CrowdStrike Surges After Earnings: What's Next?

CrowdStrike Surges After Earnings: What's Next?

By:Mike Butler

Stock in the cyber-security sector has a positive outlook for the rest of the year

- CrowdStrike’s earnings per share of $0.95 on $845.3million in revenue topped expectations of $0.82 on $839.96 million.

- CRWD stock opened up 20% today, about $68 higher than the previous close.

- The stock has an expected move of +-$100 through the rest of 2024

CrowdStrike soared after an earnings beat yesterday, exceeding earnings-per-share (EPS) and revenue estimates while painting a positive outlook for the rest of 2024. CrowdStrike is a global cyber-security company with a diverse product suite. George Kurtz, CrowdStrike's president, CEO and co-founder, offered strong commentary following the Q4 ’23 results:

"CrowdStrike delivered an exceptionally strong and record fourth quarter with net new ARR (annual recurring revenue) growth accelerating to 27% year-over-year, reaching a new high of $282 million and ending ARR growing 34% year-over-year to reach $3.44 billion. Customers favor our single platform approach, standardizing on CrowdStrike for cloud security, identity protection and LogScale next-gen SIEM (security information and event management) solutions, together representing more than $850 million of ending ARR. CrowdStrike is cybersecurity’s consolidator of choice, innovator of choice and platform of choice to stop breaches.”

CRWD stock has had a strong start to 2024 trading, opening over $100 higher after earnings than the opening print of the year of $240.32. With that said, there has been some post-earnings volatility today, with over a $30 trading range from the opening print of $360.05. We should expect to see more realized volatility going forward in CrowdStrike, especially after this intra-day mayhem.

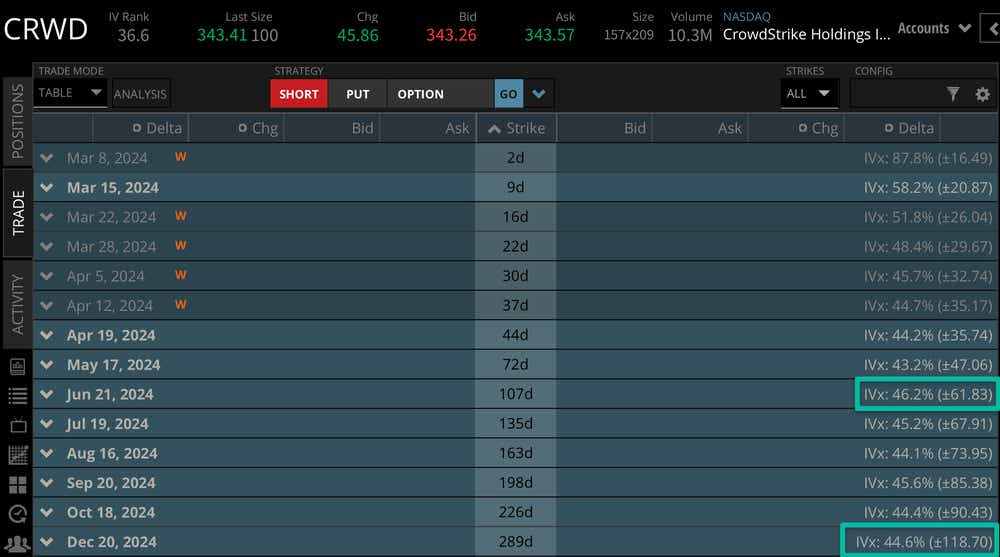

Looking through the rest of the trading year, implied volatility can tell us a lot about what is expected for a stock price. Currently, CrowdStrike has an expected stock price move of +-$61.83 through the June options cycle. This is just under 20% of the current stock price, which speaks to the volatility we're seeing now.

Through the end of the year, the market expects CRWD stock to have a +-$118.70 stock price range.

Bullish case for CrowdStrike

If you're a CrowdStrike bull, you likely believe in the sentiment delivered on the earnings call—strong expectations through the rest of the year while gaining even more marketshare in the cyber-security business. CrowdStrike was recently ranked No. 3 in the 2023 Fortune Future 50 List, so the company does have a strong footing in gaining new customers and maintaining current ones with a diverse product suite. Still, this stock is not for the weak-hearted, as we're seeing massive movements day-to-day on a percentage basis.

Bearish case for CrowdStrike

There are always two sides to every market, and CrowdStrike bears may think this relatively small earnings beat is blown out of proportion. Couple that with the fact that CrowdStrike stock has tripled over the past few months, and that begs the question of how a stock that isn't that well known could have such a massive rally that's sustainable. If you think the tech sector is going to take a hit in the next few months, we may see CrowdStrike follow suit in a potentially volatile way given the heightened implied and realized volatility in the product.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.