CrowdStrike Earnings Preview—9% Stock Price Move Expected

CrowdStrike Earnings Preview—9% Stock Price Move Expected

By:Mike Butler

After reaching a high of $398.33 in early July, the stock was trading at $200.81 less than a month later. It now sits around $267 per share.

- CrowdStrike will report quarterly earnings after the market closes on Wednesday.

- CRWD stock is up over 6% on the year but has been a more volatile ride than the gain suggests.

- Plus,, it’s new. CrowdStrike was added to the S&P 500 in June.

- The company, which specializes in cybersecurity, is expected to report an earnings-per-share of $0.97 on $958.32 million in revenue.

- It has exceeded earnings estimates four quarters in a row.

CrowdStrike earnings preview

CrowdStrike Holdings (CRWD), an American cybersecurity company that employs over 8,000 people, will report quarterly earnings on Aug. 28 after the stock market closes.

After exceeding EPS and revenue estimates four quarters in a row, CrowdStrike will look to continue the streak if it can exceed the earnings per share (eps) estimate of $0.97 on $958.32 million in revenue.

CrowdStrike stock is up over 6% year-to-date, but the trading range has been more volatile than one might assume. After reaching a high of $398.33 in early July, the stock was trading at $200.81 less than a month later. CRWD stock currently sits around $267 per share.

CrowdStrike was added to the S&P 500 in June of this year, making this the fastest cybersecurity company to achieve this feat. George Kurtz, CEO and founder of CrowdStrike, offered positive sentiment in the press release: “We founded CrowdStrike on the belief that the future of security would be driven by AI and a cloud-native architecture that could collect data at scale. We built the first cybersecurity platform, born in the cloud, AI-native, with a single, intelligent sensor that forever changed what organizations expect from modern security ...”

“From Day 1, the CrowdStrike team has been steadfast in our mission to protect customers and stop breaches. This mission endures, serving as our north star on the path to sustained impact today and well into our future."

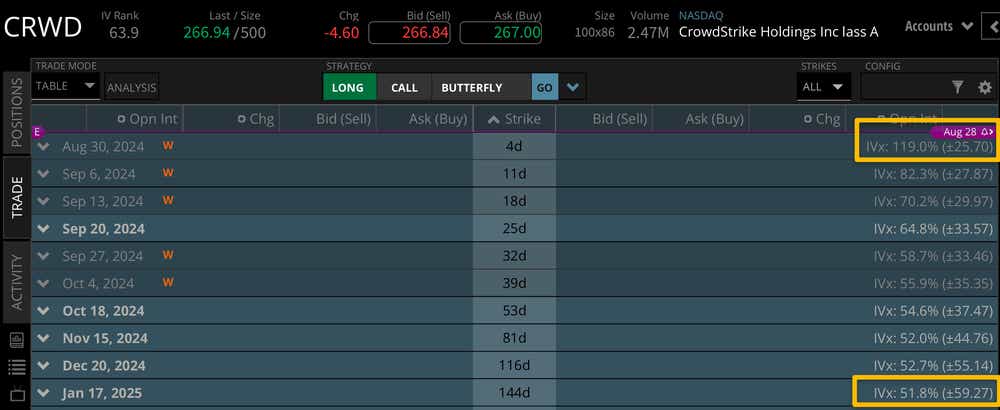

It seems sentiment is generally positive leading into the earnings report this week, but implied volatility tells us we should expected to this stock price o tmove around a lot after the report is released: CrowdStrike stock has an expected move of +/- $25.70, based on current implied volatility this week. This is just under 10% of the notional value of the stock price, which puts it on the higher end of the range for earnings reports. Looking to January of 2025, we see the implied volatility of +/- $59.27 for the stock, which means the market is placing a lot of weight on this week with almost half of the movement for the rest of the year being priced into this earnings call.

Bullish on CrowdStrike for earnings

Active investors bullish on CrowdStrike are looking for continued outperformance from an EPS and revenue perspective, and plenty of AI chatter. The addition to the S&P 500 earlier this year can't hurt the bullish sentiment, but the company has more pressure to continue to perform now. If performance is exceed this quarter, we could see the stock move to the upside after the announcement if the market digests the report in a positive way.

Bearish on CrowdStrike for earnings

CrowdStrike bears are clearly looking for an earnings miss this quarter. We've seen this stock price sell off aggressively once already this year, and that could be the case if CrowdStrike fails to paint a bullish picture for the rest of the year on Wednesday. High implied volatility for an earnings announcement tells us there is a lot of uncertainty around the report, which doesn't exactly play into the hands of bulls. Still, if we are to see CRWD stock sell off, bears will want to hear a neutral to bearish sentiment for the quarter and rest of the year.

Tune in to Options Trading Concepts Live on Wednesday at 11 a.m. CDT for a full options earnings strategy review for CrowdStrike and Nvidia (NVDA) earnings as well!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.