DraftKings Earnings Preview: Volatile Markets Expected

DraftKings Earnings Preview: Volatile Markets Expected

By:Mike Butler

The fantasy sports and sportsbook company has beaten revenue and EPS estimates handily over the past three quarters

- DraftKings is set to report earnings on Feb. 15 at 3:15 p.m. Central Time.

- Most notably, DraftKings is expected to enter positive EPS territory this quarter.

- DraftKings is expected to report an EPS of $0.18 on $1.24 billion in revenue.

A few years ago, you could watch any sporting event and see your typical advertisements related to sports, finance, and much more. These days, you're bound to see at least one advertisement for sports betting—maybe even a DraftKings (DKNG) advertisement.

Sports betting and fantasy sports have taken the world by storm, and it feels like it's just the beginning. Sports broadcasts now show fantasy-point leaders, probabilities, and much more related to the sports betting realm. For Super Bowl LVIII, Nevada sportsbooks alone raked in $185.6 million in wagers for the game.

DraftKings now offers sports betting in 22 states, and I expect that number to grow over the years. The popular sports wagering company is set to report earnings on Feb. 15 at 3:15 p.m. Central Time, after the stock market closes. DraftKings is expected to report earnings per share (EPS) of $0.18 on $1.24 billion in revenue.

DraftKings stock has been volatile

DKNG stock has been very volatile over the past few years, reaching a high of $74.38 in March 2021, and a recent low of $9.77 in May 2022. The stock has rebounded since then, and currently sits at $42.43.

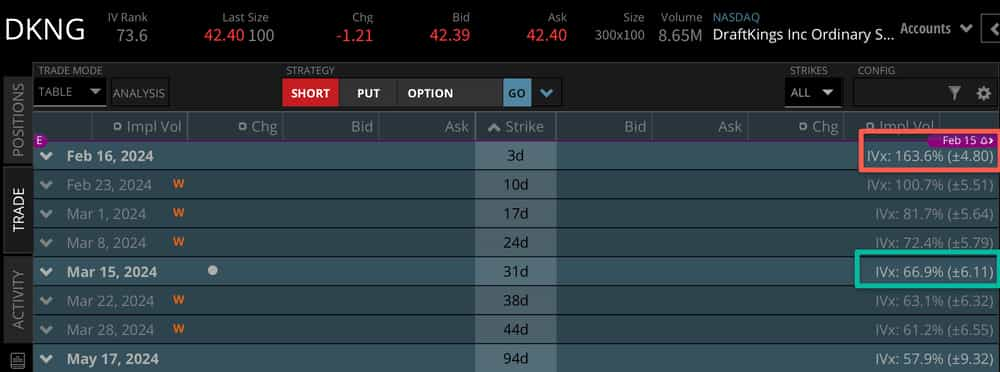

The expected move for this week, based on current implied volatility, is over 10% of the stock price at +-$4.80. This is the highest expected move relative to the stock price that I've seen this earnings quarter.

Looking further out in time, we can see that this earnings announcement makes up a massive chunk of the expected stock price move through the March 15 options cycle, which sits at +-$6.11. In other words, options that are priced in the cycle that expires Friday, Feb. 16 are almost as expensive as options that expire on March 15.

The stock market is expecting fireworks from the DraftKings earnings report on Thursday.

Bullish on DraftKings for earnings

As a sports better myself, I think DraftKings tries hard to get and keep your attention if you're betting on sports relative to other mobile sportsbooks.

The company offers plenty of odds, boosts, deposit matches and much more to create an excellent betting environment for the consumer. What caught my eye for this quarter is that DraftKings is expected to report an EPS gain instead of a loss for Q4'23.

Last quarter, analysts expected DraftKings to report a loss of $0.13 per share. But it posted an EPS gain of $0.14. If it can beat EPS expectations yet again, that could result in a bullish move for the stock price.

Bearish on DraftKings for earnings

Big, expected moves for a stock price during earnings season isn't always a good thing—if DraftKings misses on guidance, or any of the heightened EPS or revenue expectations, we may see a bearish move in the stock from recent highs.

Realized volatility has been quite high for the sports betting giant, and nothing says a stock can't fall back down to recent lows, even if that mark seems far away.

Tune in to Options Trading Concepts Live on Thursday, Feb. 15 for an in-depth strategy overview for trading the DraftKings earnings announcement.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.