Crude Oil Prices Resist Fear-Driven Market: Is it Time to Buy?

Crude Oil Prices Resist Fear-Driven Market: Is it Time to Buy?

Black gold is bucking the market selloff as the economy slows and geopolitical trouble mounts

- Crude oil may defy the broader volatility-driven market selloff.

- The strength of the yen is a recipe for stronger oil prices—if there’s no global recession.

- Geopolitical tensions could help to provide a tailwind for oil prices as the world waits for Iran’s response to last week’s assassinations.

A volatile shakeout in risk assets intensified this week as the soft-landing narrative deteriorated, sending not only equities lower but commodities as well.

A surge in the Japanese yen is being blamed by many as the monetary policy divergence between the Federal Reserve and the Bank of Japan shrinks the yield premium offered by U.S. Treasuries against their counterpart Japanese bonds.

The yen—used as a funding currency because of its low cost of borrowing—is now blowing up the carry trade. The carry trade, put simply, is when investors borrow the currency to fund trades, usually bought in U.S. dollars.

Will a carry trade blowup continue to affect crude oil prices?

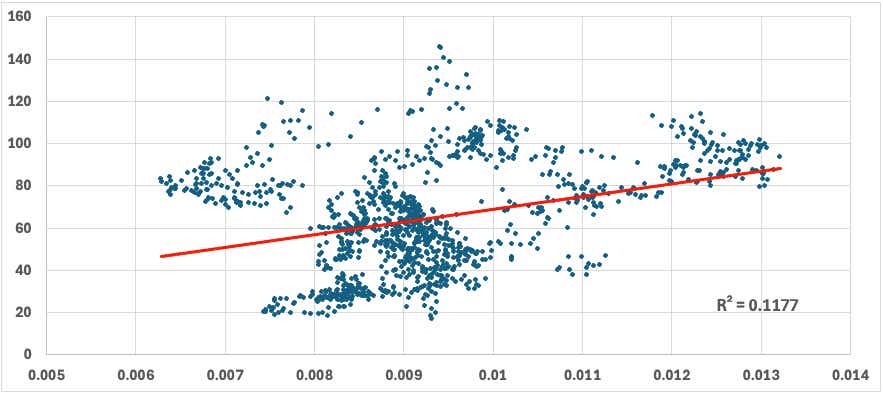

Typically, a stronger Japanese currency correlates with higher oil prices because Japan imports almost all its energy products. When the yen strengthens, it enables Japan to buy oil at cheaper prices, which typically increases demand. There are numerous ways to measure crude oil’s correlation with the yen, but a regression analysis going back to 2000 showed that 11% of variance in crude oil prices is affected by the yen.

But that isn’t what we’re currently seeing. This could be temporary, however, as the initial wave of volatility is likely causing traders to sell the commodity out of fear. One could even argue that it’s too early to sell oil on speculation that we are in or very near a recession because the physical oil market remains rather resilient—as shown by the backwardation currently in the crude oil and Brent crude oil futures.

While it might be too early to decipher whether the global economy is slowing enough to warrant the recent pullback in crude oil prices, about 12% over the last five weeks, there could be some hefty upside to play on a short-term retracement if recession fears don’t materialize quickly.

Volatility, as measured by the Chicago Board Options Exchange’s VIX Index (VIX), tends to retrace to the mean rather quickly. That is, volatility spikes, like the one we’re seeing now, normally subside quite rapidly. The problem is timing this retracement. Nevertheless, the VIX did come off its highs through today’s session, and oil prices rose as the VIX fell on Monday.

Time to go long crude oil?

Price action in crude oil futures (/CLU4) flashed an encouraging signal on Monday, with prices rising into positive territory and failing to hold below the June swing lows on an intraday basis.

Traders stepped in to buy oil around the 72 level, and prices failed to make a new bottom after this morning’s purchasing managers’ index (PMI) from the Institute for Supply Management (ISM) showed an increase in business activity and new orders, which helped to ease concern over a hard landing.

Geopolitical premium still has room to the upside for crude oil prices

Meanwhile, geopolitical concerns remain elevated, and there is potential for further escalation as Israel awaits Iran’s response to the recent assassinations of high-level Hamas and Hezbollah commanders. That escalation, believed to come as soon as today, has the potential to reignite conflict in the region and potentially widen the war.

Crude prices have discounted the recent escalations, but if Iran’s response crosses Israel’s red lines, whatever those may be, we could see markets move to price in a possible escalation.

Another geopolitical tailwind for oil bulls came with the news that Libya’s El Sharara oil field suspended operations today, as reported by Argus. The exact reason for the shutdown is not known, but it was ordered by the Libyan National Army, the military controlling Libya’s east and south. The shutdown may affect up to 250,000 barrels per day, but as today, only about a 60,000 barrels-per-day (bpd) reduction could be confirmed, according to a Reuters report.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.