Monthly Futures Seasonality, December 2023: Higher Volatility, Stronger Bonds

Monthly Futures Seasonality, December 2023: Higher Volatility, Stronger Bonds

From bonds, to commodities, to currencies, December has produced outsized gains. What can traders expect based on December's futures seasonality?

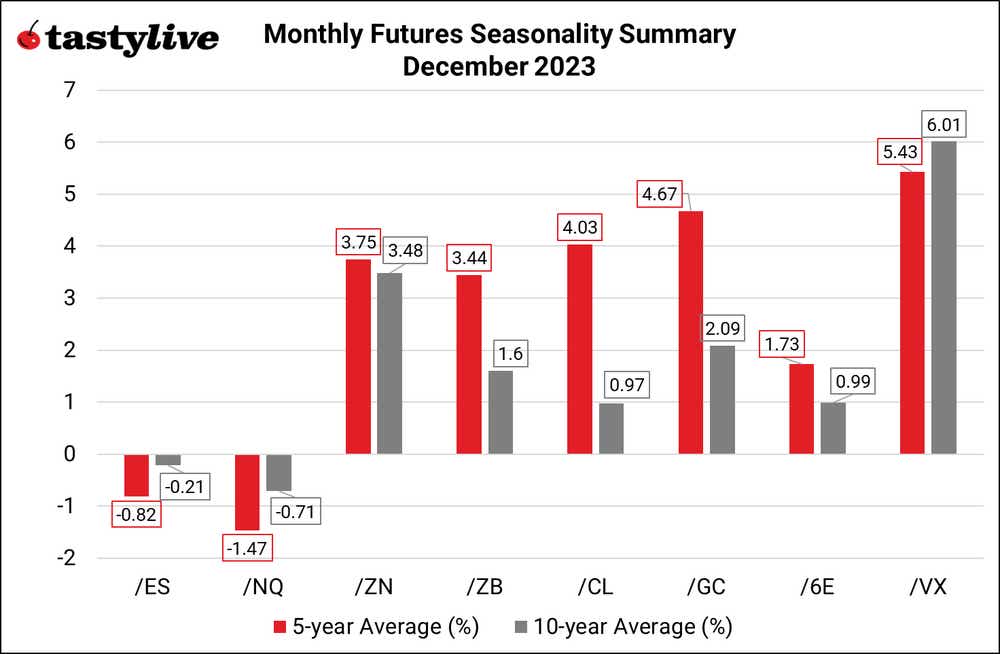

- December is a slightly bearish month for the S&P 500 and NASDAQ 100.

- It's a bullish month for Treasuries.

- December is also typically good for commodities and currencies.

November is typically one of the better months of the year, and November 2023 didn’t disappoint. The S&P 500 posted its best monthly gain since July 2022, registering the fourth-best month for stocks in the past decade.

Alas, the holiday cheer may soon die down, at least for equity market bulls: the past several years have produced modest losses for stocks in December. That said, nearly every other asset class loves the month of December: from bonds, to commodities, to currencies, December has produced outsized gains, making it one of the best months of the year for nearly everything else.

