Delta Earnings: Will Boeing Cause Turbulence?

Delta Earnings: Will Boeing Cause Turbulence?

By:Mike Butler

Analysts expect DAL earnings per share to be $0.36 on $12.93 billion in revenue

- Delta is the first airline to report this quarter.

- Boeing’s troubles play a role in Delta’s stock price movement.

- Estimated EPS and revenue are significantly lower than last quarter’s $1.28 on $14.22 billion in revenue, both of which beat expectations.

Delta Air Lines Inc (DAL) is set to kick off the airline sector earnings reports this week on Wednesday before the market opens.

The airlines have been a focal point the past few weeks, with so much troubling news surrounding Boeing (BA), planes that many airlines use.

Delta has a strong earnings history recently, beating EPS and revenue expectations three quarters in a row. What is interesting is that this quarter’s expectations are much lower at an EPS of $0.36 on $12.93 billion in revenue.

Traders and investors are eager to get a glimpse of Delta’s statistics for the quarter, which could be a preview for other airlines like United Airlines (UAL), American Airlines (AAL), Spirit Airlines (SAVE), and Southwest Airlines (LUV), all reporting later this month.

Strong start for DAL

Delta is off to a strong 2024, rallying over 17% from the opening print of $39.97 to the current price of around $47 per share. Many analysts are hanging their hat on Delta as a strong company to keep an eye on this year, as they look to expand premium offerings and keep load capacity per flight as high as last year, which was at 85% for fiscal year 2023.

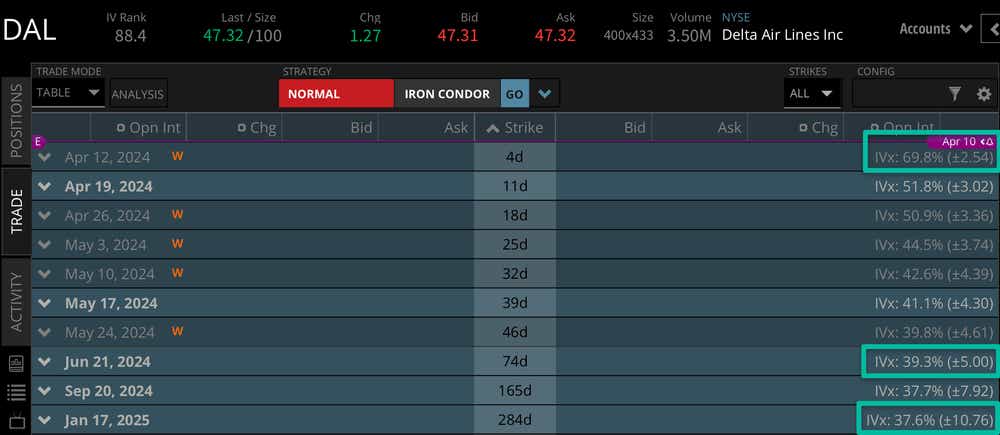

Looking at the options market, we can get a lot of information about earnings expectations based on current implied volatility. The market is pricing in a stock price move of just under 5% for this week, with a +-$2.54 expectation from the current price of $47. This is relatively low compared to other stocks we have seen reported, as earnings expected moves typically land between 5-10% of the stock price.

Looking further through the year, we can see that the June options cycle has an expected move of +-$5.00, and the January 2025 cycle has an expected move of +-$10.76. This tells us that even though this week’s expected move is relatively low, it still makes up for a large chunk of the expected move through summer.

With earnings being released before the market opens on Wednesday, the last day to place an earnings trade is Tuesday, Apr. 9 before the market closes.

Bullish case for Delta earnings

Delta bulls would love to see an earnings smash with such low expectations relative to the previous announcement. This could come off the back of a strong flight load report, and strong revenue from premium offerings. Delta has a mixed fleet of airplanes, utilizing Airbus, Boeing, Bombardier, and Embraer crafts. The fact that Delta is not completely reliant on Boeing could play a role, considering all the troubles Boeing is having recently with their crafts.

Bearish case for Delta earnings

Delta bears could see lowered expectations as a trap, implying load factor could come in light, with premium offerings revenue potentially coming in light as well. Boeing issues may scare away investors altogether, as it appears the only airline listed in this article that uses an all-Airbus fleet is Spirit Airlines.

Tune in to Options Trading Concepts Live on Tuesday for a look at options strategies ahead of Delta’s announcement Wednesday morning.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.