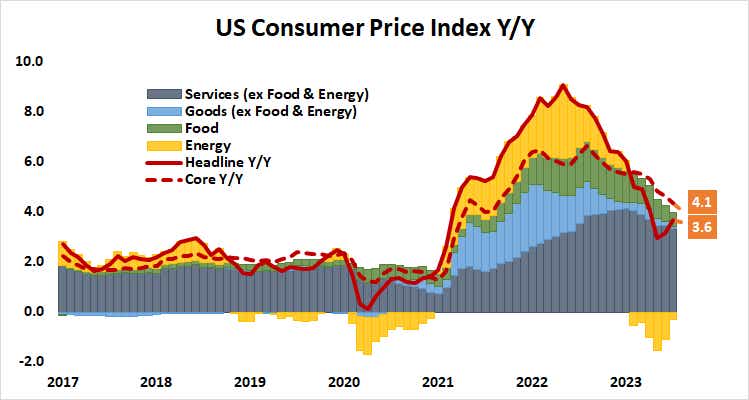

U.S. inflation is expected to have cooled in September. Analysts and economists polled by Bloomberg have penciled in a rise of 3.6% year-on-year in the headline consumer price index (CPI). That marks a climbdown from 3.7% recorded in August, breaking a two-month rising streak.

The core CPI measure excluding volatile food and energy prices is expected to inch down for a 13th consecutive month. Seesawing crude oil prices explain much of the disparity between the two measures. The core measure captures price trends where Fed policy has some agency for direct impact, so the central bank is focused there.

Another downtick will be broadly welcomed by investors. However, its ability to lift stocks in the near term probably depends on whether the outcome spurs hope for a faster transition to interest rate cuts without amplifying recession fears. An unexpected rise or a significantly larger-than-anticipated decrease may spook risk appetite.

China inflation data

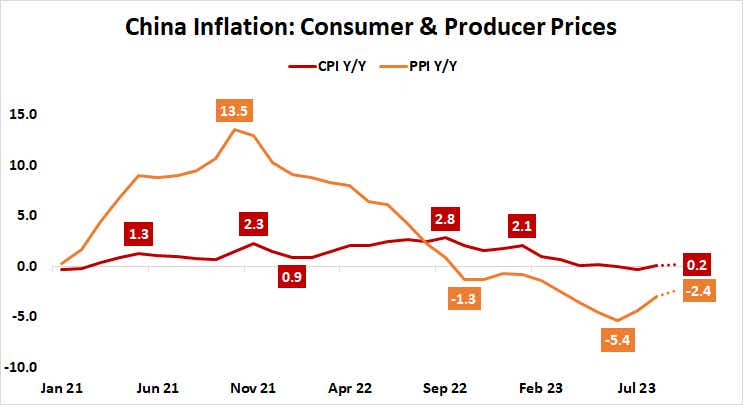

Inflation is expected to languish a hair above standstill in September when China reports the latest statistics on price trends. The headline CPI gauge is seen rising 0.2% year on year, marking a slight uptick from the 0.1% rise in August. Anemic pricing power has reflected a dearth of demand in the world’s second-largest economy.

Analysis from Citigroup suggests that Chinese economic news data outcomes still tend to underperform relative to baseline forecasts. This implies that analysts’ models are still too rosy in their assumptions. That may set the stage for a downside surprise that stokes global recession fears.

China-sensitive currencies and commodities like the Australian dollar and copper may face selling pressure in this scenario. Cyclically minded assets like stocks may also feel the string if the miss is particularly acute, especially if it amplifies whatever headwinds might come from news-flow shaping the Fed policy outlook earlier in the week.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.