Euro at Risk After Hitting One-Year High If ECB Rate Cut Bets Heat Up

Euro at Risk After Hitting One-Year High If ECB Rate Cut Bets Heat Up

By:Ilya Spivak

The currency is on pace for its biggest one-day sell-off in two months, and forces may be conspiring to push it still lower

- The euro is retreating after a blistering rally to test above 1.12 against the U.S. dollar.

- Losses may mount if Eurozone CPI data boosts bets on a 50bps ECB rate cut next month.

- Underwhelming NVDA earnings may amplify selling if the dollar gains in risk-off trade.

The euro has stumbled after hitting its highest level in over a year, probing above 1.12 against the U.S. dollar. Now, it is on pace for the biggest one-day sell-off in two months. Homegrown and global forces may be conspiring to push the currency still lower.

Euro price action has been refreshingly “normal” recently, following patterns of behavior found in the early pages of a textbook on foreign exchange markets. It has tracked closely with the spread between shorter-term interest rates in Germany and the U.S. since mid-2021, as global central banks geared up for a fight against inflation.

It’s all about Fed vs. ECB rate cut bets for the euro

U.S. economic data outcomes began to deteriorate relative to consensus forecasts in mid-April, according to analytics from Citigroup. That began to feed speculation about a round of interest rate cuts from the Federal Reserve, weighing on front-end Treasury yields and eating away at their advantage relative to European equivalents.

Against this backdrop, the euro has trekked higher from lows above the 1.06 figure, adding 5.5% by mid-August. June’s start of a rate cut cycle at the European Central Bank (ECB) marked a brief setback, but the move was widely expected and bets on next steps have been well-anchored. That has kept traders’ focus on the Federal Reserve.

Now, Fed Chair Jerome Powell has signaled a September rate cut is almost a foregone conclusion. The size of the move—a standard 25 basis points (bps) or double-sized 50bps—remains a source of speculative interest. However, markets appear unlikely to gain more insight on this front this week.

Euro may extend lower on local inflation data and NVDA earnings report

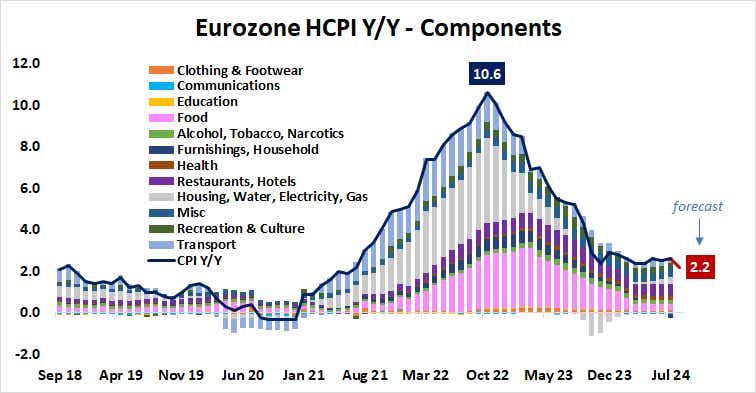

Meanwhile, incoming Eurozone inflation data may put the spotlight back on the ECB. August’s consumer price index (CPI) figures are expected to show price growth slowed to 2.2% year-on-year, marking a three-year low. As with the U.S., Citigroup analysis suggests recent outcomes have increasingly underwhelmed, implying downside surprise risk.

As it stands, the markets are pricing in an 80% probability of a 25bps ECB rate cut next month. Soft CPI data may cement the move as likely, with an especially sharp miss opening the door for a 50bps reduction. Recent comments from ECB officials seem to suggest that appetite for such a step is growing on the central bank’s Governing Council (GC).

The euro is likely to accelerate lower if disinflation gathers steam. It may be helped along by broader U.S. dollar strength if market sentiment sours after the much-anticipated second quarter earnings report from Nvidia (NVDA), a darling of the artificial intelligence (AI) sector that has powered stock market optimism for much of the year.

The upside surprise quotient in the company’s results has been narrowing for the past three quarters. This might imply analysts are getting better at benchmarking the stalwart company’s performance, which may set the stage for a still-smaller beat this time around. That might trigger a risk-off response that fuels haven demand for the greenback.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.