Euro and British Pound Likely to Fall Against U.S. Dollar

Euro and British Pound Likely to Fall Against U.S. Dollar

By:Ilya Spivak

The European Central Bank and the Bank of England signal that interest rate cuts are ahead in 2024

- Eurozone and U.K. inflation trends argue against further interest rate hikes.

- The outlook on prices is cooling despite firming rate cut bets as growth slows.

- The euro and British pound are likely to fall on dovish ECB and BOE guidance.

On the heels of an action-packed policy announcement from the Federal Reserve, central banks in the Eurozone and the United Kingdom will have their say on the path of monetary policy. As with their U.S. counterpart, they are expected to lay the groundwork for a turn to interest rate cuts in 2024.

Will Europe follow the Fed’s dovish lead?

For the European Central Bank (ECB), the ingredients for a pivot are plainly piling up. As of November, the headline inflation rate—measured by year-on-year growth in the consumer price index (CPI)—has fallen to 2.4%. That’s only a hair above the central bank’s target of 2%.

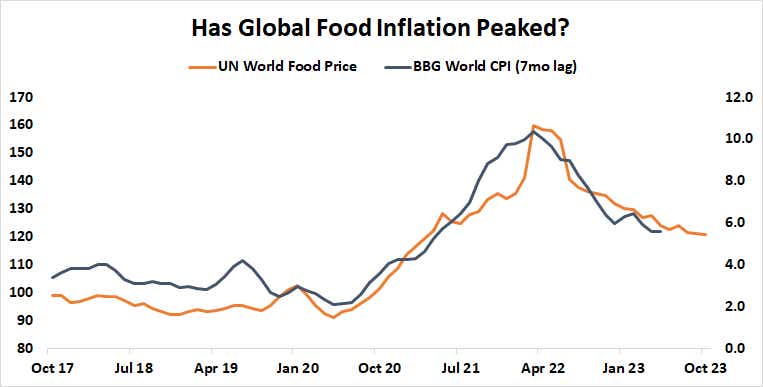

Food inflation remains the biggest contributor to price growth, accounting for half of November’s increase. There isn’t much the central bank can do with tighter monetary policy to address the issue. Food costs have helpfully eased for seven consecutive months, and leading data from the United Nations suggests the process will continue.

Meanwhile, the economy is almost certainly in recession. Purchasing managers index (PMI) data from S&P Global suggests economic activity has been shrinking for five consecutive months. A sixth contraction is on the menu when December’s data comes across the wires this week.

Looking across the English Channel, the situation is similar for the Bank of England (BOE). Here, too, food inflation is the biggest contributor to price growth. The other notables—recreation and hospitality—seem likely to fall back as the economy grinds to a halt. Purchasing managers’ index (PMI) data puts activity growth at a near-standstill as 2023 winds down.

Markets vs. central banks: will the ECB and BOE fight back?

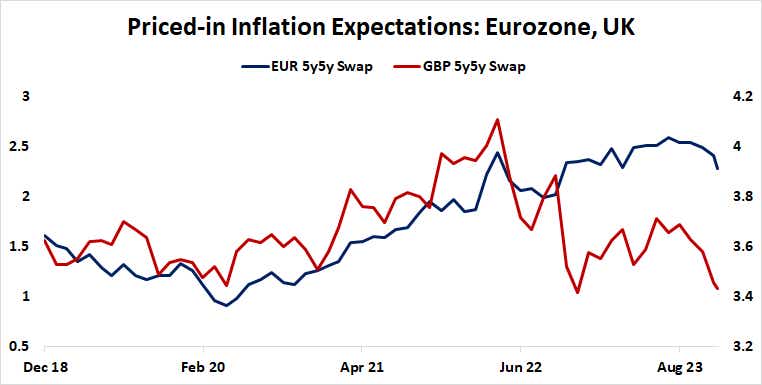

The markets have taken notice. Priced-in ECB and BOE policy expectations saw sharply dovish adjustments through November. The key consideration now is whether either of them is prepared to push back, fearing that excess rate cut speculation will unhinge inflation expectations and undermine hard-won progress.

Perhaps most tellingly, inflation expectations implied in swap and bond markets fell in October and November even as more rate cuts were being priced in. This means the ECB and BOE need not turn the screws on investors. That may hurt the euro and the British pound.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.