Monthly futures seasonality summary: December 2023

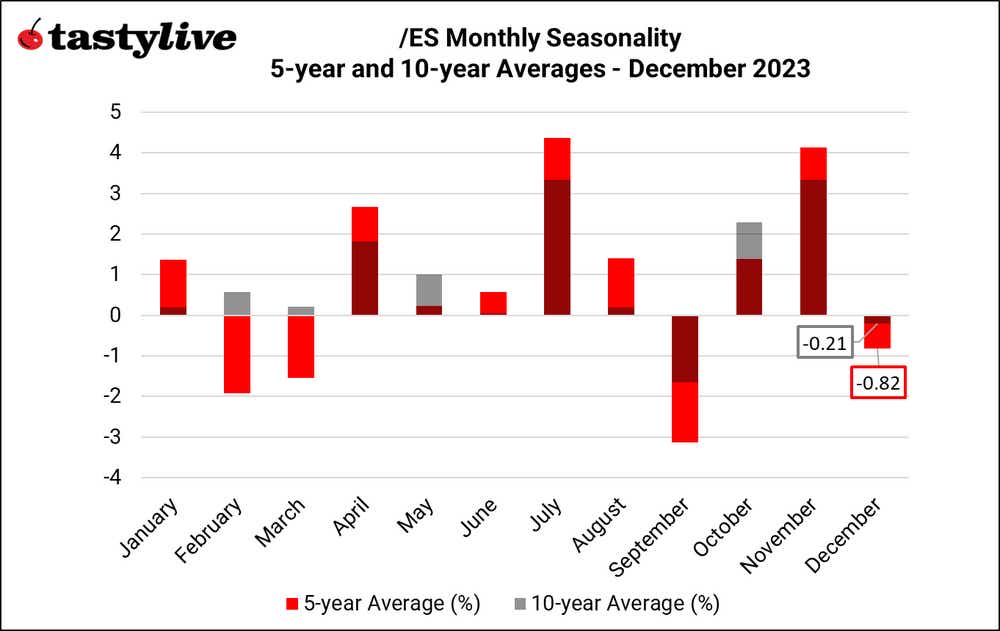

Monthly seasonality in S&P 500 (/ES)

December is a slightly bearish month for /ES, on a seasonal basis. Over the past five years, it has been the fourth worst month of the year for the index, averaging a loss of 0.82%. Over the past 10 years, it has been the second worst month of the year, averaging a loss of 0.21%.

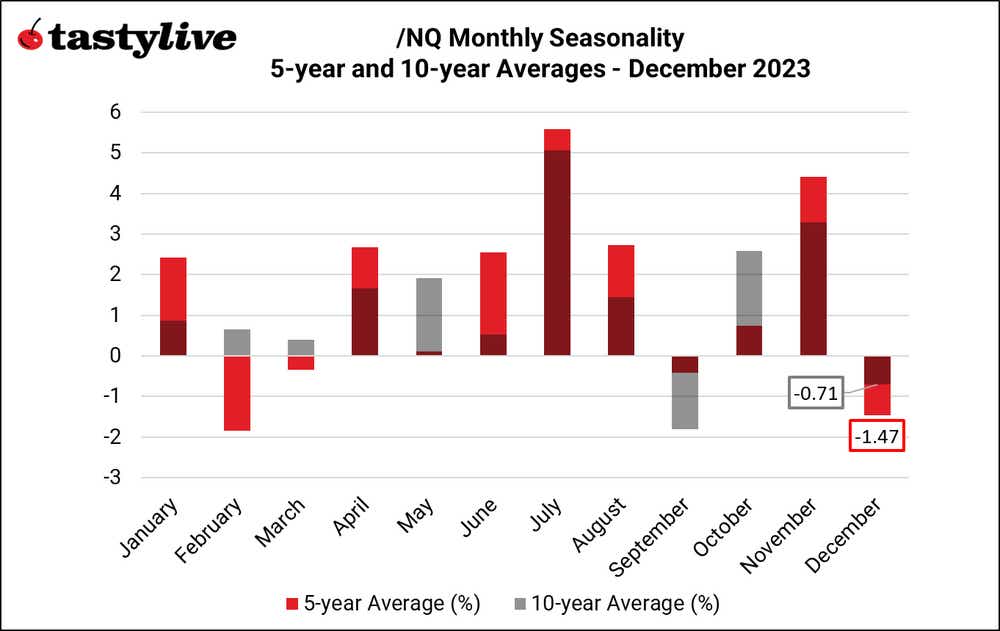

Monthly seasonality in NASDAQ 100 (/NQ)

December is a bearish month for /NQ, on a seasonal basis. Over the past five years, it has been the second worst month of the year for the index, averaging a loss of 1.47%. Over the past 10 years, it has been the second worst month of the year, averaging a loss of 0.71%.

