Will Crude Oil Prices Climb After Bearish End to 2023?

Will Crude Oil Prices Climb After Bearish End to 2023?

Breaking down crude oil markets going into 2024

- The crude Oil 2024 forecast is not as bullish as 2023.

- Concerns about speculators, OPEC, U.S. production and demand are coming into focus.

- Forecasters see some upside for the year, but risks remain.

It was a tumultuous year for crude oil markets.

2023 began with crude oil prices (/CL) around $80 per barrel, and prices traded down to $64 per barrel before going as high as $95. Going into the new year, oil traded down to $69 to hit a six-month low.

Up until October, oil bulls were enjoying a stellar rally. The threat of a slowing global economy under the threat of rate hikes was subdued, and production cuts from the Organization of Petroleum Exporting Countries (OPEC) provided a bullish backstop that sent prices surging higher from June into September.

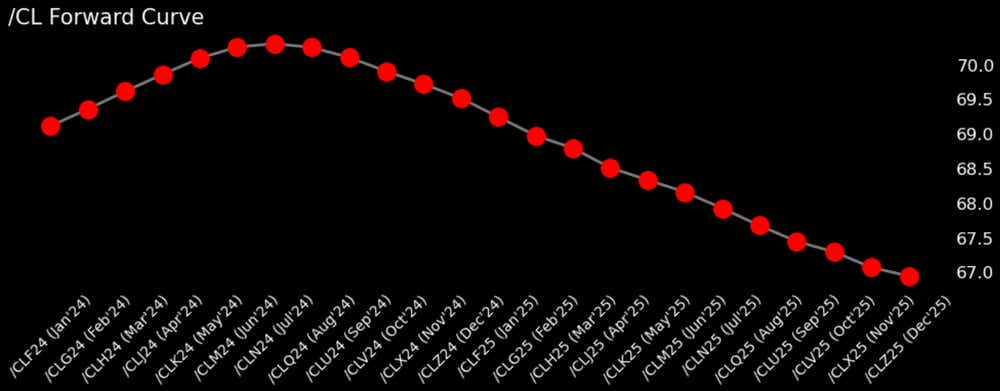

Even a conflict in the Middle East wasn’t enough to hold down the markets. In December, major oil benchmarks, including Brent and West Texas Intermediate (WTI), fell into contango, a bearish market structure that indicates oversupply.

OPEC fails to moderate prices

That narrative started to break down after economic data signaled a slowdown in consumption, and OPEC failed to assuage markets with production cuts that weren’t aggressive enough compared to expectations. At the same time, U.S. oil production, led by shale producers, soared to a record high, flooding the market with supply.

In November, the cartel decided to enact voluntary production cuts through the first quarter of 2024. The market expected more, however. Oil prices fell following the move. Some traders expected OPEC to signal production cuts through the first half of the year. It’s hard to say whether OPEC will be more aggressive in 2024. The cartel risks fueling U.S. production gains, something it would rather avoid.

Speculators got too short into year end

Speculators, otherwise known as non-commercial traders, unwound long positions and added shorts in the fourth quarter. The net position shown on the chart below highlights the relationship between price and those speculators’ positions. Alternatively, if prices rally with an elevated short position, it could cause some short covering in the market, which would drive prices higher as those traders close their shorts.

U.S. shale producers positioned to keep pumping

The U.S. is a big reason why OPEC doesn’t have as much control over the market as it once did. The United States produced at a record rate—13.24 million barrels per day (bpd) in September. That also helped drive fuel prices sharply lower going into the New Year, reflected not only in retail prices but by crack spreads in the futures market.

Despite falling prices, 2023 ended with another big acquisition deal for U.S. oilfields. Occidental Petroleum (OXY)—a Warren Buffet favorite—announced it would acquire CrownRock in a $12 billion deal. This follows the ExxonMobil (XOM) acquisition of Pioneer Natural Resources (PXD) and the Chevron’s (CVX) deal to buy Hess (HES) earlier this year. While there are signs oil production in the Permian Basin will slow in 2024, the deals signal oil producers still see plenty of upside in the Permian.

Demand too slow?

OPEC, in its December monthly oil market report (MOMR), stated an expected 2.6% global gross domestic Product (GDP) growth rate, down from 2.9% for 2023. A slowdown in economic activity isn’t a surprise following rate hikes from most of the world’s central banks, but the reality of the situation settled in for oil traders recently. If the trend of moderating growth continues, it should throttle upside for oil prices through the year.

However, on Dec. 14, the International Energy Agency (IEA) raised its demand forecast for 2024 from 930,000 barrels per day to 1.1million. The agency cited an improved economic outlook for the United States. OPEC's latest MOMR stated 2024 demand growth at 2.25 million barrels per day.

Rate cuts may rescue the market

Yesterday, the Federal Open Market Committee (FOMC) updated its economic and rate projections, citing three rate cuts in 2024 instead of two. That sent the chance for a March rate cut soaring in the futures and swaps markets, propelling risk assets higher. Oil also moved higher on the news. However, rates will remain above historical norms throughout the year, and that should slow economic growth further.

How about SPR purchases?

The United States is on a path to refilling its strategic Petroleum Reserve (SPR) after depleting around 180 million barrels. The Department of Energy has been soliciting monthly purchases to the tune of three million barrels, and those solicitations should continue throughout the year. This may help demand, but is it enough to lift prices?

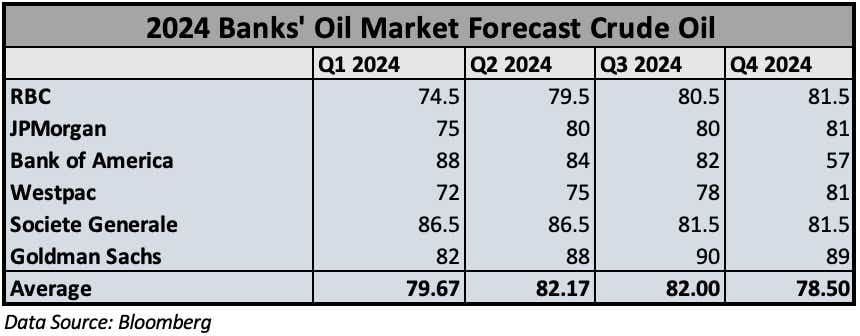

Banks see some upside for prices in 2024

Banks are slightly bullish on oil for 2024, with prices trading around the 70 handle in mid-December. The chart displays forecasts from RBC, JPMorgan, Bank of America, Westpac, Societe Generale, and Goldman Sachs. The averages for those forecasts in Q1, Q2, Q3 and Q4 were 79.67, 82.17, 82 and 78.50, respectively.

Overall, prices look poised for a modest rise in 2024, especially during the second and third quarters, although the outlook depends upon volatile factors that can quickly shift to change the forecast. A median price of $82 per barrel leaves some upside for traders to play. In any case, some volatility is likely to persist.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.