ECB and BOC Meetings, Global PMI Data, US PCE Inflation: Macro Week Ahead

ECB and BOC Meetings, Global PMI Data, US PCE Inflation: Macro Week Ahead

By:Ilya Spivak

Stocks will try to recover while the U.S. dollar faces selling pressure as PMI data anchors global recession fears while central banks in Canada and the Eurozone back away from interest rate hikes

- The October PMI data roundup may cheer markets despite signs of economic weakness.

- Central banks in Canada and the Eurozone are set to signal the end of interest rate hikes.

- U.S. PCE inflation data may lift Wall Street absent a hawkish signal for Fed policy.

Financial markets traded against a toxic backdrop last week.

Seething geopolitics sent gold and crude oil prices higher as investors worried that Israel’s clash with Gaza-based terrorist group Hamas will spill over into a broader regional conflict. Meanwhile, Federal Reserve Chair Jerome Powell reiterated the U.S. central bank’s aim to hold rates “higher for longer” even he signaled that the hiking cycle is probably over. That sank Treasury bonds and lifted borrowing costs.

Wall Street did not take kindly to these headwinds. The bellwether S&P 500 stock index shed 2.5%, erasing the previous week’s tepid rise and recording the worst performance in a month.

Here are the key macro waypoints for traders in the week ahead:

Purchasing Managers Index (PMI) surveys

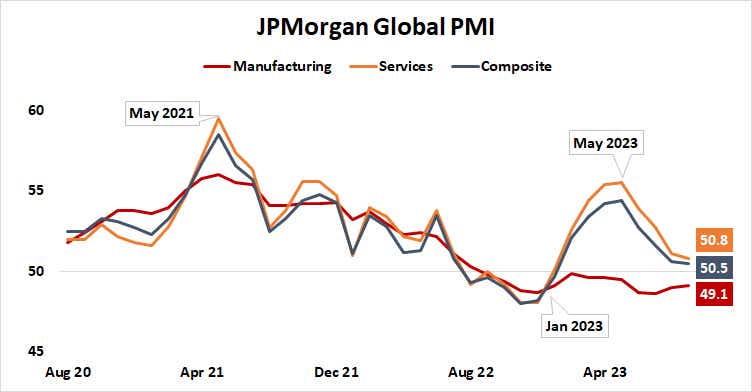

The threat of global recession seemed uncomfortably acute after September’s round of monthly purchasing managers index (PMI) data. Absent a miraculous reprieve, the landscape will probably continue to look challenging when October’s round of updates begins to roll out this week.

Preliminary surveys are due from Japan, Australia, the United Kingdom, the Eurozone and the United States. Final revisions will follow in two weeks.

The key question now is whether more evidence of anemic economic conditions still holds sway with traders. Financial markets are forward-looking. This means that economic weakness by itself is not inherently a hurdle for investors if conditions are not worse than the markets are anticipating.

Data from Citigroup shows global economic data outcomes have increasingly improved relative to forecasts since July. In fact, results now tend toward outperformance relative to baseline forecasts. This means that surprise risk is tilted to the upside on October’s PMI readings, even as the conditions they describe continue to look soft.

Bargain-hunting might ensue against this backdrop, helping support stocks and push back on the U.S. dollar. Underperforming equities in Europe and the emerging markets that have trailed their U.S. counterparts this year may see outsized catch-up gains.

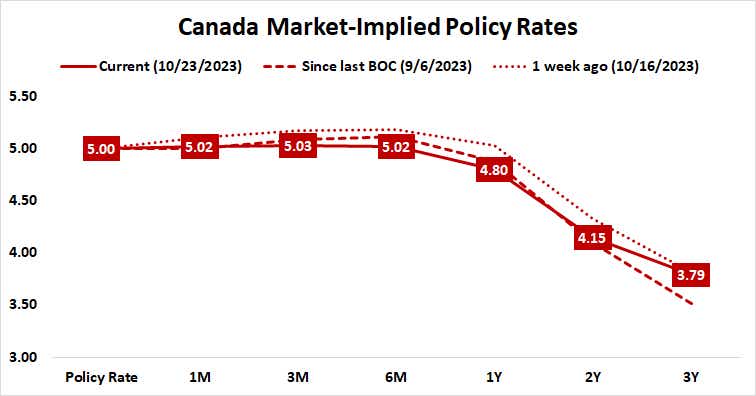

BOC monetary policy meeting

Canada’s central bank is expected to keep its target interest rate unchanged at 5%. The markets expect July’s rate hike to have marked the end of the blistering tightening cycle beginning in March 2022. The Bank of Canada (BOC) is priced in to remain on hold for the better part of a year from here, with cuts starting to emerge toward the end of 2024.