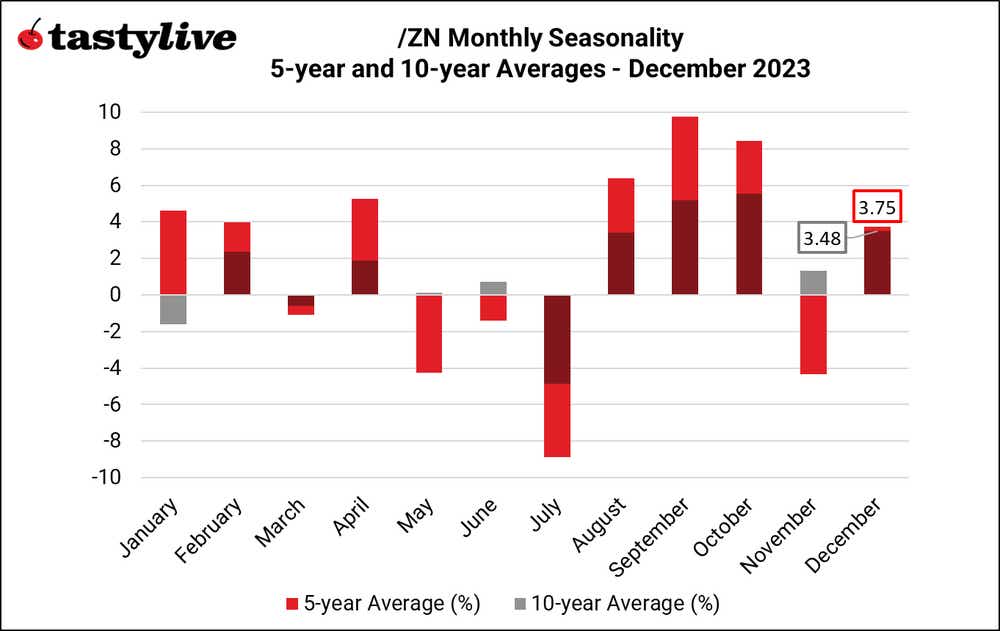

Monthly seasonality in Treasury notes (/ZN)

December is a bullish month for /ZN, on a seasonal basis. Over the past five years, it has been the sixth worst month of the year for the notes, averaging a gain of 3.75%. Over the past 10 years, it has been the third-best month of the year, averaging a gain of 3.48%.

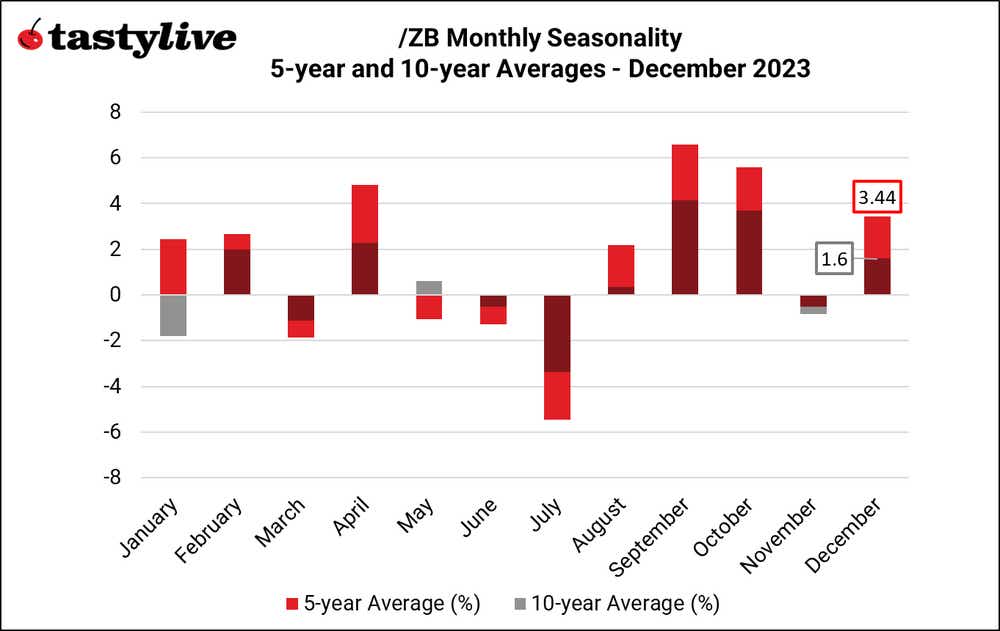

Monthly seasonality in Treasury bonds (/ZB)

December is a bullish month for /ZB, on a seasonal basis. Over the past five years, it has been the fourth-best month of the year for the bonds, averaging a gain of 3.44%. Over the past 10 years, it has been the fifth-best month of the year, averaging a gain of 1.6%.

