Delta Airlines—Will the Strong Performance Continue?

Delta Airlines—Will the Strong Performance Continue?

By:Mike Butler

The oldest operating airline in the U.S. exceeded earnings-per-share and revenue estimates the past four quarters

- Delta Airlines will report earnings Thursday before the market opens at 5:30 a.m. CDT.

- Delta exceeded earnings-per-share (EPS) and revenue estimates the past four quarters.

- The EPS estimate this quarter has been raised to $2.36 from the previous quarter's $0.36.

- Delta is banking on continued travel demand strength to help it exceed expectations again.

Delta Airlines (DAL) opened 2024 trading at $39.97 and has rallied over 16% to the current price of $46.51. As the oldest operating airline in the United States, Delta seems to have some positive momentum going into a big earnings call Thursday before the stock market opens.

Ed Bastian, Delta CEO, offered strong words for the future of 2024 in last quarter's earnings announcement: “For the March quarter, we delivered record revenue on outstanding operational performance, enabling strong earnings growth. We anticipate continued strong momentum for our business, and in the June quarter we expect to deliver record revenue, a mid-teens operating margin and earnings of $2.20 to $2.50 per share. We remain confident in our full year targets for earnings of $6 to $7 per share and free cash flow of $3 billion to $4 billion."

Delta also increased its dividend recently, and issued a press release: “Delta Air Lines' Board of Directors today declared a quarterly dividend of $0.15 per share, an increase of 50% over previous levels. The dividend is payable to shareholders of record as of the close of business on July 30, 2024, and will be paid Aug. 20, 2024."

Delta was first in completion factor and on-time arrivals relative to competitors last quarter, and was named the top U.S. airline by The Wall Street Journal for the third year in a row. The company will look to exceed expectations in a few days on their next earnings call.

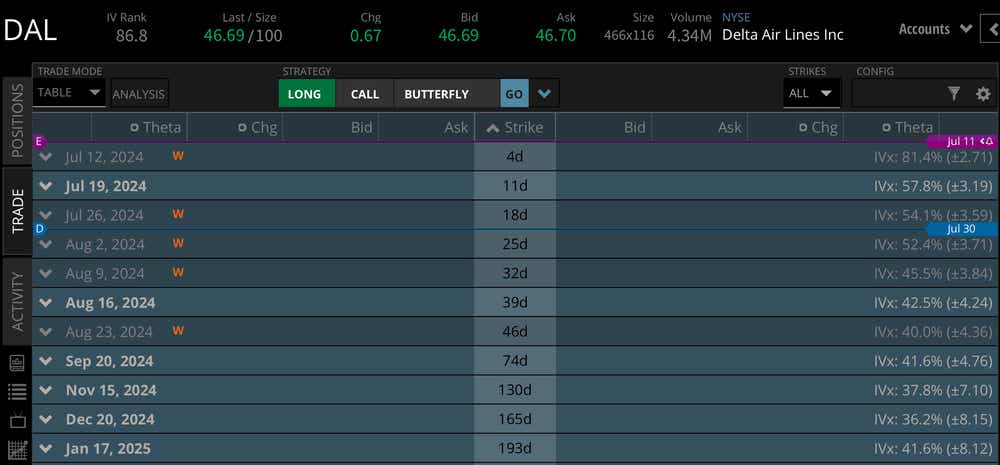

Delta has an expected stock price move of +/- $2.71 this week, based on current implied volatility, which contains the earnings announcement Thursday.

This is just under 6% of the stock price, which is on the lower end, relative to other earnings announcements made this year. Looking to the December cycle, which only has an expected move of +/- $8.15, based on current implied volatility, we can see this week has a decent implied move, relative to the rest of the year.

Bullish on Delta Airlines ahead of earnings

Delta bulls will want to see the airline smash estimates, especially the lofty earnings-per-share (EPS) increase. Company executives already painted a pretty picture for the 2024 forecast in the last earnings call, so lofty expectations will need to be met or exceeded if bulls are looking for a post-earnings rally on Thursday.

Bearish on Delta Airlines ahead of earnings

Delta bears are likely thinking Delta will miss EPS and/or revenue estimates on the earnings call, and that may send the stock lower. The EPS estimate is significantly higher than last quarter, and any sort of miss may be a weak signal for investors.

Tune in to Options Trading Concepts Live on Wednesday at 11 a.m. CDT for a full earnings strategy preview for Delta and other stocks reporting this week!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.