ECB Preview: Stock Markets, Euro to Cheer as Rate Hikes Peak

ECB Preview: Stock Markets, Euro to Cheer as Rate Hikes Peak

By:Ilya Spivak

Stock markets and the euro may find strength as the European Central Bank signals that its interest rate hike cycle has ended, setting the stage for stimulus in 2024

- The Eurozone economy is shrinking, and credit market stress is on the rise.

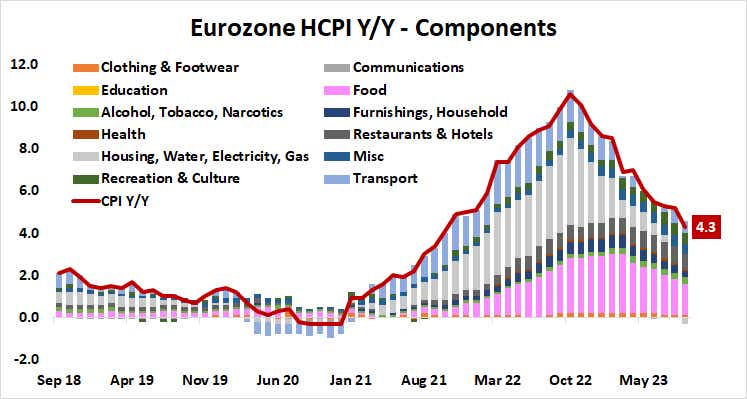

- Inflation has fallen to a two-year low, and much of what’s left is temporary.

- European stocks and the euro may rise as the ECB marks a turning point.

The European Central Bank (ECB) looks ready to end its interest rate hike cycle.

The markets are pricing in no chance of an interest rate hike when the policy-steering Governing Council delivers the outcome of its latest conclave this week. In fact, no further tightening appears on the menu from here until the lever flips to easing mode. The first 25-basis-point (bps) rate cut is penciled in to happen no later than July 2024.

ECB President Christine Lagarde seems to have all-but preannounced the central bank’s transition into wait-and-see mode a mere 24 hours before the official announcement. “We need to look at … where the risks are [but] for the moment, I’m confident that we are on a journey to bring inflation back to 2%,” she said, speaking to Antenna TV in Greece.

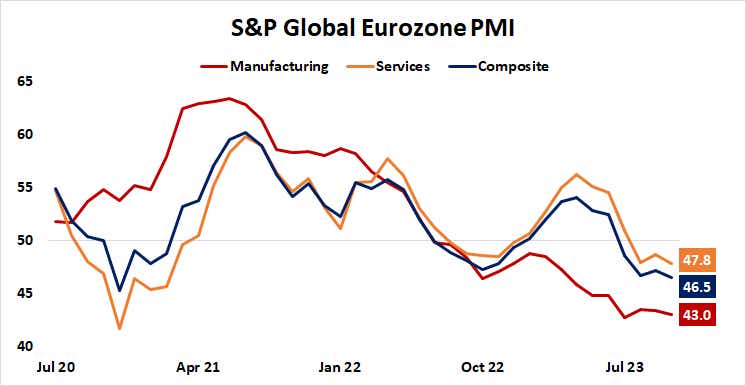

Eurozone economy shrinking, credit stress on the rise

Leading surveys of purchasing managers (PMI) released earlier this week showed the Eurozone economy stagnating for a fourth consecutive month in October, with contraction in manufacturing and the service sector. In all, the reports pointed to the worst economic conditions since November 2020. Recession is almost certainly underway.

Meanwhile, increasing uncertainty in Treasury bond markets is spilling over. A measure of financial stress from the Office of Financial Research (OFR) at the U.S. Treasury moved to the highest since the Silicon Valley Bank-led banking crisis roiled markets in March. That has pushed Eurozone lending conditions to their most restrictive in five months as the spread between German and Italian bond yields widens, signaling rising sovereign risk.

Against this backdrop, inflation has helpfully dropped to the lowest in almost two years in September. What’s more, the cost of food—a sector in which the central bank has little influence–remained the largest contributor to price growth. Excluding that drops the benchmark consumer price index (CPI) inflation gauge from 4.3% to just 2.8%.

European stocks and the euro may rise as the ECB turns a corner

This probably gives the ECB ample cover to focus on deteriorating credit conditions and anemic economic growth. The policy statement and Ms. Lagarde’s press conference thereafter will probably stress officials’ intent to hold rates at the cycle high for now to anchor expectations even as it signals that the bias has shifted to timing the next rate cut, as opposed to the next hike.

Regional stocks are likely to cheer signs that monetary authorities are turning a corner and relief is coming closer into view. The euro may find a way higher as well, shrugging off the dovish adjustment in the central bank’s tone as capital flows search for bargains in battered corners of the markets where a policy pivot seems closest to delivering a lifeline.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.