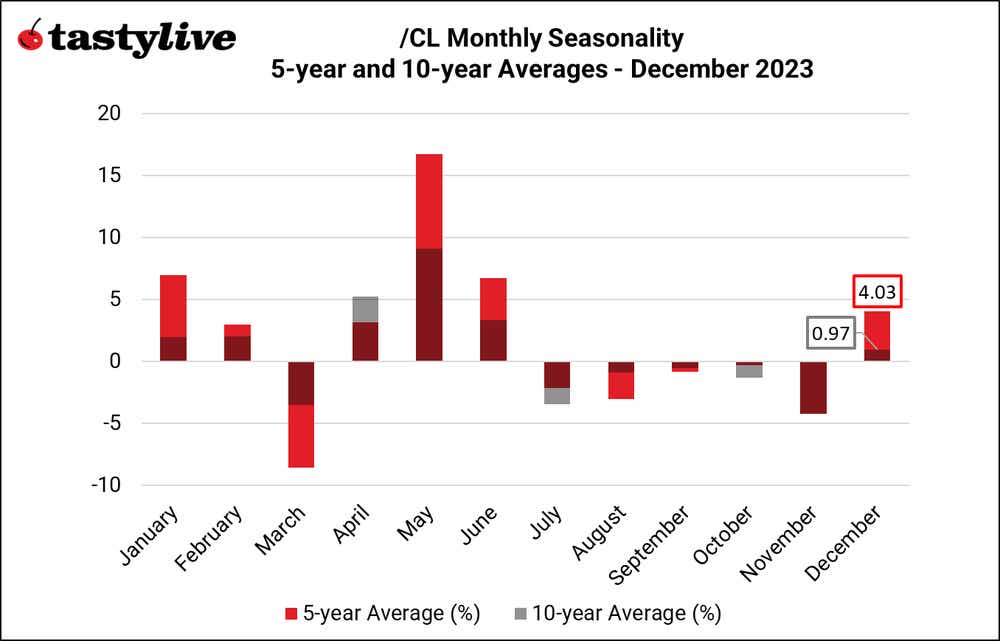

Monthly seasonality in crude oil (/CL)

December is a bullish month for /CL, on a seasonal basis. Over the past five years, it has been the fourth-best month of the year for the energy product, averaging a gain of 4.03%. Over the past 10 years, it has been the sixth-best month of the year, averaging a gain of 0.97%.

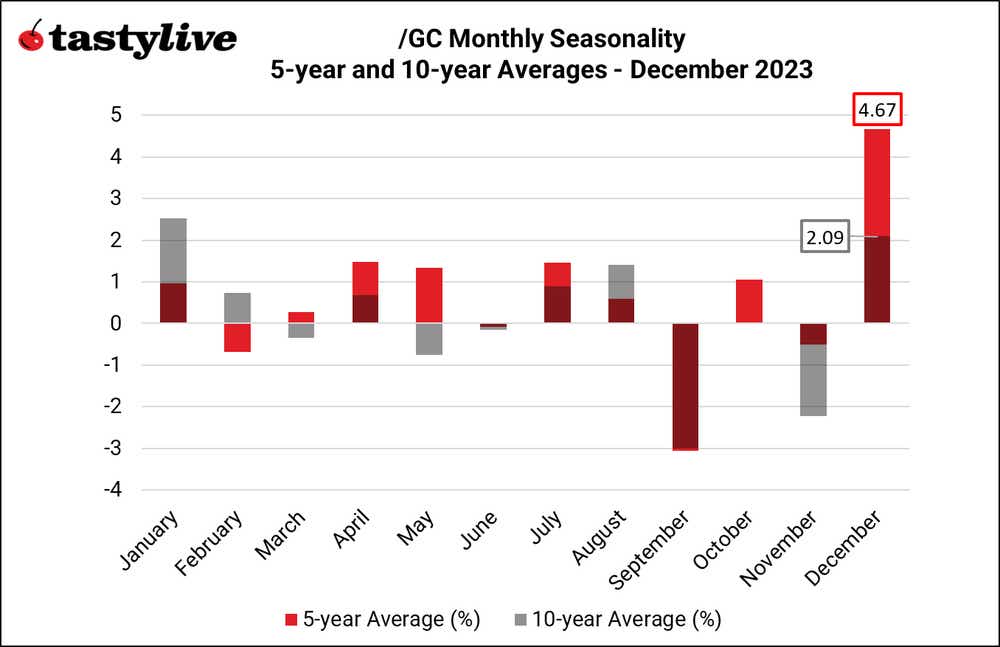

Monthly seasonality in gold (/GC)

December is a very bullish month for /GC, on a seasonal basis. Over the past five years, it has been the best month of the year for the precious metal, averaging a gain of 4.67%. Over the past 10 years, it has been the second-best month of the year, averaging a gain of 2.09%.

