German CPI Preview: Euro May Extend Higher on ECB vs. Fed Outlook

German CPI Preview: Euro May Extend Higher on ECB vs. Fed Outlook

By:Ilya Spivak

The euro is likely to rise if German inflation data tops economists’ forecasts, extending a shift in relative Europe vs. U.S. monetary policy expectations following November’s Federal Reserve policy meeting

- The euro is on pace for its best month in a year despite a dovish ECB.

- The rates outlook has shifted more in the U.S. compared with Europe.

- German CPI to lift the euro if data is higher than economists expect.

November looks like déjà vu for the euro. The currency is on pace to end the month up nearly 4%, marking the biggest rise since exactly one year prior. It added a beefy 5.3% in November 2022.

The move has curiously coincided with a dovish shift in expectations for European Central Bank (ECB) monetary policy. That seems counterintuitive. When a central bank moves toward favoring lower interest rates than previously expected, the yield on holding its currency typically declines and prices fall as capital flows to higher-paying alternatives.

With the euro’s current rise, that logic has been turned on its head. German government bond yields–a benchmark for interest rates in the broader Eurozone—peaked in early October just as the euro bottomed against the U.S. dollar. A month of consolidation followed until the currency launched higher as German rates fell in tandem.

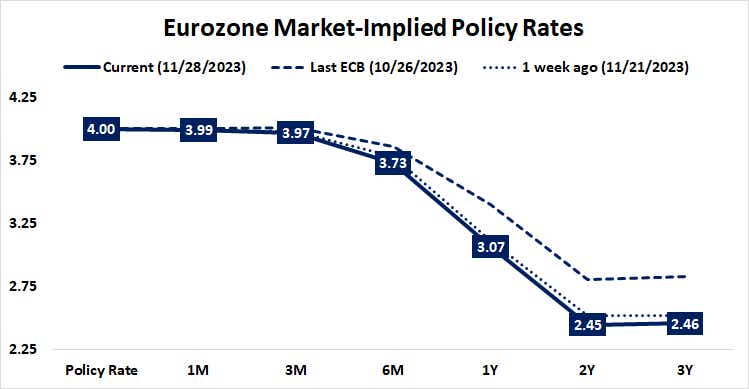

These trend moves were tellingly triggered in the wake of the Oct. 26 ECB policy meeting. The markets seemed to conclude after that conclave that President Christine Lagarde and the central bank’s Governing Council were done raising interest rates. The focus now would be the timing for the start of the follow-on rate cut cycle.

Is the euro cheering the end of ECB rate hikes?

One way to interpret this apparent disconnect is to consider that markets rewarded the euro for a more dovish central bank in an environment where a global recession looks likely. Against this backdrop, the place where recovery might come soonest could attract opportunistic capital.

The Eurozone had vastly underperformed on the economic growth front through 2023 and a recession is almost certainly underway already. If this means that the ECB will deliver stimulus faster than elsewhere, the currency bloc may lead the way back to prosperity as it did during the downturn. Eurozone stocks pointedly surged with the euro, as expected.

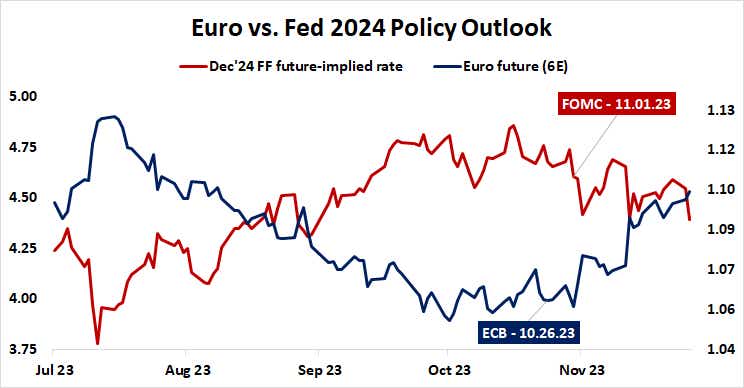

Another dynamic seems equally in play. The Federal Reserve held its own defining policy moment marked by a policy meeting just on the heels of the ECB’s late October sit-down held Nov. 1. Traders cheered the outcome, reading the messaging to mean that the U.S. central bank is also done with rate hikes.

The Fed is the pacesetter for global borrowing costs because the U.S. dollar is the overwhelmingly dominant medium of commercial exchange. Nearly 90% of global monetary transactions are settled in the greenback, according to the Bank of International Settlements (BIS). When the Fed shifts the costs of borrowing it, the price of credit moves worldwide.

Signs of a policy pivot at the Fed thus seemed to mark the end of a blistering rise in the worldwide cost of capital, which marked a turn in yields across the markets (and of course Germany). Investors cheered globally as well, with stocks rising across most geographies (although the Eurozone outperformed, highlighting the “sooner stimulus” premium).

German CPI to lift the euro if data surprises on the topside

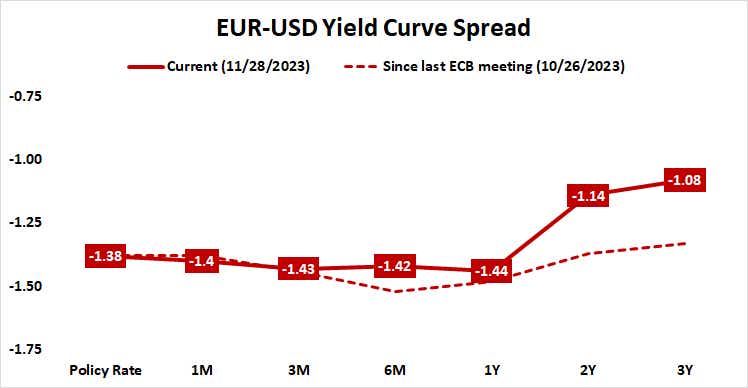

For the euro, strength seems to have come from relative factors. The ECB and the Fed signaled the end of their rate hike campaigns back-to-back. Both have seen their expected policy path shift to a more dovish setting in November. However, comparing one against the other looks to have narrowed the greenback’s yield advantage.

This means the single currency may power higher if German consumer price index (CPI) data due this week surprises with a higher reading than economists expect. Baseline forecasts envision a drop to the slowest price growth since mid-2021 but leading purchasing managers index (PMI) data published last week warns of a pickup.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.