With no changes on the menu, policymakers’ assessment of the economic backdrop and guidance on how they see conditions evolving from here will be in focus. Nearly 80% of Canada’s exports are bound for the U.S. This means that demand south of the border is a defining variable for BOC Governor Tiff Macklem and company. Traders will be eager to weigh up their assessment.

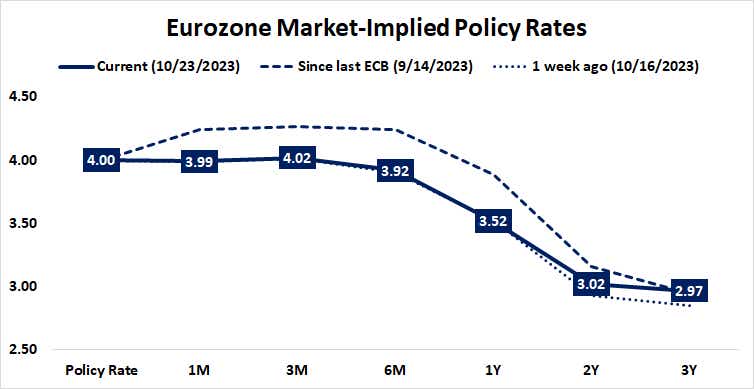

European Central Bank (ECB) monetary policy meeting

Priced in expectations for the path of ECB monetary policy have pointedly shifted to a more dovish setting since the central bank’s September meeting. The markets now see standstill through mid-2024, with rate cuts due thereafter. The first 25-basis-point (bps) reduction is penciled in to appear no later than July.

That makes sense. Leading PMI data implies the regional economy shrank in the third quarter. Meanwhile, inflation dropped to the lowest in almost two years in September. The cost of food – an area where the central bank has little influence – remained the largest contributor to price growth. Excluding that drops the benchmark consumer price index (CPI) measure of inflation from 4.3% to just 2.8%, giving the ECB cover to focus on sluggish demand.

With that in mind, the spotlight will fall on guidance in the policy statement and the press conference with ECB President Christine Lagarde following the meeting of the rate-setting Governing Council. Regional stocks are likely to cheer echoes of the dovish tone shift on display in recent comments from central bank officials.

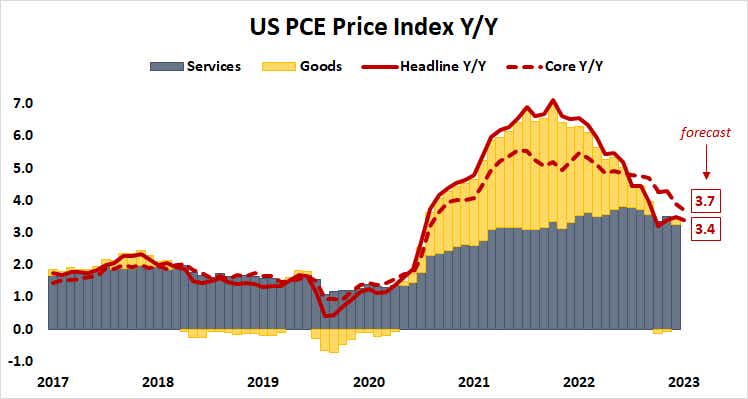

U.S. Personal Consumption Expenditure (PCE) data

The Federal Reserve’s favored inflation gauge is set to show that core disinflation continued in September, echoing the analog CPI data published earlier this month. Absent an improbably wild deviation from forecasts, the outcomes on offer are unlikely to alter the “hawkish hold” strategy most recently reiterated by Fed Chair Powell last week.

As it stands, the markets expect rates to remain at their current setting through mid-2024. The first 25 bps cut is priced in to occur no later than July. Another reduction is in the cards by November. Wall Street may find relief in results that don’t appear to delay easing any further, while the U.S. dollar might retreat.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.