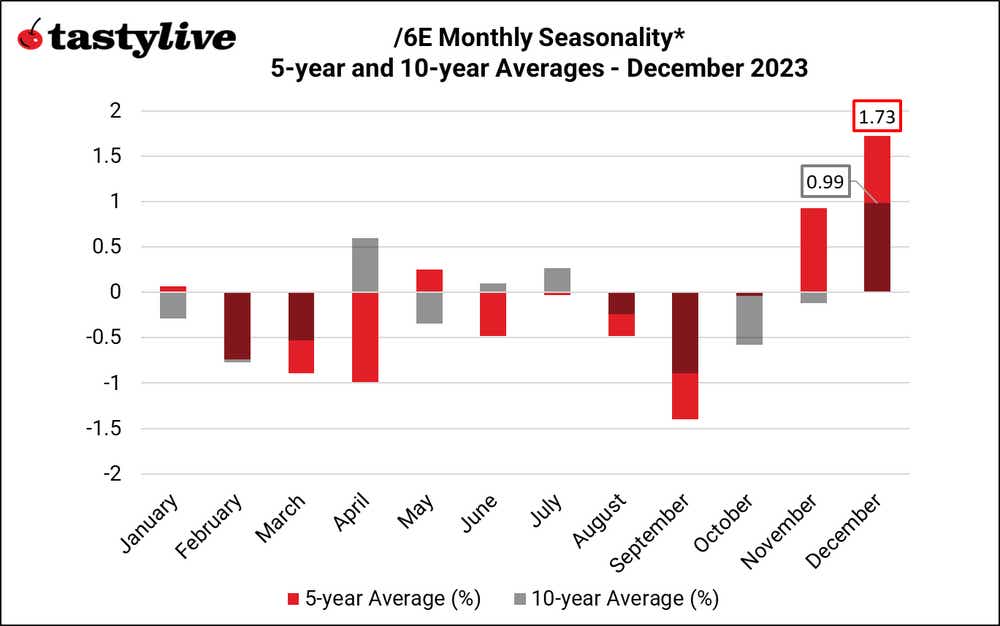

Monthly seasonality in the euro (/6E)

December is a very bullish month for /6E, on a seasonal basis. Over the past five years, it has been the best month of the year for the pair, averaging a gain of 1.73%. Over the past 10 years, it has been the best month of the year, averaging a gain of 0.99%. Note: the time series for Euro futures (/6E) does not extend beyond 2018; the data series has been backfilled using EUR/USD spot rates as a proxy.

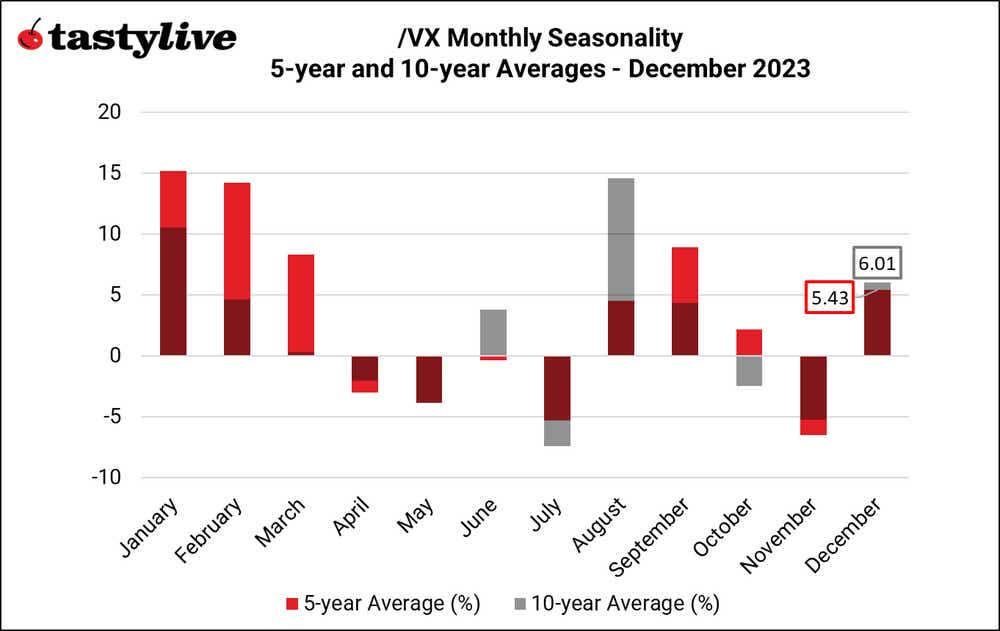

Monthly seasonality in VIX (/VX)

December is a bullish month for /VX, on a seasonal basis. Over the past five years, it has been the fifth-best month of the year for volatility, averaging a gain of 5.43%. Over the past 10 years, it has been the third-best month of the year, averaging a gain of 6.01%.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.