EUR/USD: Euro Trend in the Balance on ECB Meeting, U.S. GDP Report

EUR/USD: Euro Trend in the Balance on ECB Meeting, U.S. GDP Report

By:Ilya Spivak

The euro hangs in the balance as an ECB monetary policy announcement guides rate cut timing expectations while U.S. GDP data informs the outlook for the Federal Reserve

- The euro is at a key inflection point as markets search for direction clues.

- An ECB policy announcement is set to update the expected rate-cut timeline.

- Upbeat U.S. GDP data may cool Fed stimulus bets, boosting the dollar.

The euro is at a critical crossroads as back-to-back event risks line up to force a breakout, one way or another.

The multinational currency has been edging higher against the U.S. dollar since the beginning of October 2023. A pullback in the opening weeks of 2024 brought it to challenge the bounds of that trend. The market must now decide if it’ll bounce or break.

Traders will have plenty to consider as price action tries to resolve a directional bias. The European Central Bank (ECB) is due to deliver a much-anticipated monetary policy announcement as market-watchers try to find-tune rate cut expectations. The first glance at fourth-quarter U.S. gross domestic product (GDP) data follows later in the day.

Is the ECB ready to start cutting interest rates?

Inflation dropped back to 2.9%, quite different from the peak at 10.6% in November 2022. A bit of statistical noise in energy costs may nudge up headline readings in the months ahead, but this influence is set to fade as temporary fuel subsidies following Russia’s invasion of Ukraine rebase out of the calculation.

Food prices are still the biggest contributor, adding nearly one percentage point to the headline reading in December. There is relatively little that the ECB can do here to encourage disinflation. However, global food prices are already dropping. Transmission to overall inflation seems to take about seven months, setting the stage for more cooling ahead.

Meanwhile, leading purchasing managers index (PMI) data published this week shows that economic activity contracted for a seventh consecutive month in January. This seems to beg for a central bank reprieve. The key question now is when the ECB is prepared to begin easing, and how far it is willing to go.

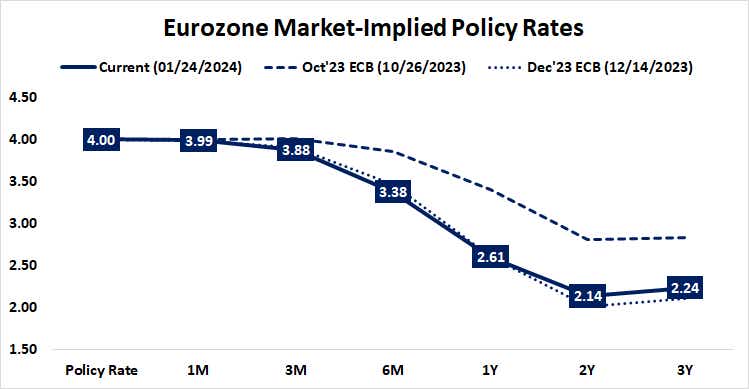

Markets expect five rate cuts

The markets have fully priced in five 25-basis-point (bps) interest rate cuts in 2024, with a 27% probability for a further sixth one. The key question now is when the first reduction will occur. The probability of a move at the April policy meeting is now 68%. That initial step is fully priced in by June, along with an 82% probability of a further 25bps cut.

All eyes now turn to the post-meeting press conference with ECB President Christine Lagarde. She has vocally pushed back against rate cut speculation, arguing that–while rate hikes are probably over—the central bank intends to hold rates at the cycle high to ensure inflation expectations have been capped.

If the tone on display at this week’s presser appears less forceful than Lagarde’s earlier protests, traders may reason that the groundwork for easing is beginning to emerge. That is likely to weigh on the euro. Alternatively, another loudly hawkish outing might lift the currency—as traders reason rate cuts will begin later into the year.

Is U.S. economic growth going strong?

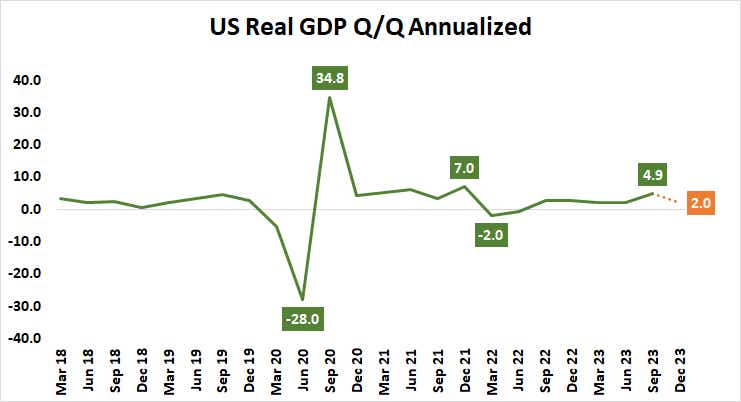

As for U.S. GDP data, it is expected to show that the annualized pace of economic growth slowed to 2% in the fourth quarter, down from the blistering 4.9% in the three months to September. Nevertheless, January’s U.S. PMI data put the economy on better footing than the markets were anticipating.

Manufacturing unexpectedly returned to growth for the first time since April, while the service sector expanded at the fastest rate since June. That added up to the fastest pace of economic activity growth since mid-2023, sailing past forecasts envisioning a slump to a fourth-month low.

A similarly impressive GDP showing may eat into Federal Reserve rate cuts expectations, pushing the euro lower as the dollar gains. That would encourage a process that is already underway: traders have erased one 25bps cut from baseline expectations in the past two weeks, leaving five of them (125bps or 1.25% in total) still on the menu.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.