Copper Prices May Rise as Speculators go Long

Copper Prices May Rise as Speculators go Long

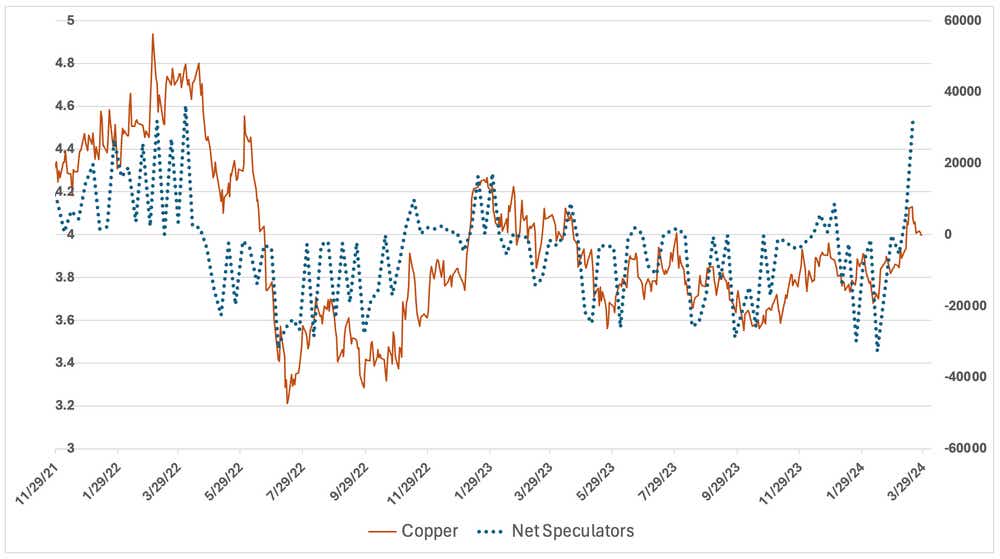

The Commodity Futures Trading Commission is showing the highest net long position among non-commercial traders since April 2022

- Copper prices trimmed their losses today.

- Speculator positioning points to a bullish bias.

- Copper inventory remains seasonally high but relief is in sight.

Copper prices recovered from losses this morning to make small gains in afternoon trading, indicating a potential easing of selling pressures witnessed since last week when prices hit the highest levels since April. With prices now at the December swing high, traders will have to sort out a direction for the metal amid conflicting fundamental forces.

Speculators pile into copper long positions

The positioning among copper traders points to a growing bullish bet in the market, with the Commodity Futures Trading Commission (CFTC) showing the highest net long position among non-commercial traders, otherwise known as speculators, since April 2022.

Breaking down the numbers in the commitments of traders report (COT) shows 124,000 longs against 92,000 shorts. Both longs and shorts increased their positions for the week ending March 19, although longs went heavier, adding 36,877 contracts vs. 10,379 short contracts—a ratio of more than 3-to-1 longs to shorts.

The changes in positioning data bode well for longs, especially because there isn’t an elevated short position in the market, which could sometimes cause squeezes when there are upward price movements. Long positioning is the highest since May 2021, but short positioning is only at levels from just February.

Another way to look at the data is the fact that last time speculators were this net long, copper prices were nearly 20% higher than today’s levels. While there are endless ways to interpret positioning data, breaking it down at basic levels that we’ve considered appears to point to a bullish bias.

Inventory remains high on seasonal basis

Copper that sits in warehouse in China fell for the first time of the year last week, although stockpiles remain at the highest levels since 2020 for this time of the year at 285,000 tons. The inventory drop could mark a turning point in supply because Chinese smelters have agreed to cut production, which should see less refined copper hitting warehouses. That, combined with incoming rate cuts amid an already resilient global economy, especially in the United States, could help copper resume its earlier upward trend.

Trading copper

Given that bulls have defended the psychologically important 4 level on Wednesday, which also coincides with the January swing high, traders might want to get long by selling a put spread, given the relatively high implied volatility (IV) marked by an implied volatility rank (IVR) of 68.2.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.